The 2016 Caesars Bankruptcy Proceedings That Seemingly Would Never End

Posted on: December 24, 2016, 10:00h.

Last updated on: December 20, 2016, 09:03h.

The bankruptcy of Caesars main operating unit, CEOC, was already a year old by the beginning of 2016 and apparently going nowhere fast.

CEOC filed for chapter 11 bankruptcy in June 2015 in a bid to reorganize the lion’s share of its 18 billion debt. This was accumulated when the company, then known as Harrahs, was acquired in a 2007 $30 billion leveraged takeover by hedge funds Apollo and TPG, just before recession rocked the casino industry.

The bankruptcy reorganization plans immediately found opposition in the form of CEOC’s junior shareholders who believed they were getting a raw deal.

Many of them sued Caesars in a bid to hold the parent to guarantees of CEOC’s debts. They also accused the company of systematically stripping the bankrupt unit of its most prized assets for the benefit of its controlling private equity backers.

Liquidation a “Hoot”

By January 2016, negotiations had made little headway. Judge Benjamin Goldgar expressed his exasperation at the fact that Caesars was sitting on seven million pages of what it considered confidential or privileged documents, thereby obstructing a court-appointed examiners’ report into the junior creditors’ claims.

“It doesn’t have to end with a confirmed plan,” said the judge, while warning that the case could be converted to chapter 7 liquidation. “That would just be a hoot, wouldn’t it?” he added.

The report was finally produced in March, and it didn’t look good for the casino giant. Ex-Watergate prosecutor Richard Davis and his team found that Apollo and TPG had in 2012, indeed, begun a strategy to weaken CEOC and strengthen their own hand in the preparation for potential bankruptcy proceedings.

This certainly had a whiff of fraud about it, and Davis estimated potential damages for creditors’ claims ranged from $3.6 billion to $5.1 billion.

Turning Point

As negotiations continued throughout the year, we saw a mediator resign in exasperation. But turning point appeared to arrive the judge granted a request that Caesars private equity backers and directors would have to “pony up the paper,” and reveal details of their financial wealth to the court.

A new, improved offer, aided by the $4.4 billion sale of Caesars Interactive’s Playtika social gaming operation, swiftly appeared and finally brought the junior creditors on board after 23 months of bitter legal squabbles.

There was also improved equity for the creditors in a future reorganized company, which saw Apollo and TPG lose their controlling stake. In all, the pot was sweetened to the tune of $5 billion for the junior creditors, a condition of which was that Caesars would be released from allegations of asset stripping and resulting legal claims.

All’s well that ends well? Except that Caesars may not be out of the woods yet. In November, the bankruptcy watchdog, the US Trustee, filed an objection to the releases on the grounds that they offered exculpation of “a wide array of parties for acts far beyond the plan or the Chapter 11 cases,” according to Reuters.

The watchdog also said the legal releases were too broad for shielding against willful misconduct or actual fraud.

You can’t please everyone, as Caesars is learning at its own peril. On Monday, the gaming operator’s bank lenders, the highest in the chain of creditors, threatened to withdraw their support of the new plan, branding the terms of the new debt that are set to be received under the reorganization “unacceptable.” They gave the embattled casino giant until today, December 24, to make it right.

A trial to confirm the bankruptcy is due to take place in January.

Related News Articles

PAGCOR Auctioning Two Parcels of Land at Site of Solaire Casino

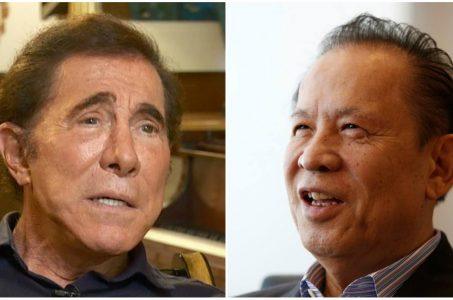

Wynn Resorts Must Face Former Shareholder Kazuo Okada in Court, Judge Rules

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 31 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

— December 13, 2024 — 7 Comments

No comments yet