Amaya Stock Insider Trading Allegations Hit Toronto’s Aston Hill Asset Management Former Execs

Posted on: April 13, 2017, 11:20h.

Last updated on: April 13, 2017, 11:37h.

Canada’s Ontario Securities Commission (OSC) has accused former executives of asset management firm Aston Hill of insider trading in Amaya stock.

Ben Cheng, the company’s former president and chief investment officer at the time, and John David Rothstein, its ex-senior VP and national sales manager, are alleged to have profited from the trades in 2014, while allegedly being party to non-public information relating to Amaya’s takeover of the Olford Group and its most famous asset, PokerStars.

While the term “accused” in Canada appears to sometimes mean the equivalent of “charged” in the US, there are several definitions, making the exact status of this case opaque.

It’s alleged that Cheng learned of the pending takeover at a meeting in April 2014, at which he signed a non-disclosure agreement. But on June 11, 2014, the day before the acquisition was made public, the OSC alleges that Cheng tipped off Rothstein about the deal and told him to spread the word among other Aston Hill clients.

Spreading the Word

“Cheng … suggested to Rothstein to inform others, who had lost money on certain other investments promoted by [Aston Hill], about the acquisition before it was announced,” the OSC said in its statement. “Rothstein understood that the purpose of providing them with the material, undisclosed information was to make up for these losses.”

“Material information” is that which is not yet public, but could impact a business’s share price if and when that information is ever released.

According to OSC transcripts, soon after the meeting, Rothstein himself bought 700 shares in Amaya, selling them two days later for a $5,507 profit. Rothstein passed the information onto Frank Soave, who was, at the time, a VP and investment adviser at CIBC Wood Gundy. Soave made just under $100,000 from subsequent trading.

The OSC also alleges that Cheng, Soave, and Eric Tremblay, former CEO of Aston Hill, made false or misleading statements during the course of the commission’s investigation.

Taking Stock

Amaya’s stock rose rapidly in the weeks prior to the announcement of the takeover, suggesting something was going on behind the scenes. Rumors of the deal were reported in the gambling press a full three weeks before it was publicly announced. On the Friday before these rumors were first publicized in the press, stock shot up by nearly 14 per cent.

In December 2014, the OSC’s Quebec counterpart, AMF, raided Amaya’s offices, seizing computers and documentation. In March 2016, it charged the company’s founder, major shareholder, CEO and chairman, David Baazov, with five counts of securities fraud.

Baazov was forced to resigned from his executive roles at Amaya as a result, and has since sold the vast majority of his stake in the business. He is due to stand trial for the charges, to which he has plead not guilty, this coming November.

Related News Articles

David Baazov Forms New Global Investment Company

DOJ to Release $33.5 Million in AP/UB Online Poker Player Paybacks

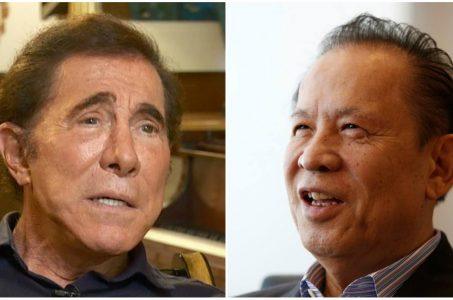

Wynn Resorts Must Face Former Shareholder Kazuo Okada in Court, Judge Rules

Most Popular

Jackpot News Roundup: Two Major Holiday Wins at California’s Sky River Casino

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

MGM Osaka to Begin Construction on Main Resort Structure in April 2025

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 33 Comments -

Zillow: Town Outside Las Vegas Named the Most Popular Retirement City in 2024

— December 26, 2024 — 31 Comments -

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

— December 27, 2024 — 9 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments

No comments yet