Cosmopolitan Nightclub Lawsuit Awards Former Hedge Fund Manager $160.5 Million

Posted on: April 28, 2017, 03:30h.

Last updated on: April 28, 2017, 02:45h.

A 2012 Cosmopolitan nightclub attack has resulted in a $160.5 million verdict for a patron who was brutally assaulted by resort security after he allegedly head-butted the Marquee Las Vegas general manager.

Nongaming amenities and attractions are a huge draw in Las Vegas these days, and resorts are continually trying to enhance their mass-market allure. Getting the next generation, the millennial, inside Strip doors is seen as a paramount issue, but a verdict reached by a jury this week might ward off some would-be Cosmopolitan partygoers.

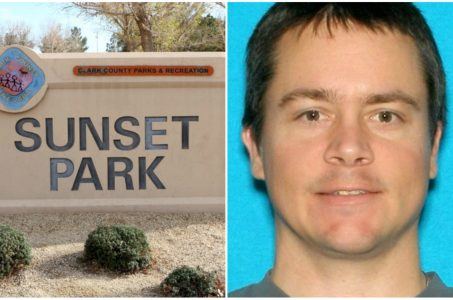

The case involves former financial advisor David Moradi, who until 2012 ran a New York-based hedge fund that oversaw roughly $1 billion. The investor reportedly made $11 million alone in 2011.

According to his lawsuit, Moradi was trying to leave the Marquee nightclub at the Cosmopolitan of Las Vegas after paying a more than $10,000 tab.

That’s when a manager and security demanded he turn over identification and his credit card due to an issue with his signature. The millionaire refused, and the two sides become combative.

The Cosmopolitan says Moradi head-butted its nightclub’s general manager before security apprehended him and escorted the New Yorker to a security room. That’s where, according to the prosecution, he was attacked.

“The Marquee security members and manager shoved David to the ground, causing his head to forcefully hit the concrete,” Moradi’s prosecution claimed, as reported by the Las Vegas Review-Journal. “The Marquee security members and manager repeatedly hit and smashed David’s head into the concrete and continually held his head and right eye against the concrete with a high degree of pressure.”

Jury Doesn’t Buy Defense

The Cosmopolitan nightclub case boiled down to whether Moradi actually suffered brain injuries. A Las Vegas neurosurgeon said he did, and diagnosed Moradio with a traumatic brain injury. His lawyers argued that’s what led to his hedge fund’s collapse.

Cosmopolitan’s defense claimed the hedge fund was failing before the incident, and that the victim didn’t suffer a brain injury, nor any permanent damage.

The jury sided with Moradi, and the court’s $160.5 million award was based on damages and the loss of future wages.

Hedged Bets on Cosmopolitan

Moradi’s $160.5 million payday isn’t the first time the Cosmopolitan has been taken by a hedge fund member.

First envisioned in 2004 by Soros Fund Management, the holdings company of billionaire George Soros, and David Friedman, a former Las Vegas Sands executive, the planned $3.9 billion under-construction project went into financial ruin when the 2008 recession hit.

Deutsche Bank eventually took control of the resort, and finally opened the casino 2010. The Cosmopolitan was the only casino to open in Las Vegas that year.

Four years later in 2014, the Blackstone Group bought the property at the discounted price of $1.73 billion. That same year, Blackstone, a private equity asset management company and hedge fund, helped finance Amaya’s $4.9 billion buyout of the parent companies to PokerStars and Full Tilt Poker.

Blackstone’s founder and CEO Stephen Schwarzman is a longtime Republican, who is also an informal advisor to another man who’s owned casinos, President Donald Trump.

Related News Articles

US Sanctions Kings Roman Casino in Laos For Operating Global Crime Network

Steve Wynn Cannot Sell Shares in Wynn Resorts, Says Nevada Judge

Most Popular

VEGAS MYTHS RE-BUSTED: The Strip is the Brightest Place on Earth

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Jackpot News Roundup: Two Major Holiday Wins at California’s Sky River Casino

VEGAS MYTHS RE-BUSTED: The Traveling Welcome to Las Vegas Sign

Caesars Virginia in Danville Churns Out Long Lines, Lofty Excitement

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 33 Comments -

Zillow: Town Outside Las Vegas Named the Most Popular Retirement City in 2024

— December 26, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

— December 27, 2024 — 7 Comments

No comments yet