DraftKings Insiders Sold Nearly $206M in Stock This Year

Posted on: December 31, 2024, 04:50h.

Last updated on: December 31, 2024, 04:50h.

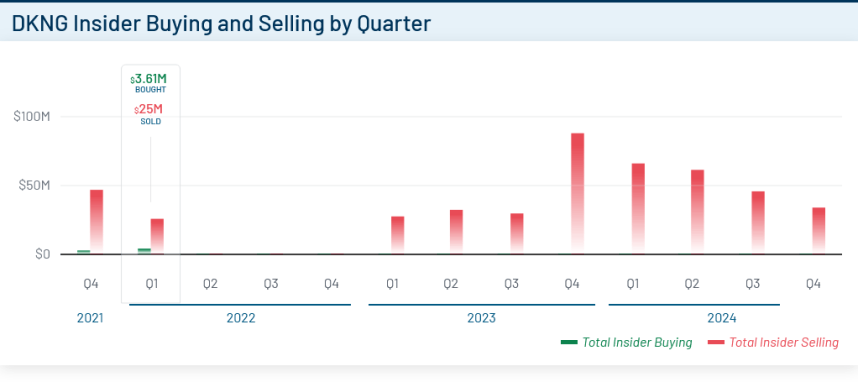

Barring any new filings that emerge in the days ahead, DraftKings (NASDAQ: DKNG) insiders appear to have sold nearly $206 million worth of the gaming company’s shares in 2024 as the stock notched a market-lagging performance.

Following December sales by Chief Legal Officer R. Stanton Dodge and co-founder Paul Liberman totaling more than $30 million, DraftKings insiders dumped $205.54 million of the gaming company’s equity in 2024, according to MarketBeat data, extending a trend decried by retail investors.

Adding to market participants disdain for insider selling at DraftKings is the fact that high-ranking executives at the sportsbook operator aren’t buying any stock. Of the 20 insider transactions this year listed by MarketBeat, including those by co-founders Liberman and CEO Jason Robins — all are sales and none are purchases.

The “positive” is that insider selling at DraftKings waned as 2024 moved along. After totaling roughly $66 million in the first quarter, that figure declined to $61 million in the April through June period. It fell to $45 million in the third quarter before dropping to $34 million in the final three months of the year.

DraftKings Performance Exacerbates Insider Selling

The consistent spate of insider selling at DraftKings accrued against the backdrop of tepid returns for investors. Shares of the gaming company rose just 5.53% this year.

Not only did that performance significantly lag the returns of the Nasdaq 100, S&P Select Sector Consumer Discretionary, and S&P 500 indexes — each of which gained more than 25% this year — it also badly trailed rival Flutter Entertainment (NYSE: FLUT). The parent company of FanDuel — DraftKings’ most direct competitor — surged 44.39% in 2024.

Arguably making matters worse for DraftKings shareholders is the fact that Flutter insiders aren’t frequent sellers of the stock. Over the past three months, there have been no insider transactions — buys or sales — at the Irish gaming company.

In September, Flutter announced a $5 billion share repurchase program, dwarfing the $1 billion buyback plan announced by DraftKings in August.

Insider Selling Light at Other DraftKings Rivals, Too

The insider selling at DraftKings stands out because comparable action at rival iGaming/online sports betting operators was light this year and that’s true even when excluding Flutter from the equation.

For example, insider selling at Caesars Entertainment (NASDAQ: CZR) was less than $350,000 over the past year and in the first two quarters of 2024, high-ranking executives at the Caesars Sportsbook owner bought significantly more stock than they sold.

At ESPN Bet parent Penn Entertainment (NASDAQ: PENN), insiders bought $2.61 million worth of shares over the past year compared to sales of just $126,578, according to MarketBeat data. In terms of number of transactions, buys outnumbered sales at Penn by a 4-to-1 margin.

Related News Articles

MGM, Fanatics Could Be Buyers if Sports Betting M&A Heats Up

Rush Street Interactive Takes Shot at DraftKings, Says No Surcharge

Codere Online Trouncing de-SPACed Gaming Competition

Most Popular

Jackpot News Roundup: Two Major Holiday Wins at California’s Sky River Casino

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

MGM Osaka to Begin Construction on Main Resort Structure in April 2025

Mississippi Gaming Commission Approves Site for Biloxi Casino Resort

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 33 Comments -

Zillow: Town Outside Las Vegas Named the Most Popular Retirement City in 2024

— December 26, 2024 — 31 Comments -

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

— December 27, 2024 — 9 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments

No comments yet