Billy Walters “Savvy Investor,” Not Insider Trader, Court Hears

Posted on: April 5, 2017, 06:00h.

Last updated on: April 5, 2017, 12:18h.

On the penultimate day of arguments in the Billy Walters trial, Walters’ lawyers positioned their client as a man who displays the kind of acumen investing In the stock market that he has throughout his sports betting career.

Walters, one of the most famous and successful sports bettors in the world, stands accused of making $43 million from illegal stock market trades using insider tips, allegedly provided by Tom Davis, the former chairman of Dean Foods Co.

The message this week was clear: Walters is so smart at stock market investment that he doesn’t need to cheat.

The defense called a parade of stock market brokers to testify in confirmation of that assertion.

Prosecution Star Witness Embezzled Money

The only problem for Walters is the star witness for the prosecution, Tom Davis himself, who has testified in court that he became a “virtual conduit of information” on Dean Foods for his former friend Walters.

Davis is testifying against Walters as part of a plea bargain with federal prosecutors after admitting charges including securities fraud and wire fraud.

Barry Berke, Walters’ attorney, has argued that Davis is an unreliable witness and “a liar” who “wrongfully implicated Walters only after he got caught stealing from a charity and cheating on his taxes.”

Davis himself has admitted in court that he embezzled money from a charity for battered women in order to help fund his love of gambling and hookers.

He has also admitted he borrowed over $1 million from Walters, part of which he told Walters was to refinance a Dallas bank, but in reality it was for himself, and he blew it gambling. He lost $200,000 alone on one hand of blackjack, in 2011 at the Cosmopolitan in Las Vegas.

The Babe Ruth of Risk

Appearing for the defense, stockbroker Rob Miller, of Stifel Nicolaus & Co., told the jury that Walters was a “very, very aggressive investor” who would make trades in amounts anywhere from $5 million to $100 million and would study the markets assiduously.

“He really, I would say, combined a professional style of gathering research and information with a gambler’s trading instinct,” said Miller. “He was far and away my most aggressive investor.

“Sometimes he’d talk to me in gambling parlance,” he added. “Oftentimes, he would refer to his investments as ‘bets.’ ”

Another broker referred to him as the “Babe Ruth of Risk.”

Closing arguments are expected on Wednesday.

Related News Articles

David Baazov Forms New Global Investment Company

DOJ to Release $33.5 Million in AP/UB Online Poker Player Paybacks

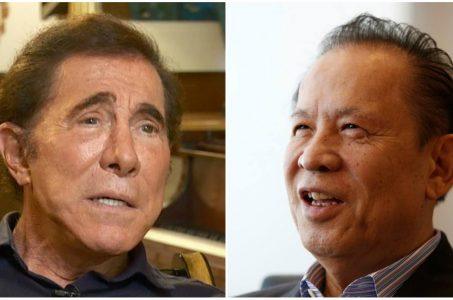

Wynn Resorts Must Face Former Shareholder Kazuo Okada in Court, Judge Rules

Most Popular

Sphere Threat Prompts Dolan to End Oak View Agreement

MGM Springfield Casino Evacuated Following Weekend Blaze

This Pizza & Wings Costs $653 at Allegiant VIP Box in Vegas!

Atlantic City Casinos Experience Haunting October as Gaming Win Falls 8.5%

Most Commented

-

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 4 Comments -

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments -

Chukchansi Gold Casino Hit with Protests Against Disenrollment

— October 21, 2024 — 3 Comments

Last Comment ( 1 )

This whole thing is a sham for the goverment.