MVIS Debuts BlueStar Online Betting, Esports Index

Posted on: March 31, 2022, 01:28h.

Last updated on: March 31, 2022, 01:39h.

MV Index Solutions (MVIS) — a German provider of equity and fixed income gauges for use by exchange traded funds (ETFs) providers — recently introduced a new benchmark addressing internet wagering and esports companies.

The BlueStar Global Online Gambling, Video Gaming and eSports Index (BVGOG) debuted earlier this week. It tracks companies involved in the online gambling, video gaming and eSports industries.

This is a modified market cap-weighted index, and only includes companies that generate at least 50% of their revenue from online gambling, video gaming and/or eSports,” according to the index provider.

The new index is home to 50 stocks, with the top 10 holdings combining for 61 percent of its weight. It’s not yet clear if a fund issuer will be using the gauge over the near-term. Currently in the US, there are two sports betting ETFs — the Roundhill Sports Betting & iGaming ETF (NYSEARCA:BETZ) and the iBET Sports Betting & Gaming ETF (NASDAQ: IBET), the latter of which is actively managed, meaning it doesn’t follow an index.

Inside the BlueStar Index

As its name implies, the BlueStar Global Online Gambling, Video Gaming and eSports Index isn’t focused solely on betting companies. But such firms are well-represented in the benchmark.

For example, Australian slot machine Aristocrat Leisure, Evolution AB, FanDuel parent Flutter Entertainment, Entain Plc, and DraftKings (NASDAQ:DKNG) are all among the index’s top 10 holdings. Other wagering entities in the index include Rush Street Interactive (NYSE:RSI), Skillz (NYSE:SKLZ) and sports betting data provider Sportradar (NASDAQ:SRAD).

Upon inclusion, stocks are capped at weights of eight percent.

“With wider adoption of online gambling and sports betting throughout the US and the rest of the world, and incorporation of augmented and virtual reality in video gaming, the companies included in this index are in prime position to be amongst the winners,” said Josh Kaplan, Global Head of Research & Investment Strategy at MV Index Solutions, in a statement.

Esports Excitement

A potential source of allure for fund issuers considering the index is the growth of esports, which could gain momentum as more states approve regulated wagering on it.

Wagering on competitive computer gaming is viewed as a future growth driver for the US sports betting industry. But it’s one that hasn’t been tapped into in a significant fashion yet. Esports is one of the most widely watched sports in the US, and analysts expect it to eclipse all traditional sports, except the NFL, in terms of television viewership over the next several years.

The BlueStar Global Online Gambling, Video Gaming and eSports Index allocates 95 percent of its portfolio to large- and mid-cap stocks. That’s while the consumer discretionary and communication services sectors combine for 90 percent of the fund’s roster. Consumer cyclical is the home sector for wagering equities.

Related News Articles

Derek Stevens Announces Circa Las Vegas Resort and City’s Largest Sportsbook

DraftKings Jumps On Improved 2023 Guidance

U.S. Integrity, Odds on Compliance Form Sports Betting Compliance Giant

Most Popular

IGT Discloses Cybersecurity Incident, Financial Impact Not Clear

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

What ‘Casino’ Didn’t Tell You About Mob Wife Geri Rosenthal

Fairfax County Officials Say No NoVA Casino in Affluent Northern Virginia

Most Commented

-

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 8 Comments -

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 5 Comments -

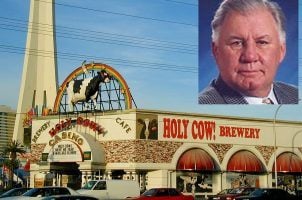

LOST VEGAS: The Historic Holy Cow Casino

— November 29, 2024 — 4 Comments -

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments

No comments yet