Corvex Management Boosts MGM Stake to 15.67 Million Shares

Posted on: August 18, 2021, 08:21h.

Last updated on: August 18, 2021, 12:40h.

Keith Meister’s Corvex Management upped its position in MGM Resorts International (NYSE:MGM) during the second quarter.

The hedge fund controlled by the MGM board member now owns 15.67 million shares of the largest operator on the Las Vegas Strip, a stake valued at $668.47 million as of June 30, according to a Form 13F filing with the Securities and Exchange Commission (SEC).

Corvex’s portfolio contains more than 30 equity positions, spanning stay-at-home stocks, reopening ideas, and “event-driven” plays. While the hedge fund owns shares in several consumer discretionary stocks, including Amazon (NASDAQ:AMZN), MGM Resorts is the only casino operator on its roster.

Form 13F doesn’t indicate exactly when an investor buys or sell shares. But it’s likely Corvex is in the money on the newest part of its MGM stake, as the stock gained 7.4 percent in the June quarter. The shares are up 20.37 percent year-to-date.

Corvex is the fourth-largest institutional investor in MGM, trailing only fund issuers Vanguard, BlackRock, and State Street.

Meister Bullish on MGM Online Exposure

Shares of the Bellagio operator represent 29.39 percent of Corvex’s assets under management, and the hedge fund controls 3.2 percent of the gaming company’s shares outstanding, according to GuruFocus data.

Meister’s enthusiasm for the company at which he holds a board seat stems in part from the thriving BetMGM business. In an interview with CNBC earlier this year, the investor said he’s “massively bullish on the potential opportunity for BetMGM,” while noting it’s “a misvalued asset” inside the gaming company.

When the casino operator reported second-quarter results earlier, it said BetMGM is the second-largest online sportsbook and iGaming platform in the US.

BetMGM is a 50/50 joint venture between MGM and Entain Plc (OTC:GMVHY). That structure, coupled with the casino company’s increasing cash stockpile, is stoking speculation among analysts and investors that as the online casino/sports betting business continues gaining market share, MGM will tire of sharing the economics and make another takeover offer for the British operator.

In January, Entain rejected an $11.06 billion bid from MGM, calling it inadequate.

Meister Paid Off for MGM

Meister joined MGM’s board in January 2019, eventually becoming one of the architects of the company’s asset-light strategy. That’s seen the casino operator shed much of its real estate holdings to raise cash that can be allocated to faster-growing businesses.

That strategy is paying off handsomely, with recent transactions confirming as much. In July, MGM surprised Wall Street by paying $2.12 billion for half of CityCenter and selling the property assets of Aria and Vdara to Blackstone for $3.89 billion.

Two weeks ago, VICI Properties (NYSE:VICI) said it’s acquiring MGM Growth Properties (NYSE:MGP) for $17.2 billion in stock, creating a $4.4 billion windfall for MGM via its stake in MGP.

Related News Articles

Most Popular

IGT Discloses Cybersecurity Incident, Financial Impact Not Clear

What ‘Casino’ Didn’t Tell You About Mob Wife Geri Rosenthal

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

Fairfax County Officials Say No NoVA Casino in Affluent Northern Virginia

Most Commented

-

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 6 Comments -

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 5 Comments -

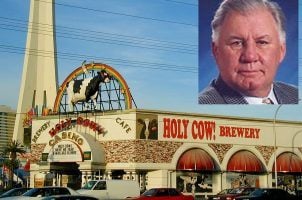

LOST VEGAS: The Historic Holy Cow Casino

— November 29, 2024 — 4 Comments

No comments yet