China Mulling Legal Action Against Foreign Casinos Targeting Mainland High Rollers

Posted on: October 13, 2020, 10:05h.

Last updated on: October 13, 2020, 11:27h.

The People’s Republic of China is continuing its crusade to stop international casino resorts from marketing and catering to its wealthiest citizens.

The Standing Committee of the National People’s Congress (NPC) is reviewing a law that would make it a crime for overseas casinos to lure in Chinese gamblers, according to The China News Service. How a Chinese law might be enforced in another country isn’t clear, nor are the penalties that the People’s Republic is seeking to impose on gaming resorts that violate its potential law.

The law being reviewed would further crackdown on cross-border gambling. Mainland citizens are prohibited from gambling, the lone exception being China’s state-run lotteries.

Macau, a Special Administrative Region (SAR) of China with its own autonomous government, is the world’s richest gambling epicenter. When China discusses cross-border gambling crackdowns, mainland officials say that generally excludes Macau.

China’s Tightening Grip

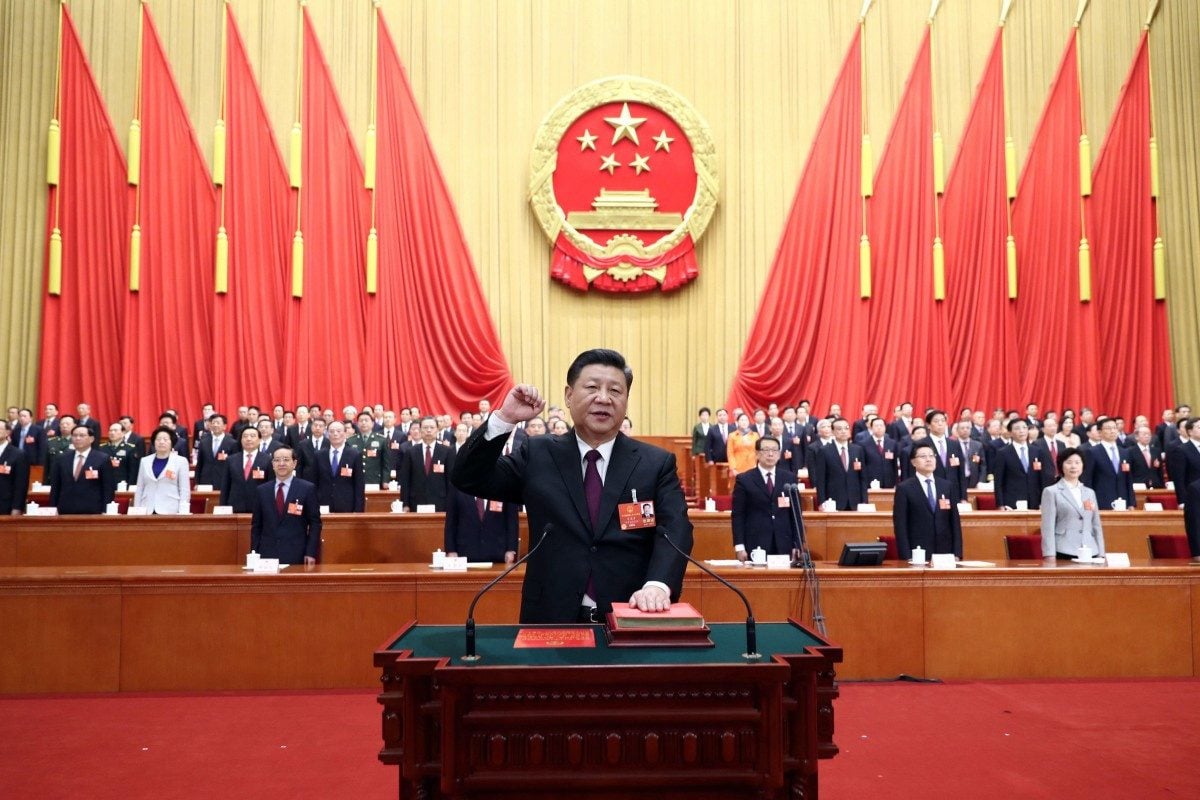

Mainland China citizens are permitted to gamble in Macau, but their high-stakes gambling has come under central government scrutiny in recent years. They’re not allowed to use the SAR as a tax haven to move money out from the People’s Republic control. In 2013, after Macau’s six licensed casino operators won a record $45 billion, China President Xi Jinping directed law enforcement to better monitor VIP junket groups.

Junkets work with Macau’s multibillion-dollar casino resorts, guaranteeing them a certain amount of revenue from Chinese VIPs. The junket groups receive a commission but are responsible for recouping debts.

China has viewed the massive flow of money across its borders as a national security risk. The suppression of junket operators resulted in gross gaming revenue (GGR) plummeting from $45 billion in 2013 to less than $28 billion in 2016.

GGR is down severely in 2020 due to COVID-19. Through September, Macau casinos have won $4.8 billion, down 82.5 percent. With the news out of China that the country is mulling further restrictions on cross-border gambling, US-traded casino operators invested in Macau saw their stocks slide today. As of the afternoon, Las Vegas Sands was down 1.3 percent, MGM Resorts 1.8 percent, Wynn Resorts 3.2 percent, and Melco Resorts 1.7 percent.

A note this week from gaming industry analysts at Bernstein voiced concerns regarding “uncertainty surrounding potential money flow constraints out of China” in relation to Macau’s near-term COVID-19 recovery effort.

International Offenders

Junket groups in other parts of Asia and Oceania have targeted Chinese gamblers. In 2016, China arrested and imprisoned 18 Crown Resorts employees on charges of committing “gambling crimes.”

China’s Ministry of Culture and Tourism announced in August the formation of a blacklist of foreign casinos that routinely target its citizens. The People’s Republic says it plans to impose travel restrictions on those destinations, though it has yet to confirm any such banned destination.

China is also seeking to block offshore gaming operators based in the Philippines from facilitating online gambling for mainlanders. Philippines President Rodrigo Duterte has refused to assist China in that mission, telling Xi that the tax revenue from the internet casinos is critical to his country.

Related News Articles

Stanley Ho Family Bicker After Late Casino Mogul Didn’t Leave Will

China Court Convicts, Imprisons 36 Suncity Operatives

Levo Chan Trial Heats Up as Macau Judge Loses It with Tak Chun Witness

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 31 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet