Bwin.party Still in Rumored Takeover Negotiations with Amaya and William Hill

Posted on: March 11, 2015, 01:48h.

Last updated on: March 11, 2015, 01:52h.

Bwin.party has announced that takeover negotiations over the sale of all or part of its assets with more than one unnamed company have intensified, and talks are now at a “further stage,” company Chairman Philip Yea said today.

Last month, the company’s shares fell by 20 percent in one day following reports that negotiations had broken down, prompting bwin.party to move to quash the rumors.

Shares bounced back slightly several days later when further market chatter suggested that Amaya Gaming was still courting the company, and the news that a takeover deal between William Hill and 888 Holdings was off invited speculation that the British bookmaking giant might now also be eyeing a move for bwin.party.

Who’s at the Table?

Amaya was linked with a $1.2 billion acquisition of the company last November, when Financial Times Alphaville Editor Paul Murphy and Bryce Elder from the FT’s London markets announced that their “usually reliable source” had said the deal was “all but wrapped up.”

Bwin, which up until that point had denied that it was looking for a sale, was forced to confirm that it had opened up “preliminary discussions with a number of interested parties.”

At the same time, several news outlets also reported that Playtech, Ladbrokes, and Apollo Global Management (which partly owns Caesars Entertainment), were also courting the company.

According to Yea, a number of indicative proposals are still on the table.

“The board has entered into a further stage of discussions with each party with a view to assessing the relative attractions of these proposals,” he told media sources today.

Delays in the takeover talks are likely to be a result of the complexity of the negotiations. There’s even speculation that prospective buyers may be more interested in acquiring certain company assets, rather than the entire company.

Bwin.party’s sports betting arm, for example, is likely to be more attractive than its underperforming poker operation. Meanwhile, its reliance markets in unregulated countries might also be a thorny issue for prospective buyers.

Revenues Continue to Fall

Amaya, however, might be prepared to absorb partypoker, perhaps viewing its established and licensed operations in New Jersey as an asset, while bwin’s proven technical expertise in the online sports betting market might bolster its ambition to launch a PokerStars sportsbetting platform across Europe.

Meanwhile, bwin.party posted a year-on-year decline in total company revenues from €652.4 million to €611.9 million in 2014, and an operating loss after tax of €94.3 million compared to a profit of €41.1 million in 2013.

Outside New Jersey, poker performed particularly badly, with CEO Norbert Teufelberger citing “challenging conditions” for the 29 percent dip in revenues.

“The full year impact of ISP blocking in Greece coupled with the structural decline of regulated poker markets in Continental Europe affected our overall financial performance for the year,” he said.

Related News Articles

Caesars’ Debt-Servicing Agility Troubles Wall Street

Republican Chaffetz Reintroduces Failed RAWA

Alleged Bitcoin Creator Craig Wright Gets Home Police Raid in Sydney

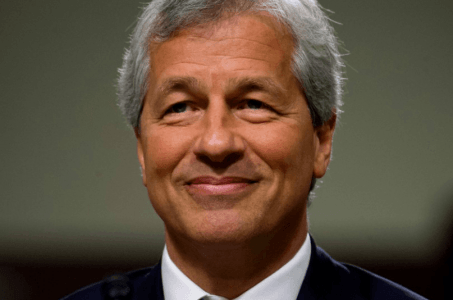

JP Morgan Chief Calls Bitcoin a ‘Fraud’ That Will Crash Like 17th Century Tulips

Most Popular

This Pizza & Wings Costs $653 at Allegiant VIP Box in Vegas!

Sphere Threat Prompts Dolan to End Oak View Agreement

Fairfax County Officials Say No NoVA Casino in Affluent Northern Virginia

Atlantic City Casinos Experience Haunting October as Gaming Win Falls 8.5%

Most Commented

-

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 4 Comments -

Chukchansi Gold Casino Hit with Protests Against Disenrollment

— October 21, 2024 — 3 Comments

No comments yet