Penn National Gaming Credit Downgrade Not Derailing Epic Stock Rally

Posted on: March 24, 2020, 11:13h.

Last updated on: March 24, 2020, 12:16h.

Penn National Gaming (NASDAQ:PENN) is extending a jaw-dropping run that has seen the embattled gaming stock more than triple off its 52-week low notched last week, even as Moody’s Investors Service lowered the operator’s credit rating deeper into junk territory.

Battered by casino closures across the US at the hands of the coronavirus, Penn National and other regional gaming stocks are being drubbed this month. But in recent days, some of the names are rebounding on hopes the federal government will provide stimulus assistance to the travel and leisure industry, and perhaps put cash directly in the pockets of Americans.

Previously chastened Penn bulls appear undaunted by the Moody’s downgrade, sending the stock higher by almost 42 percent today (at this writing) on volume that is already more than triple the daily average. That after the stock surged 24.21 percent, 29.56 percent, and 34.73 percent, respectively, in the past three sessions.

The downgrade of Penn’s corporate family rating (CFR) is in response to the disruption in casino visitation resulting from efforts to contain the spread of the coronavirus, including recommendations from federal, state, and local governments to avoid gatherings and avoid non-essential travel,” said Moody’s in a note obtained by Casino.org. “These efforts include mandates to close casinos on a temporary basis.”

Moody’s lowered the operator’s credit rating to B1 from Ba3 with a negative outlook. The move is the latest in a series of downgrades or warnings that such actions are coming by from ratings agencies on gaming companies.

Ominous Outlook

Moody’s new rating of B1 on Penn is considered speculative and bonds with that mark are judged to be of “high credit risk.” That grade is the fourth-lowest in non-investment grade territory on the Moody’s scale.

“Penn’s B1 CFR reflects the meaningful earnings decline over the next few months expected from efforts to contain the coronavirus and the potential for a slow recovery once properties re-open,” said the research firm. “The rating also reflects Penn’s high leverage along with longer-term fundamental challenges facing Penn and other regional gaming companies related to consumer entertainment preferences and US population demographics that Moody’s believes will continue to move in a direction that does not favor traditional casino-style gaming.”

That jibes with points raised by other credit firms, which are concerned that consumer tastes will be altered in the wake of the COVID-19 outbreak. Even if the situation is rapidly resolved, that doesn’t necessarily mean gamblers will rush back to casinos.

Even with its recent rally, Penn remains one of the most battered regional gaming stocks. From current prices, it would need to roughly double to get back to where it was the day the Barstool Sports deal was announced in January, and almost triple to return to its 52-week high.

Cash Considerations

With a zero revenue environment setting in for gaming companies, Wall Street is growing concerned about the cash positions of operators and their respective survival timelines.

At the end of last year, Penn had $437 million in cash, and this month, the company fully drew down a $700 million bank line of credit, according to Moody’s. Still, Penn and its rivals are dealing with unprecedented macroeconomic tremors.

“The gaming sector has been one of the sectors most significantly affected by the shock, given its sensitivity to consumer demand and sentiment,” said the ratings firm. “More specifically, the weaknesses in Penn’s credit profile, including its exposure to travel disruptions and discretionary consumer spending, have left it vulnerable to shifts in market sentiment in these unprecedented operating conditions, and Penn remains vulnerable to the outbreak continuing to spread.”

Related News Articles

Most Popular

The Casino Scandal in New Las Vegas Mayor’s Closet

This Pizza & Wings Costs $653 at Allegiant VIP Box in Vegas!

Sphere Threat Prompts Dolan to End Oak View Agreement

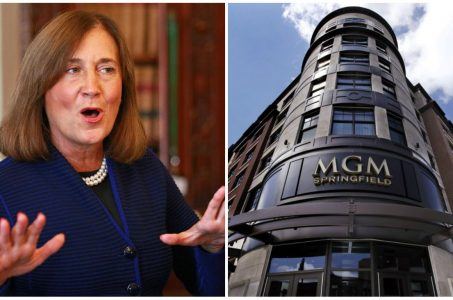

MGM Springfield Casino Evacuated Following Weekend Blaze

Most Commented

-

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 4 Comments -

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments -

Chukchansi Gold Casino Hit with Protests Against Disenrollment

— October 21, 2024 — 3 Comments

No comments yet