Caesars $3.7 Billion Takeover Bid Backed by William Hill Board

Posted on: September 30, 2020, 06:33h.

Last updated on: September 30, 2020, 10:47h.

Caesars Entertainment has agreed to acquire British bookmaker William Hill (WH) for £2.9 billion, or $3.7 billion, in cash.

The US casino giant shut out a rival bid from its former controlling shareholder, the private equity group Apollo Global, to capture the hearts and minds of the WH board, which has given the proposal it’s unanimous backing.

The deal, which represents a 25 percent premium on the UK company’s share price prior to bidding, must be agreed to by 75 percent of WH shareholders. If that happens, Caesars said it hopes to finalize the deal in the first half of 2021.

An enlarged Caesars — its $17 billion combination with Eldorado Resorts now complete — hopes that WH’s know-how will help it corner a US sports betting market that could one day be worth $30 billion to $35 billion, according to some analysts.

Caesars has said the acquisition could help it generate between $600 million and $700 million in revenues next year in online and sports betting.

“William Hill’s sports betting expertise will complement Caesars’ current offering, enabling the combined group to better serve our customers in the fast-growing US sports betting and online market,” Tom Reeg, the chief executive of Caesars, said.

Always the Bridesmaid

WH has long sought consolidation to help weather the regulatory headwinds in the European markets in recent years. But until now it has been the perennial bridesmaid.

Negotiations with the likes of The Stars Group and 888 have fallen through over the years, while competitors like Flutter Entertainment and GVC have formed successful combinations to overtake WH in scale.

In the meantime, the bookmaker has turned its attention to the new US sports betting markets to offset challenges closer to home. Here in the US, it is the largest operator of sportsbooks in the country and has a lucrative deal with Caesars to operate sports betting at its properties, with an 80/20 split in favor of WH.

Shareholder Dilemma

Caesars made it clear that this deal would be jeopardized if William Hill were to reject its advances, useful leverage that helped convince the WH board to reject the Apollo bid.

But Caesars has also said that its focus will be on the WH’s US arm alone and that it has no interest in its operations across the pond, which means they will likely be sold. This leaves shareholders with a dilemma — reject the deal and trash the WH’s hopes in the US, or accept it and witness the breakup of the 86-year-old company.

Over recent years, [WH] has transformed from a business once heavily reliant on UK retail into a company that is truly diversified by geography and channel, providing a stable standalone platform for future growth,” said WH chairman Roger Devlin in a statement.

“For now, it is very much business as usual,” Devlin continued. “Employees will be kept fully informed through this process. In terms of our UK and International businesses, we believe they have a strong future ahead, and we will work with Caesars to find suitable partners to further the long-term growth prospects of these businesses.”

Related News Articles

Genius Sports Merging with SPAC dMY Technology in $1.5 Billion Deal

AGS Soars on Reported Inspired Entertainment Takeover Bid

Caesars Could Bid for Flutter Following UK Whitepaper Release

Everi Buying Select Video King Assets for $59M

Most Popular

IGT Discloses Cybersecurity Incident, Financial Impact Not Clear

What ‘Casino’ Didn’t Tell You About Mob Wife Geri Rosenthal

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

Fairfax County Officials Say No NoVA Casino in Affluent Northern Virginia

Most Commented

-

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 6 Comments -

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 5 Comments -

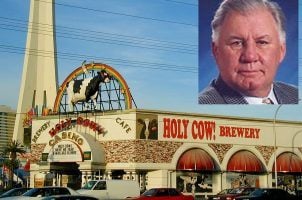

LOST VEGAS: The Historic Holy Cow Casino

— November 29, 2024 — 4 Comments -

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments

No comments yet