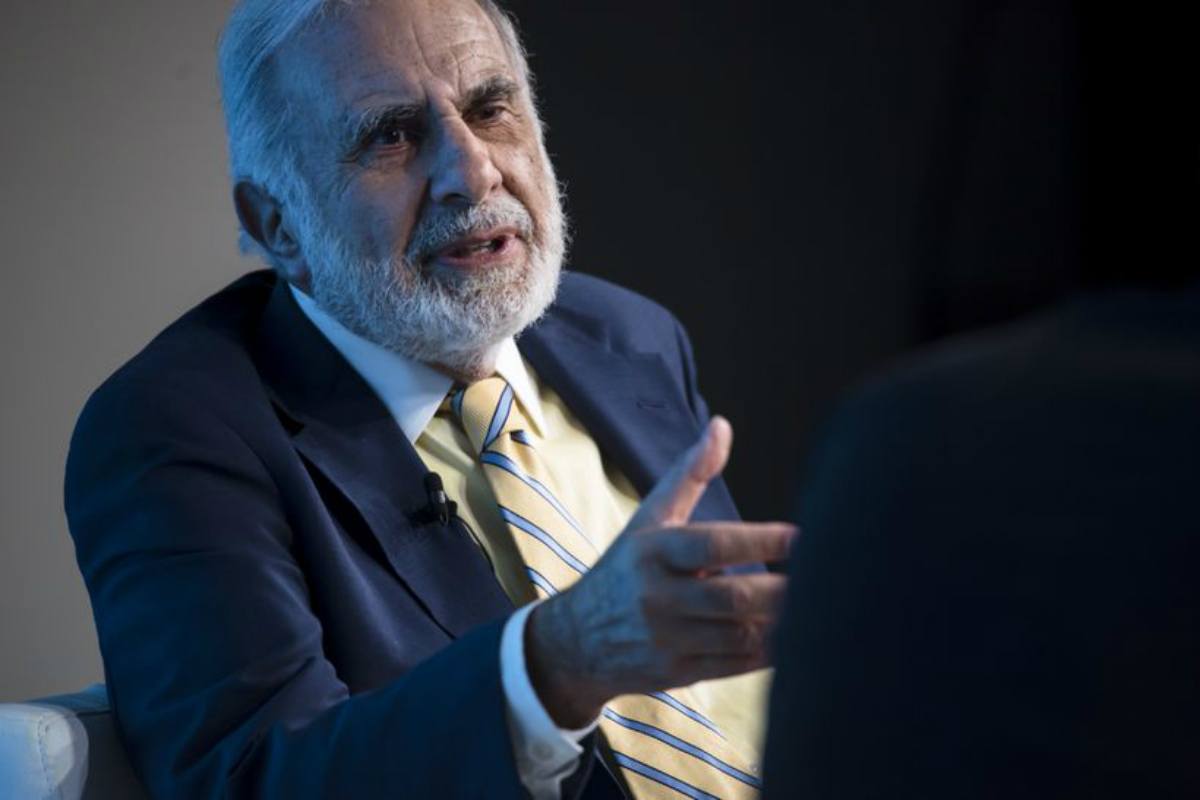

Caesars Entertainment Board Frustrated With Billionaire Carl Icahn Regarding Acquisition Price

Posted on: June 18, 2019, 09:38h.

Last updated on: June 18, 2019, 09:38h.

The Caesars Entertainment Board of Directors is becoming frustrated with billionaire Carl Icahn over a potential selling price of the casino operator that owns its namesake brand, as well as Harrah’s, Bally’s, and Horseshoe properties across the US.

The news comes from the New York Post‘s Josh Kosman, who has broken several updates on the Caesars acquisition process. Icahn has acquired a 28.5 percent stake in the casino giant.

Kosman relays that Icahn is more eager to sell the company than the majority of those on the 11-person board. Eldorado Resorts is the frontrunner to acquire the larger Caesars, but the two parties have yet to settle on a price that appeases both sides.

Icahn … has agreed that Eldorado’s $10.50 offer, which represented a measly 15 percent premium over the stock, was unacceptable. But he is also willing to accept less than the board is now seeking,” sources explained to Kosman.

Since acquiring a considerable position in Caesars, Icahn has been pushing for the company to sell. He’s been afforded three seats on the board, and handpicked new CEO Tony Rodio to lead the company in the interim.

Latest Developments

Eldorado announced yesterday that it was selling two casinos in Missouri and another in West Virginia to Century Casinos and VICI Properties in a deal valued at $385 million.

Gaming analysts opined that the transaction hints the seller is inching closer to a deal for Caesars, and the sale is an effort to ease potential federal anti-trust concerns. It also frees up a considerable amount of money for Eldorado to make a cash and stock offer.

“Although we have no direct insight into the matter, we suspect investors will speculate as to whether or not this could be Eldorado’s first step toward making another transformational acquisition,” Stifel analyst Steven Wieczynski explained.

Icahn purchased most of his Caesars Entertainment shares at around $9. While he rejected the $10.50 per share offer, the corporate raider is growing tired of the lengthy process and is willing to take something far less than the $13 the Caesars board is seeking.

Stock Performance

It’s been a bumpy ride for Caesars shareholders as the potential acquisition with Eldorado plays out. Despite Icahn’s substantial investment in the financially distraught company, shares have essentially remained flat. That shows that investors aren’t convinced that a forthcoming deal is on the way.

Usually, when a company announces that it’s up for sale, its stock price jumps. Buyout deals normally are agreed to at a premium for the selling company, so investors try to front run the premium that a buyer might pay,” The Motley Fool’s Travis Hoium wrote in April. “That hasn’t happened with Caesars Entertainment.”

However, a Post source believes Icahn will use his financial prowess to convince the Caesars board to accept an offer. “No one’s better at getting things done than Carl,” the insider opined.

Icahn’s experience in the gaming industry is lengthy. His holdings company has owned Tropicana Entertainment – which it sold last year to Eldorado for $1.85 billion – and also Trump Entertainment Resorts.

Related News Articles

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

Last Comments ( 2 )

You’re quoting a 2 month old Motley Fool article? You do realize the stock is up 11% in the last two weeks on very high volume. It now trades just $0.40 below the baseline $10.50 offer. This cut and paste journalism is worthless but if you aren’t smart enough to write your own piece and bring fresh facts or insight then don’t bother. But if you must then at least check the facts!

Let the deal fall through. Force Caesars to clean house and downsize through property sales. Refocus on MAJOR US markets (Vegas, AC, South), and Asia. OR split company into separate companies by brand and sell unprofitable brands, OR separate company into Pre-Harrah’s merger (Caesars Entertainment & Harrah’s) and sell separately. Sell Rio-Las Vegas at any cost.