PlayUp’s Pending License Denial in Ohio May Lead to Other Issues

Posted on: December 17, 2022, 07:01h.

Last updated on: January 3, 2023, 05:58h.

What possibly happens in Ohio could have repercussions elsewhere in the country for PlayUp.

The Australian-based gaming company has taken down an online slot-like game after the Ohio Casino Control Commission announced during its Wednesday meeting that it intended to deny the operator a sports betting license.

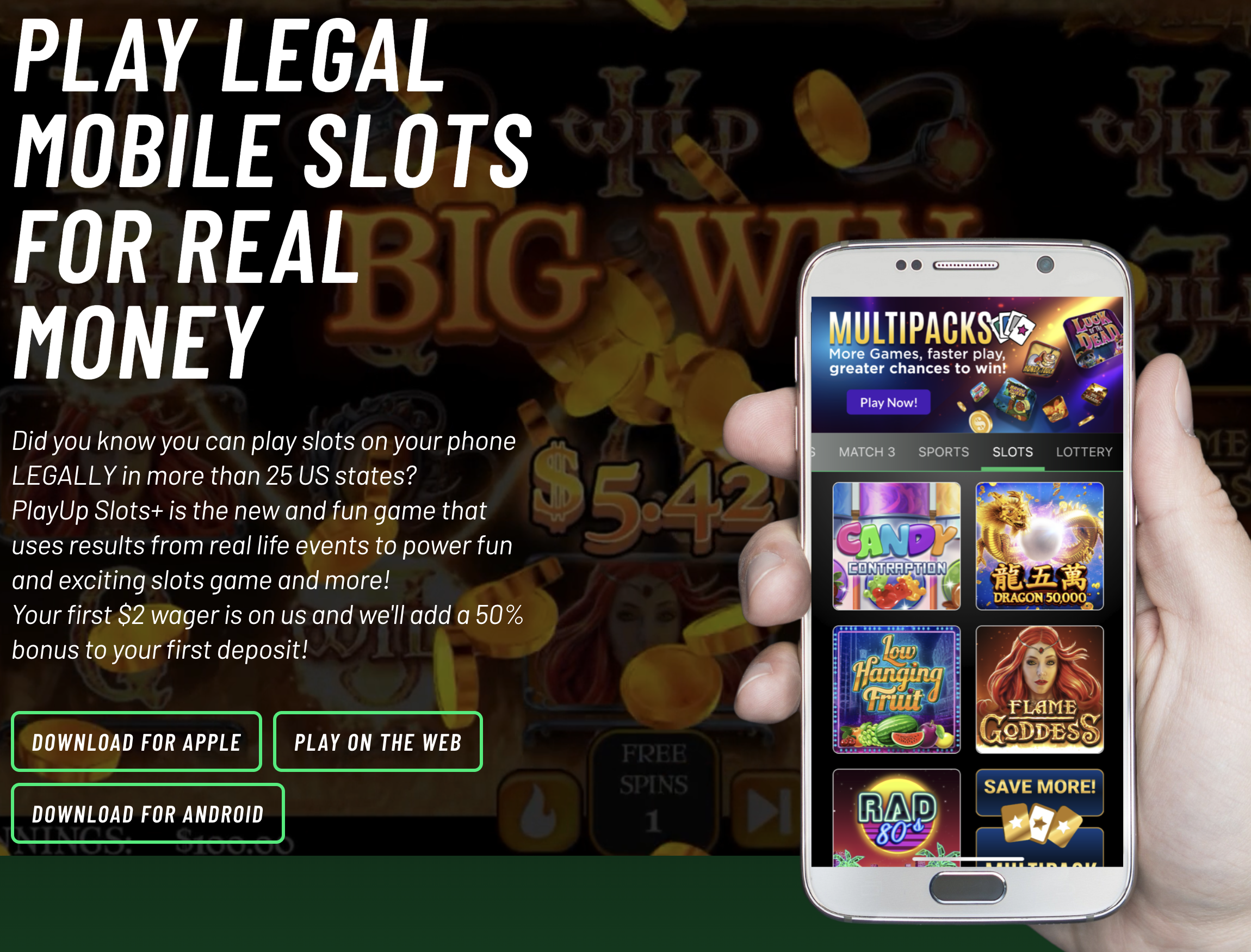

The commission sent PlayUp a letter on Dec. 2 saying because the company had “one or more disqualifying violations,” it would not be considered “suitable or eligible” for licensure. In that letter, the OCCC said PlayUp accepted “illegal wagers” from American bettors through its Slots+ product.

The commission also accused PlayUp of breaking Ohio law by “engaging in false, deceptive, misleading, or otherwise impermissible advertising… by advertising the Slots+ product as legal gaming in the state of Ohio.”

OCCC Executive Director Matt Schuler also informed commissioners at its meeting Wednesday that the agency issued a cease-and-desist notice to PlayUp and Potent Systems, its technology partner. Schuler added that the companies had started taking steps to comply with the commission’s request.

Mentions of Slots+ have been removed from PlayUp’s website, and a page for the game has also been wiped from Facebook.

A cached webpage for Slots+ described the game as using “results from real life events to power fun and exciting slots.” It also listed 26 states where Slots+ and PlayUp’s racebook were available. Ohio was listed on the cached page, but the site noted only the racebook was legal in the Buckeye State.

PlayUp is currently licensed to offer sports betting in Colorado and New Jersey. It also holds an iGaming, or online casino, license in New Jersey. In Ohio, it’s slated to be a mobile partner with JACK Casino Cleveland. Last month, JACK lost a mobile partner when MaximBet announced it was ceasing operations.

Appeal Hearing Planned

PlayUp did not respond to requests seeking comment.

The company does have the right to request a hearing in its case, and OCCC Director of Communications Jesica Franks confirmed to Casino.org that one will be held in the matter.

Under Ohio’s process, the hearing will allow PlayUp and the state to offer evidence and question witnesses on both sides. The presiding judge will then issue a report and the OCCC commissioners will then take action.

The hearing could happen in January, although it’s uncertain when the judge’s report will be completed.

Should the OCCC decide to deny PlayUp, it could impact the company’s suitability in other states where it is licensed or may be applying.

Richard Schuetz has worked as both a gaming executive and a regulator. He told Casino.org that states require licensees to reveal material events in another jurisdiction.

“That’s what can trigger the dominoes,” he said.

Ohio Issue PlayUp’s Latest Woe

A pending denial in Ohio is not PlayUp’s only concern.

Three months ago, PlayUp announced plans to merge with a special purpose acquisition company (SPAC) in an effort to become a publicly traded company. On Dec. 8, that SPAC, IG Acquisition Corp. (IGAC), filed an 8-K report with the US Securities and Exchange Commission that noted the parties signed an amended agreement that allows IGAC to explore opportunities with other companies.

The reason for the entry into the Amendment Agreement is because of the delay in obtaining the Company’s (PlayUp’s) audited financial statements and other materials, as well as market conditions that have made it difficult to obtain financing necessary to consummate the transactions,” IGAC said in the filing. “Unless the Company is able to deliver its audited financial statements and obtain the necessary funding, IGAC intends to seek to locate an alternative target company and potentially pursue the consummation of a business combination with such alternative target company.”

In November 2021, PlayUp had a $450 million purchase offer from FTX, the now-collapsed cryptocurrency exchange currently making headlines after its founder was arrested in the Bahamas this past week. That deal fell through, and has since become a key issue in a lawsuit and countersuit between PlayUp and Dr. Laila Mintas, PlayUp’s former US division CEO.

This past January FTX agreed to invest $35 million in PlayUp.

Related News Articles

IGAC Ends $350M Deal That Would Have Taken PlayUp Public

Sports Betting Roundup: Caesars, SuperBook Opens New Retail Sportsbooks

Most Popular

Sphere Threat Prompts Dolan to End Oak View Agreement

MGM Springfield Casino Evacuated Following Weekend Blaze

This Pizza & Wings Costs $653 at Allegiant VIP Box in Vegas!

Atlantic City Casinos Experience Haunting October as Gaming Win Falls 8.5%

Most Commented

-

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 4 Comments -

Chukchansi Gold Casino Hit with Protests Against Disenrollment

— October 21, 2024 — 3 Comments -

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments

No comments yet