DraftKings/Golden Nugget Deal Draws Mostly Positive Response from Analysts

Posted on: August 11, 2021, 01:47h.

Last updated on: August 11, 2021, 02:40h.

On Monday, DraftKings (NASDAQ:DKNG) announced the acquisition of online casino operator Golden Nugget Online Gaming (NASDAQ:GNOG) for $1.56 billion in equity.

It’s DraftKings’ largest purchase since becoming a freestanding public company in April 2020. It is being viewed as further confirmation of the opportunity set in the internet casino industry. Already mostly bullish on DraftKings, analysts are viewing the deal for Tilman Fertitta’s Golden Nugget Online in a favorable light.

B. Riley analyst David Bain, who doesn’t cover DraftKings, but does rate GNOG, says the transaction fills holes for the suitor.

First, it offers DKNG a more significant iGaming stake and cheaper forward market access through the preferred Golden Nugget deal where it is live with a casino,” said Bain. “Further, we have argued iGaming is structurally more profitable than online sports wagering.”

While DraftKings is already an established player in the online casino space, the industry isn’t easy to break into, as Bain notes, and it’s cost-intensive to organically garner customers, underscoring why mergers and acquisitions in the space are expected to heat up.

“The transaction should fast-forward a needed iGaming player base for DKNG where GNOG is live — DKNG’s current player base of younger males differs materially from iGaming’s more similar older/female offline slot demographic,” adds the B. Riley analyst.

Potentially Big Boost to DraftKings Stock

DraftKings stocks has been mostly steady this week, ticking modestly higher in the wake of the deal announcement. GNOG shares soared on Monday, reflecting the 53 percent premium the buyer is paying for the iGaming company.

Over time, the purchase could pay significant dividends for DraftKings, particularly if the $300 million in expected cost efficiencies being touted are realized or exceeded. Additionally, GNOG brings a database of 5.5 million rewards club members to the table, providing the buyer with a robust avenue with which to cross-sell sports wagering and daily fantasy sports (DFS).

Macquarie analyst Chad Beynon says that at maturity, assuming the $300 million in savings is realized, the GNOG buy could be worth $5 to $7 on DraftKings’ stock price.

“We estimate every $10 million in incremental synergies equates to additional accretion of 40 cents a share,” said the analyst. “That said, this is still a major iGaming acquisition in an increasingly competitive space at a time when DraftKings was currently yielding high teens iGaming share and expressed confidence that this was stable.

Probably Good Deal for DraftKings

DraftKings CEO Jason Robins told members of the press Monday that the GNOG purchase is a “steal” for his company, and that might not be hyperbole.

The sportsbook operator is paying for less of a premium for GNOG than is seen on another recent deal in the space. By Bain’s estimation, GNOG could have eventually controlled 10 percent of internet casino market and been worth $27 a share. DraftKings is paying barely more than $18.

Macquarie’s Beynon says DraftKings has ample motivations for the deal, and the transaction “is a major positive” for other iGaming operators.

Related News Articles

Everi Buying Select Video King Assets for $59M

MGM Could Wait Before Bidding Anew for Entain

Emerald Island, Rainbow Club Casinos Acquired by ECL Hospitality

Most Popular

IGT Discloses Cybersecurity Incident, Financial Impact Not Clear

What ‘Casino’ Didn’t Tell You About Mob Wife Geri Rosenthal

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

Fairfax County Officials Say No NoVA Casino in Affluent Northern Virginia

Most Commented

-

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 6 Comments -

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 5 Comments -

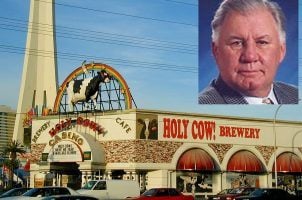

LOST VEGAS: The Historic Holy Cow Casino

— November 29, 2024 — 4 Comments

No comments yet