CFTC Says PredictIt Founder Will Get Fair Chance to Refute Allegations Against Exchange

Posted on: March 24, 2023, 08:15h.

Last updated on: May 25, 2023, 06:09h.

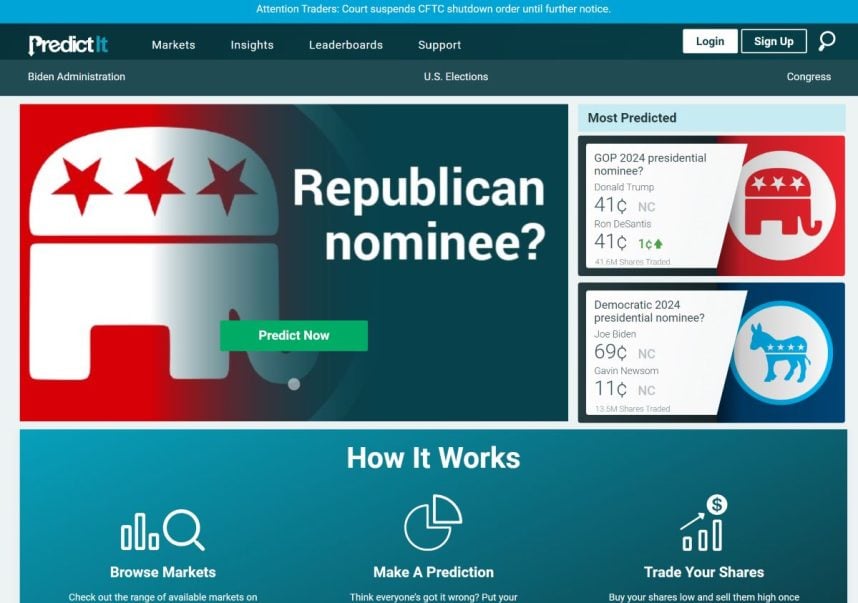

In defending its motion to end an injunction granted to PredictIt, the US Commodity Futures Trading Commission (CFTC) told a federal appeals court on Thursday it’s giving the founder of the online political futures exchange due process as the federal agency considers revoking the no-action letter that led to PredictIt’s creation.

The CFTC’s March 2 letter to Victoria University of Wellington stands as “a preliminary determination,” the commission stated in its 29-page filing. That letter also retracted an Aug. 4, 2022, letter to the university that revoked the no-action declaration and, instead, listed three allegations uncovered by the Division of Market Oversight (DMO). DMO is allowing the university to respond to its findings with a deadline that has been pushed to April 5.

“Depending on the University’s response, staff may determine not to withdraw the no-action letter, or continue their no-action position as to unexpired contracts, as Plaintiffs wish,” the CFTC’s filing stated. “If not, staff will explain why.”

Victoria University isn’t a plaintiff in the federal case that PredictIt filed with Aristotle International and several traders and researchers who use the exchange. The case originated in US District Court in Texas, with plaintiffs then taking their request for an injunction to the Fifth Circuit to prevent the exchange from being shut down due to language in the CFTC’s August letter calling for existing markets to be liquidated by February 15.

The court granted that injunction nearly two months ago.

CFTC: PredictIt ‘Morphed’ Into Larger Exchange

The CFTC’s filing Thursday was its rebuttal to the plaintiffs’ response to the commission’s March 3 motion calling for the federal appeals court to lift the injunction.

By pulling the August letter, which had the February liquidation date, the CFTC argues that there’s no longer a need for an injunction and that the plaintiffs’ appeal is rendered moot. As such, it calls for the case to go back to the federal district court where the commission has called for it to be moved from Texas to the District of Columbia US District Court.

In the March 2 letter, the DMO claimed PredictIt has been violating the terms of the no-action letter essentially since the exchange began in 2014. That includes offering markets outside of the scope determined in the letter. DMO also alleged that Aristotle, a DC-based political consulting and technology firm, was actually the outfit running PredictIt and had paid a Victoria University subsidiary for the right to do so.

Aristotle managing the exchange would run counter to the CFTC’s decision to allow a “small-scale, not-for-profit” exchange run by the New Zealand school for research purposes.

The evidence now suggests PredictIt may never have been that,” the commission stated. “At a minimum, however, PredictIt appears to have morphed into something quite different than what the university had originally represented.”

According to the CFTC, the university proposed that three professors and an administrator would be the individuals running the exchange, and that it would contract with a vendor to ensure the identities of people registering on the exchange and that they were old enough to participate.

It’s possible that the court won’t act on the CFTC’s request until the commission itself renders a decision after considering Victoria University’s objections, and the commission said it won’t object to additional briefings on the matter should the three-judge panel still have questions.

CFTC Argues Against Sanctions

The CFTC also responded to plaintiffs’ claims that its staff violated the terms of the injunction by issuing a new letter.

Rather than cite the injunction, the CFTC says PredictIt and the other plaintiffs cited their own motion for the injunction.

“A motion is not an order,” the commission stated. “And this Court’s January 26, 2023, order did not incorporate or reference any text in Plaintiffs’ briefs, or give any other indication whatsoever that Plaintiffs’ intro language was now the law.”

In addition, the CFTC said its new letter didn’t call on PredictIt to stop its markets. All the new letter did was remove the February 15 “liquidation mandate,” which was the crux of the plaintiffs’ case.

Lastly, any request for sanctions should be denied, according to the commission, because it has sovereign immunity.

“The CFTC’s conduct throughout this litigation has been consistent, taken in good faith, and at a minimum, substantially justified,” it claimed, adding the litigation was “only necessary because Plaintiffs filed suit without ever citing any case in which any court has held a no-action letter or its revocation judicially reviewable.”

Related News Articles

Most Popular

IGT Discloses Cybersecurity Incident, Financial Impact Not Clear

Sphere Threat Prompts Dolan to End Oak View Agreement

This Pizza & Wings Costs $653 at Allegiant VIP Box in Vegas!

MGM Springfield Casino Evacuated Following Weekend Blaze

Most Commented

-

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 4 Comments -

Chukchansi Gold Casino Hit with Protests Against Disenrollment

— October 21, 2024 — 3 Comments -

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments

No comments yet