Bally’s Plugs Chicago Casino Funding Gap in $2B Deal with GLPI

Posted on: July 12, 2024, 09:48h.

Last updated on: July 12, 2024, 11:13h.

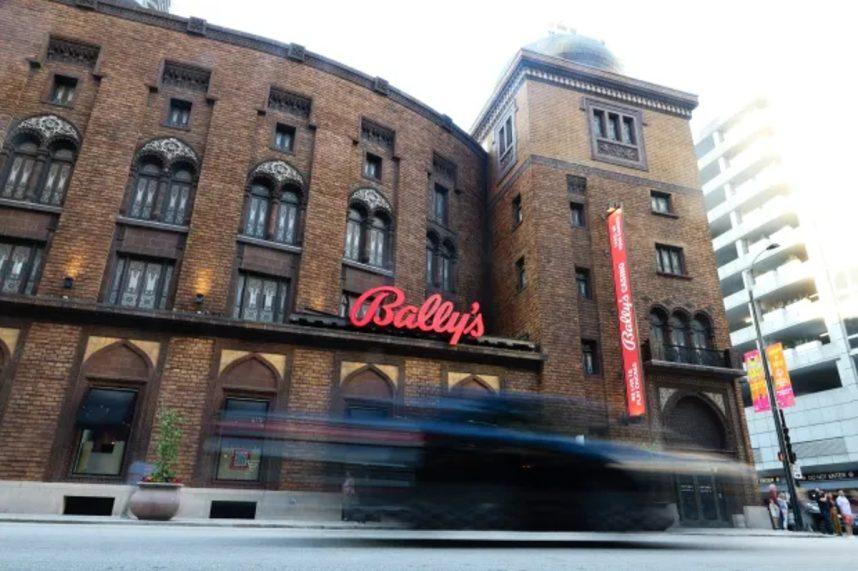

Shares of Bally’s (NYSE: BALY) surged Friday after the gaming company announced it will strike deals with Gaming and Leisure Properties (NASDAQ: GLPI) for an aggregate of $2.07 billion in financing. That closes an $800 million shortfall the operator faced on its Chicago casino hotel project.

An affiliate of Gaming and Leisure — one of the largest owners of gaming real estate — is acquiring the property assets associated with Bally’s Chicago venture and will “fund construction hard costs of up to $940 million at an 8.5% initial cash yield.” That funding will be delivered from August 2024 through December 2026.

In addition to the development funding of hard costs, GLPI also intends to acquire the Chicago land for approximately $250 million before development begins. Upon GLPI’s purchase of the Chicago land, rent will commence under a new lease carrying a 15-year initial term with an initial cash yield of 8%,” according to a statement issued by the real estate investment trust (REIT).

The announcement arrived at a critical time for Bally’s in Chicago. In March, executives from the Rhode Island-based regional casino operator told the Nevada Gaming Control Board (NGCB) the company was facing an $800 million funding gap in Chicago, stoking concerns that the much-ballyhooed debut of a casino resort in the city may not come to life.

The lease agreement on the Chicago property has been amended to reflect annual rent of $20 million at a cap rate of 8.5%. Shares of Bally’s are higher by 4.71% at this writing.

More Details on Bally’s Chicago Casino

By procuring the needed financing and, assuming various local regulatory approvals are granted over the near term, it’s possible that Bally’s could soon commence demolition of the Freedom Center, potentially positioning the operator to meet the expected September 2026 debut of the Chicago gaming venue.

Bally’s also announced that the location of the 500-room hotel tower will be moved to the southern end of the property. The initial plan called for the hotel to be located at the northern end, but it was later discovered that would damage underground infrastructure, sparking criticism that neither Bally’s nor the city had properly thought out the project.

The gaming company also implied it intends to move forward with an initial public offering (IPO) tied to the Chicago plan that is designed to allow local investors, including business owners and minority groups, to own up to 25% of the venture.

Other Moving Parts in Bally’s/GLPI Agreement

Before Friday, Bally’s and GLPI had an existing relationship that was poised to grow, and not just because of the Chicago pact. As part of the broader agreement, the REIT is acquiring the real estate of Bally’s Kansas City and Bally’s Shreveport for a total of $395 million. The combined annual rent on those properties will be $32.2 million, “representing an 8.2% initial cash capitalization rate.”

The two sides also agreed to alter the terms of an agreement under which the REIT can acquire the property assets of Bally’s Twin River casino in Lincoln, RI before the end of 2026 for $735 million, down from a previously agreed upon $771 million. Initial annual rent would be $58.8 million.

“As a part of the amendment, GLPI will be granted a right to call the Lincoln Transaction beginning in October 2026, coinciding with the scheduled maturity of Bally’s revolving credit facility. All such transactions are subject to required regulatory approvals,” according to the press release issued by the gaming company.

GLPI already owns the property associated with Bally’s Tiverton Casino & Hotel. The REIT’s existing New England footprint consists of the Tiverton venue, the Hollywood Casino Hotel in Bangor, Maine, and Plainridge Park Casino in Plainville, Mass., both of which are operated by Penn Entertainment (NASDAQ: PENN).

Related News Articles

Golden Nugget Could Be Savior of Danville Pensions

Bally’s Hit with Another Credit Rating Downgrade

Most Popular

This Pizza & Wings Costs $653 at Allegiant VIP Box in Vegas!

Sphere Threat Prompts Dolan to End Oak View Agreement

Fairfax County Officials Say No NoVA Casino in Affluent Northern Virginia

Atlantic City Casinos Experience Haunting October as Gaming Win Falls 8.5%

Most Commented

-

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 4 Comments -

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments

Last Comment ( 1 )

Both of today's Bally's press releases also mention a planned land-based Bally's casino in State College, PA. Will GLPI be involved with financing that casino also? Why is that project currently never mentioned in the media anymore? Folks near the Nittany Mall are quick to point out that the Bally's casino won't be near the mall. It will be located in a former Macy's department store that is INSIDE the Nittany Mall. Bally's was probably just kidding when mentioning "NEAR" in every Bally's press release for the past two years, right?