Entain Officially Adds Critic Ricky Sandler to Board

Posted on: January 3, 2024, 06:25h.

Last updated on: January 4, 2024, 09:54h.

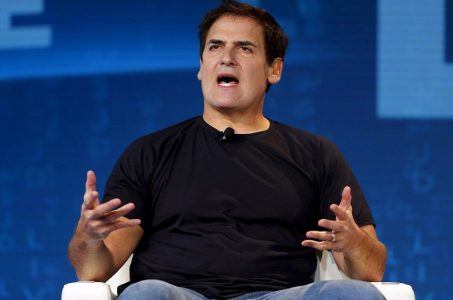

Shares of Coral owner Entain Plc (OTC: GMVHF) closed higher in UK trading Wednesday after the gaming company officially appointed Eminence Capital founder and critic Ricky Sandler to its board of directors in a nonexecutive capacity.

Speculation regarding Sandler’s potential appointment to Entain’s board surfaced in mid-December soon after the operator announced the immediate resignation of CEO Jette Nygaard-Andersen, an executive of whom Sandler was openly critical.

Sandler’s appointment to the board comes after hedge funds Dendur Capital and Sached Heam Capital took stakes in Entain, pushing the company to place the Eminence Capital boss on the board and include him in the process of filling other board vacancies. News of Entain possibly acquiescing to those demands surfaced just three days after Keith Meister’s Corvex Management announced it took a 4.4% stake in the gaming company.

I look forward to working with my fellow directors to help Entain achieve long-term success and create lasting value for its shareholders,” said Sandler in a statement.

Sandler’s hedge funds is estimated to hold as much as 5% of Entain’s shares outstanding, making it one of the largest investors in the sportsbook operator.

Entain Analysts Bullish on Sandler Board Appointment

Analysts view Entain adding Sandler to the board as a positive for a company that some view as lacking direction and that others see as ripe for a transformative transaction.

Interactive Investor analyst Victoria Scholar said in a note to clients that Sandler joining the Entain could set the stage for the company to divest part or all of its 50% stake in BetMGM, something he’s previously pushed for. Speculation to that effect is heightened following Corvex taking a stake in Entain because that hedge fund is also an MGM investor and Meister sits on the board of the casino operator.

Scholar added that Entain needs “new voices on the board to help mastermind a turnaround.” Analysts at AJ Bell view Sandler joining the board as a fresh start for the Ladbrokes owner.

“After the departure of CEO Jette Nygaard-Andersen in December, the company needs to find some direction. At least last year’s conclusion of a HMRC probe into a legacy business in Turkey provides the company with something of a clean slate from which to try and get earnings on an upwards trajectory,” according to the research firm.

Entain Has Valuable Assets

There’s no denying that Entain possesses valuable assets — namely its international wagering unit and the 50% interest in BetMGM. Those holdings are likely why the operator drew hefty takeover offers in 2021 from MGM and DraftKings (NASDAQ: DKNG) that were ultimately rejected, perhaps marking the beginning of the end for Nygaard-Andersen.

It remains to be seen if Sandler pushes for an outright sale of the company, but with him on the board and other activist investors holding the stock, a transformative transaction could be just a matter of time.

Specific to MGM, that company said last year it won’t revisit a full takeover bid for Entain, but it has also made clear it would like to fully control BetMGM.

Related News Articles

DraftKings And Fanatics Nearly Sealed Massive Merger, Now Rivals

Mesquite Gaming Could Be Readying Sale

Evolution Group Could Be Player in Live Dealer M&A, Says Research Firm

Miriam Adelson Using Sands Stock Cash to Buy Dallas Mavericks Majority

Most Popular

VEGAS MYTHS RE-BUSTED: The Mob Buried Hundreds of Bodies in the Desert

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

Former Resorts World & MGM Grand Prez Surrenders Gaming License

Most Commented

-

Whiskey Pete’s Casino Near Las Vegas Closing After 47 Years

— December 17, 2024 — 8 Comments -

Former Resorts World & MGM Grand Prez Surrenders Gaming License

— December 15, 2024 — 8 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 8 Comments -

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

— December 13, 2024 — 7 Comments

No comments yet