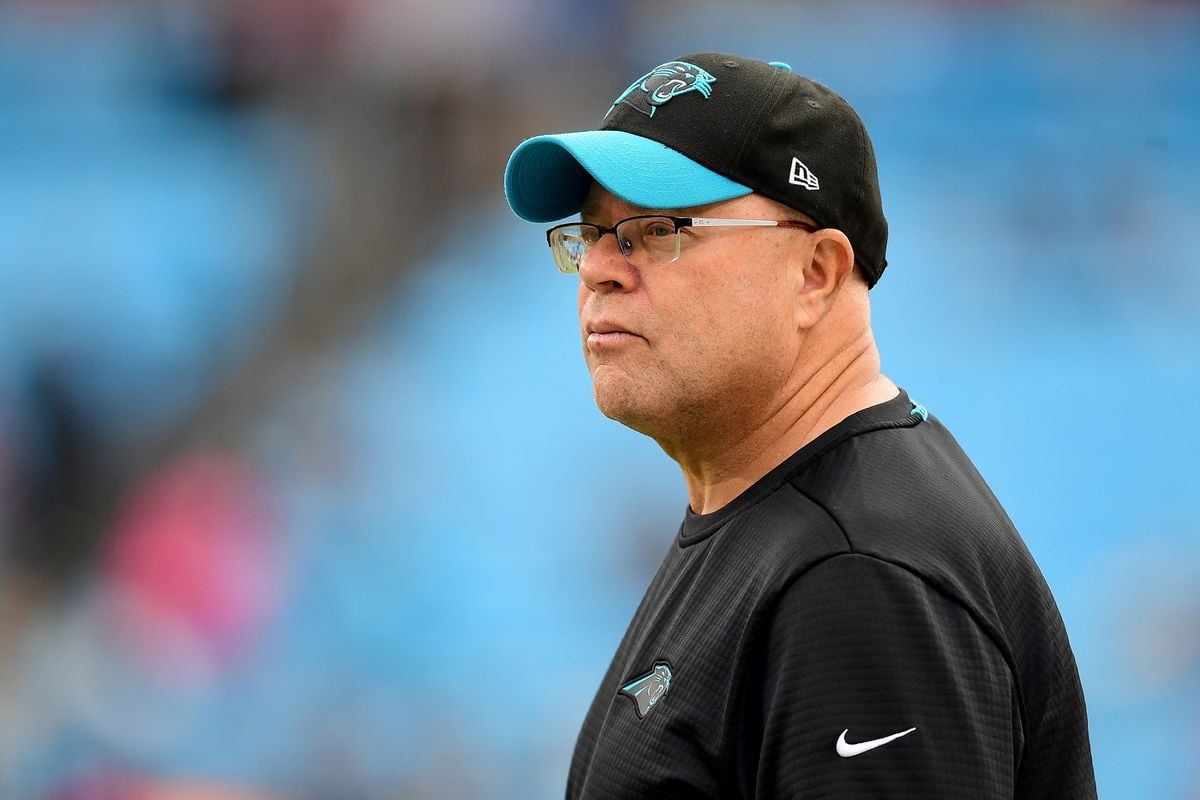

NFL Owner David Tepper’s Hedge Fund Scoops Up Shares of Sands, Wynn Resorts

Posted on: May 16, 2022, 02:59h.

Last updated on: May 16, 2022, 03:21h.

David Tepper’s Appaloosa Management made two additions to its equity portfolio in the first quarter, and both hail from the gaming industry.

The hedge fund founded by the owner of the NFL’s Carolina Panthers initiated stakes in Las Vegas Sands (NYSE:LVS) and Wynn Resorts (NASDAQ:WYNN) in the first three months of the year, representing its only new positions as of March 31.

Although many of Appaloosa’s investments such as distressed debt and other fixed income are not disclosed via 13F filings, the fund’s equity portfolio has proven to be a source of excellent returns. Tepper is opportunistic in his equity investing and often takes a contrarian view,” according to WhaleWisdom.com.

In the March quarter, the hedge fund bought 525,000 shares of Las Vegas Sands and 225,000 shares of Wynn Resorts, according to a 13F filing with the Securities and Exchange Commission (SEC). Those are the only gaming names currently in the Appaloosa portfolio. But the investment vehicle owns several other consumer discretionary stocks. That’s the sector where gaming equities reside.

Tepper’s fund has previously bought and sold gaming stocks. For example, it held a position in Caesars Entertainment (NASDAQ:CZR) in mid-2019 leading up to that company receiving an acquisition offer from Eldorado Resorts.

Tepper Making De Facto Macau Bet

By making Sands and Wynn its gaming stocks of choice, Appaloosa is, in essence, betting on a Macau rebound.

LVS owns five integrated resorts in the world’s largest casino hub, while Wynn’s Wynn China arm runs a pair of gaming venues there. Both companies derive significant portions of their revenue and earnings before interest, taxes, depreciation and amortization (EBITDA) from the Chinese territory, which has been a negative attribute since the start of the coronavirus pandemic.

While 13F filings don’t mention exactly when professional investors add or eliminate positions, Appaloosa is likely down on LVS and Wynn for the sheer fact that both stocks slumped in the first quarter, owing to China’s ill-fated zero COVID policy.

However, shares of Macau concessionaires, including strong contributions from Sands and Wynn, soared last Friday amid speculation that Beijing is considering loosening some travel restrictions. That would allow more mainland China residents and foreigners to enter the SAR.

LVS owns just one other gaming venue – Marina Bay Sands (MBS) in Singapore — while Wynn controls Wynn and Encore Las Vegas and Encore Boston Harbor.

Not Controversial for NFL Owner

There may have been a time when an owner investing in casino stocks would have been frowned upon by the NFL, but that era is long gone. Additionally, there are no signs that Tepper is looking to affect significant change, such as a sale, at either Las Vegas Sands or Wynn.

Moreover, Appaloosa manages dozens of equity positions and could simply be looking for quick gains in the pair of casino stocks.

For its part, the NFL itself is an investor in some sports betting-related companies, and owners Robert Kraft of the New England Patriots and Jerry Jones of the Dallas Cowboys were early investors in DraftKings (NASDAQ:DKNG).

Related News Articles

Las Vegas Expects 322,000 Thanksgiving Visitors – Workers Picket Airport

Disney CEO Bob Iger Lukewarm on Sports Betting

Most Popular

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

VEGAS MYTHS RE-BUSTED: The Traveling Welcome to Las Vegas Sign

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 33 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet