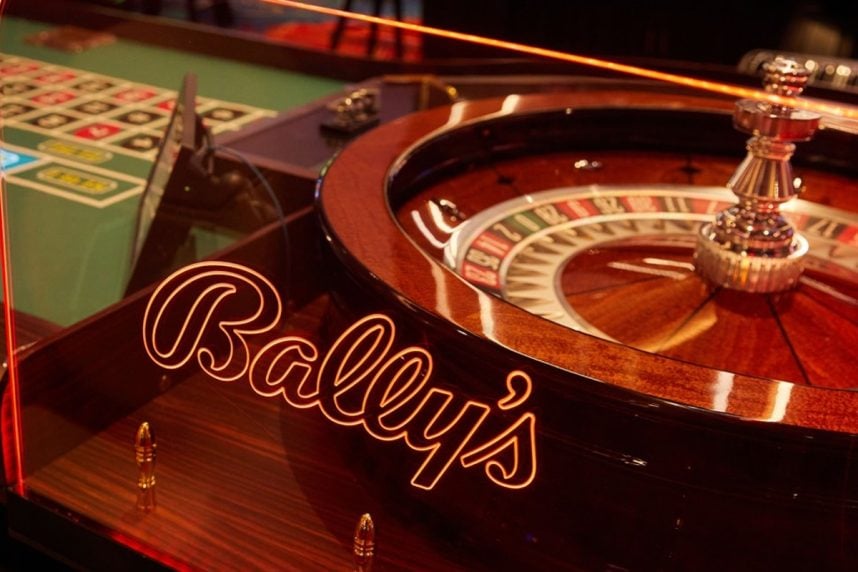

Bally’s Wins Over Rhode Island Senate President for iGaming, Legislation Introduced

Posted on: April 28, 2023, 09:28h.

Last updated on: April 29, 2023, 12:02h.

Rhode Island-based Bally’s Corporation has successfully convinced several of the state’s most powerful lawmakers to support the legalization of iGaming.

In February, Bally’s began campaigning for online casino privileges. The company cited concerns that the emergence of online sports betting in neighboring Massachusetts would cut into Rhode Island’s online sports betting revenue. That would affect the state’s subsequent gaming tax allocation,

The company holds a monopoly on casino gambling in the state. It operates Rhode Island’s two brick-and-mortar casinos, Bally’s Twin River Lincoln and Bally’s Tiverton.

Bally’s officials told state lawmakers that their predictions have now come true. Massachusetts’ online sportsbooks, which opened in March — and the 2021 liberalization of online casino gaming in Connecticut — are hurting the company’s Rhode Island operations. For the state to sustain and grow its annual gaming taxes, Bally’s contends iGaming is needed.

State Senate President Dominick Ruggerio agrees. Ruggerio and six cosponsors filed Senate Bill 948 this week to allow Bally’s to conduct online casino games.

“Our state casinos provide an important source of revenue to fund vital programs and investments that benefit all Rhode Islanders,” Ruggerio said after introducing the expanded gambling measure.

Currently, iGaming with interactive slot machines and table games is legal in only six states: Delaware, New Jersey, Pennsylvania, West Virginia, Connecticut, and Michigan.

Tax Goldmine

Sports betting might get most of the gaming industry headlines, but oddsmakers generate far less revenue than iGaming platforms. In New Jersey, for instance, sportsbooks generated gross gaming revenue (GGR) of $762.9 million in 2022. Online casino revenue totaled more than $1.66 billion.

Though Rhode Island is the smallest state in terms of size and the seventh least-populated, with just 1.1 million residents, state officials say iGaming would provide a large tax benefit. Legal internet casinos, state leaders believe, could result in a potential tax windfall of more than $100 million annually.

SB948 proposes a 50% tax on online slot machines and an 18% tax on interactive table games. The legislation doesn’t propose a licensing fee for Bally’s or its online gaming partners.

Ruggerio’s bill has been referred to the Senate Special Legislation and Veterans Affairs Committee for initial consideration.

Committed to Rhode Island

Bally’s this week showed off its recent renovations and expansion of its Twin River Lincoln Casino Resort.

The company pledged to invest $100 million into its two state casinos in exchange for Rhode Island lawmakers extending its casino monopoly by 20 years. The subsequent $60 million Twin Rivers overhaul resulted in 40,000 square feet of additional gaming space. The Lincoln Investment included a 14,000-square-foot Korean day spa.

Bally’s officials aren’t concerned that retail patrons might move online should iGaming become legal. The company says the liberalization of online casinos in other states has only grown revenue overall.

Bally’s operates iGaming in New Jersey through its Atlantic City casino and in Delaware through its Bally’s Dover Casino Resort.

Related News Articles

Maryland iGaming Bill Would Ask State Voters If They Want Online Casinos

Iowa iGaming Measure Introduced, Bill Doesn’t Seek Passage in 2023

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet