MGM Makes Cut in Goldman Sachs ‘Buyback Basket’

Posted on: October 21, 2024, 03:58h.

Last updated on: October 22, 2024, 09:22h.

MGM Resorts International’s (NYSE: MGM) long-standing commitment to repurchasing its shares is well-known on Wall Street.

Those efforts have resulted in a significant reduction to the casino giant’s shares outstanding tally, but also some accolades of sorts.

For example, the gaming stock was included in the newest iteration of the Goldman Sachs buyback basket — a collection of stocks of dedicated share repurchasers that, in aggregate, often beats the S&P 500.

Last year, share repurchase activity among S&P 500 member firms declined 13% due to high interest rates and a 1% tax on buybacks, but Goldman sees buyback activity rising 13% this year, and 15% in 2025.

Relative to 2024, a modest decline in valuations and a normalization of the lending environment should support a modest reacceleration in buyback growth,” said David J. Kostin, chief US equity strategist, in a note. “However, we expect interest rates will remain around current levels, constraining debt-funded buyback activity.”

The bank forecasts financial services and technology as the sectors most likely to account for the biggest percentages of S&P 500 buyback activity.

MGM Consumer Cyclical Buyback Leader

MGM, which sports a trailing 12-month buyback yield of 14%, is one of just five consumer discretionary names in the Goldman buyback basket, and the lone gaming name. Other metrics used are availability of credit, earnings growth rates, interest rates, and valuation.

Last year, the Aria operator bought back $2.3 billion of its shares and announced a new $2 billion buyback program in November 2023. In the second quarter, the gaming company repurchased $400 million worth of its shares and, as of the end of that period, has reduced its shares outstanding count by nearly 40% since 2021.

MGM’s buybacks are pertinent to investors because share repurchases are more tax-efficient than dividends, and unlike some rivals, the operator hasn’t restored its quarterly payout, which was cut during the early days of the COVID-19 crisis.

MGM’s buyback leadership has also arguably been a catalyst in driving rival casino operators to up their purchases of their shares.

MGM Buybacks Standout

As Goldman’s Kostin noted, if interest rates don’t decline materially, many companies could eschew buybacks because some previously fund that method of returning capital to shareholders by issuing debt at low interest rates.

That makes MGM’s buyback efforts compelling because the gaming leader has largely funded its repurchases by way of its rising free cash flow, not by selling bonds. At the end of the second quarter, the company had $2.4 billion in cash on hand, indicating it has the resources to maintain a solid pace of share count reduction.

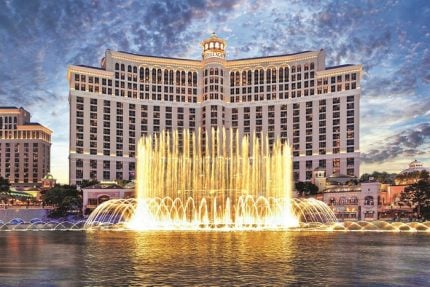

The Bellagio operator reports third-quarter results on October 30, and it’s possible it will provide an update on recent buyback activity and related plans at that time.

Related News Articles

Sphere Entertainment Has ‘Too Many Unknowns,’ Says Analyst

Bellagio Stake Sale Could Bode Well for Caesars, VICI, Says Analyst

Wynn Selling $800M in Debt to Pay DOJ Fine, Redeem 2025 Bonds

Most Popular

IGT Discloses Cybersecurity Incident, Financial Impact Not Clear

Sphere Threat Prompts Dolan to End Oak View Agreement

This Pizza & Wings Costs $653 at Allegiant VIP Box in Vegas!

MGM Springfield Casino Evacuated Following Weekend Blaze

Most Commented

-

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 4 Comments -

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments -

Chukchansi Gold Casino Hit with Protests Against Disenrollment

— October 21, 2024 — 3 Comments

No comments yet