DraftKings Stock Is Scorching Hot, Beloved by Younger Investors

Posted on: June 2, 2020, 08:23h.

Last updated on: June 2, 2020, 11:29h.

DraftKings (NASDAQ:DKNG) is popular among the younger demographics, including millennials and Generation Z, that are so coveted by gaming companies. Investors in those age groups appear fond of DraftKings stock, too.

The name has more than doubled since its April 24 initial public offering (IPO), even as the US sports scene was largely non-existent over that period because of the coronavirus. Big betting events since the DraftKings IPO include the NFL Draft, a couple of charity golf matches, and a handful of NASCAR races. But nothing from the four major US athletic leagues.

Neither Wall Street nor retail investors are deterred, as the latter keep piling into the sportsbook operator’s shares. Over the past day, more than 6,300 users of the popular Robinhood investing app flocked to DraftKings stock, according to data provided by the broker.

Robinhood is popular with younger investors because it’s a mobile app, doesn’t charge commissions, and allows investors to purchase fractional shares, among other traits.

Not Waiting for a Dip

An issue vexing investors since the DraftKings IPO is the stock’s seemingly unrelenting rise – one not hindered by down days for the broader market or tepid analyst commentary. Even with the lack of a notable pullback in the stock, retail market participants are flocking to the name.

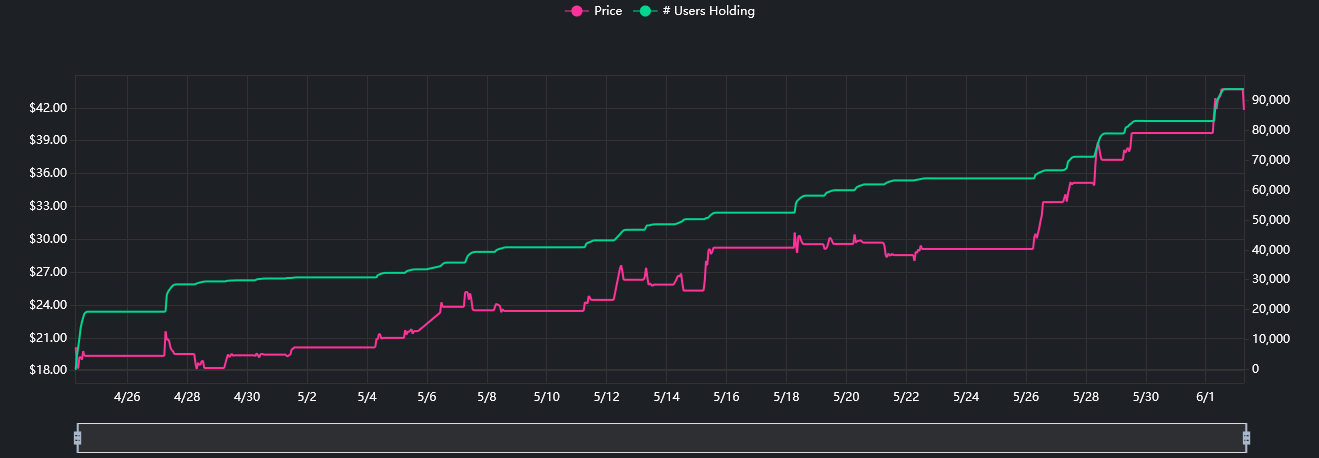

Robinhood data confirms that as DraftKings rises, so do the number of users on the platform holding the stock. From May 1 through June, the stock doubled. But the amount of Robinhood clients holding the name tripled.

Currently, only 64 securities are more widely owned by Robinhood account holders than DraftKings. That group includes two gaming stocks: MGM Resorts International (NYSE:MGM) at number 41, and Penn National Gaming (NASDAQ:PENN) in the 52nd spot.

Over the past 30 days, DraftKings is the most popular stock on Robinhood, while MGM is third. Combined, roughly 54,600 users of the brokerage app flocked to those two gaming equities over the past month.

Why It Matters

Robinhood’s primary clientele – younger investors – isn’t a secret, and because the app caters to retail market participants, many of which don’t have large accounts, some professional investors look at the platform as a contrarian indicator.

Said differently, a pro could take the opposite side of popular trades based on the notion that a capital-starved retail investor has reasonable odds of getting the trade wrong.

However, DraftKings could be a different case. First, it’s not retail money that accounts for the stock more than doubling in less than two months. Second, there are some credible catalysts behind the rally, including the company’s push into in-game betting, iGaming, and the possibility of a fast-tracked entry into the potentially lucrative Illinois market, among other factors.

Add to that, CEO Jason Robins is making the rounds as more media organizations grow curious about how the stock is soaring against a no-sports backdrop, and all but one of the analysts covering the name has the equivalent of a “buy” rating on DraftKings.

Related News Articles

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 31 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

Last Comment ( 1 )

Poker has turn out to be a multibillion dollar business. Video Poker - Is the most payable games in an on-line on line casino and live on line casino. In accordance to Jeff and Krista, the images on-line truly doesn't give it justice.