BetMGM Making iGaming Strides

Posted on: October 3, 2024, 04:28h.

Last updated on: October 4, 2024, 09:18h.

As measured by downloads of mobile applications, BetMGM is making progress in getting its online casino offering in front of more bettors.

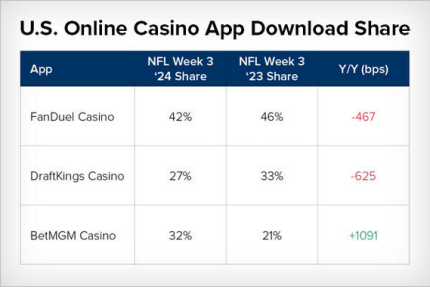

Citing Sensor Tower data, Eilers & Krejcik Gaming (EKG) noted that through the first three weeks of the 2024 NFL season, downloads of BetMGM’s casino app surged relative to the year-earlier period, while downloads comparable platforms from rivals DraftKings and FanDuel trended lower.

For BetMGM, those strides are important because internet casino is widely viewed as one of the operator’s areas of strength even though it’s ceded some market share in that space over the past several years. Online casinos are viewed as a significant long-term growth frontier for gaming companies – one offering superior margins relative to online sports betting.

BetMGM iGaming Investments Paying Off

BetMGM is a 50/50 joint venture between MGM Resorts International (NYSE: MGM) and Entain Plc (OTC: GMVHY). The progress the operator is making in iGaming is important because it previously dubbed 2024 as “a year of investment,” potentially signaling a stronger commitment to online casino.

We’ve seen similar trends across the entire first month of the NFL season, suggesting BetMGM is investing heavily to capture online casino GGR share this fall,” noted EKG. “BetMGM casino app downloads meanwhile, are up by a very punchy +74% y/y, while FanDuel Casino and DraftKings Casino downloads are up by +24% and +25%, respectively.”

The research firm pointed out that before BetMGM’s renewed iGaming push, its share of the domestic online casino market fell to 20%, or third place, in the second quarter. That decline may have been part of the impetus behind the renewed emphasis on the operator’s internet casino offering.

“However, in the August 8-September 23 period, BetMGM Casino captured 32% download share among this group, up from 25% last year,” according to EKG.

Why iGaming Matters to BetMGM

iGaming’s long-term growth potential makes it pivotal for operators such as BetMGM. Currently, just seven states — Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, Rhode Island, and West Virginia – permit that form of wagering, but that figure is expected to grow in the years ahead as states scramble for new revenue sources.

Specific to BetMGM, iGaming could be an avenue through which the company stands out relative to peers – something it’s struggled to do in online sports betting (OSB) where DraftKings and FanDuel effectively hold a duopoly.

“OSB is a more competitive space where BetMGM has been less of a standout. Casino has long been BetMGM’s stronger suit—our app testers consistently highly rank BetMGM Casino for its depth of content and features — so a harder pivot toward casino, amid BetMGM’s reinvestment year, would make sense,” concluded EKG.

MGM has also made a series of bolt-on acquisitions aimed at fortifying its iGaming footprint, and there’s evidence some of those moves could pay dividends over the long term.

Related News Articles

Caesars Sportsbook Customer Retention Impresses

iGaming Upstarts Can Make Headway, Says Research Firm

Disney Tech Exec LaBerge Joining Penn Entertainment as CTO

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet