Feds Warn Prediction Markets That Contracts Linked to Crime Are Prohibited

Posted on: December 31, 2024, 09:57h.

Last updated on: December 31, 2024, 09:57h.

The United States federal government is reminding online betting exchanges that function as derivate financial markets that offering event contracts involving crime remains prohibited.

Kalshi and other prediction-based online exchanges are regulated by the U.S. Commodity Futures Trading Commission (CFTC). Last week, the independent agency of the U.S. government that oversees derivates, including futures, swaps, and options, told Kalshi and others like it that contracts based on outcomes associated with crime, assassination, terrorism, and war are banned.

CFTC Regulation 40.11 prohibits event contracts that reference terrorism, assassination, war, gaming, or an activity that is unlawful under any state or federal law. The CFTC explains that the statute bans markets “contrary to the public interest.”

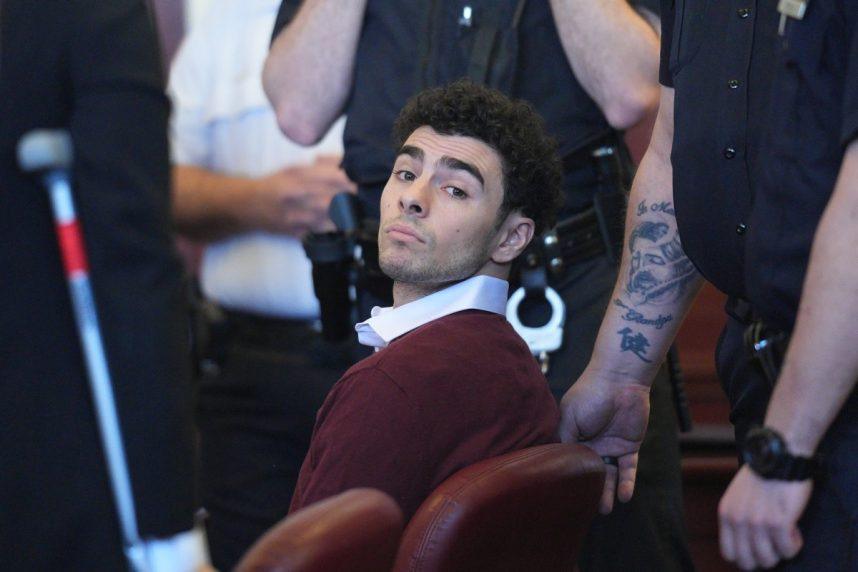

The notice to Kalshi came after the online wagering exchange launched contracts involving Luigi Mangione, the suspected gunman in the Dec. 4 killing of UnitedHealthcare CEO Brian Thompson.

Contracts Rescinded

Days after Mangione was arrested at a McDonald’s in Altoona, PA, Kalshi debuted several contracts regarding the alleged gunman’s future. They included when Mangione might be extradited to New York, whether he would plead guilty, and if Mangione would say he didn’t act alone.

Less than 48 hours after the markets went live, Kalshi yanked the betting questions “after receiving notice from our regulators.”

Betting markets like Kalshi are free to launch hot-button issues such as those surrounding Mangione without first gaining approval from the CFTC. However, the federal agency can order contracts to be paused for review or for them to be withdrawn from the market should the CFTC deem them to violate Regulation 40.11.

While exchanges that accept customers from the U.S. are regulated by the CFTC and must refrain from engaging in contracts banned by Regulation 40.11, sites like Polymarket do not. The website that deals in cryptocurrency continues to offer 10 contracts about Mangione.

More than $441K has been wagered on the Polymarket question, “Is Luigi Mangione’s YouTube channel real?”

“On Dec. 9 the YouTube channel @PepMangione posted a video titled “The Truth,” stating, “If you see this, I’m already under arrest.” This market will resolve to ‘Yes’ if the https://www.youtube.com/@PepMangione YouTube channel is real, i.e., it is proven to be operated by Luigi Mangione or a person/system that he authorized. Otherwise, this market will resolve to ‘No,'” the contract reads.

Ongoing Criticism

Despite federal courts siding with prediction contract exchanges this fall and allowing sites like Kalshi to take bets on the 2024 presidential election, there remain plenty of critics of the emerging industry.

It’s straight gambling,” Cantrell Dumas, director of derivatives policy at Better Markets, a financial policy think tank in Washington, told Bloomberg. “People are betting on whether this person is allegedly responsible for the assassination of another human being, and here we are desensitized to this and betting on whether he’ll enter a guilty plea.”

It’s expected that the CFTC under the second Trump administration will again be friendlier to these types of exchanges. Trump has pledged deregulation — not more federal oversight. The president-elect has promised to repeal 10 federal regulations for every new one imposed.

Related News Articles

Election Betting Apps Kalshi, Polymarket Top Apple App Store Charts

Most Popular

Jackpot News Roundup: Two Major Holiday Wins at California’s Sky River Casino

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

MGM Osaka to Begin Construction on Main Resort Structure in April 2025

Mississippi Gaming Commission Approves Site for Biloxi Casino Resort

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 33 Comments -

Zillow: Town Outside Las Vegas Named the Most Popular Retirement City in 2024

— December 26, 2024 — 31 Comments -

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

— December 27, 2024 — 9 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments

No comments yet