Financial Analysts Bullish on Macau, Predict ‘Roughly 20 Percent’ Growth for November

Posted on: November 28, 2017, 05:07h.

Last updated on: November 28, 2017, 05:11h.

The rebounding Macau gaming market shows no signs of slowing down. That’s the news from analysts at several major brokerage firms, agreeing that year-over-year gross gaming revenue (GGR) in the Chinese casino enclave will increase by 18-20 percent in November, once final monthly numbers are tabulated.

Based on figures collected in the month’s early weeks, Japanese brokerage Nomura estimated year-over-year growth of “roughly 20 percent” for November, estimating that the total would come to about $2.8 billion by month’s end.

Casinos were on pace to take in a bit more than that before the Monday note was written, but the fact that the remaining days in the month were weekdays suggested that the daily average might dip a bit.

Macau Rebound Continues

A similar estimate was made on Tuesday by analysts at Sanford C. Bernstein. They made a slightly more conservative projection, but one that was largely in line with Nomura’s numbers.

“We estimate November GGR to a range of [$2.76 billion] and [$2.78 billion], an estimated year-on-year increase in November of plus 18 percent to plus 19 percent,” the Bernstein analysts wrote. The brokerage said that both mass market and VIP revenue would be up double digits compared to the same month last year.

The strong growth continues a trend that has been ongoing for more than a year now. The city’s gaming sector has enjoyed 15 straight months of growth, an impressive rebound from the three years of declines following a corruption crackdown from the Chinese government in Beijing.

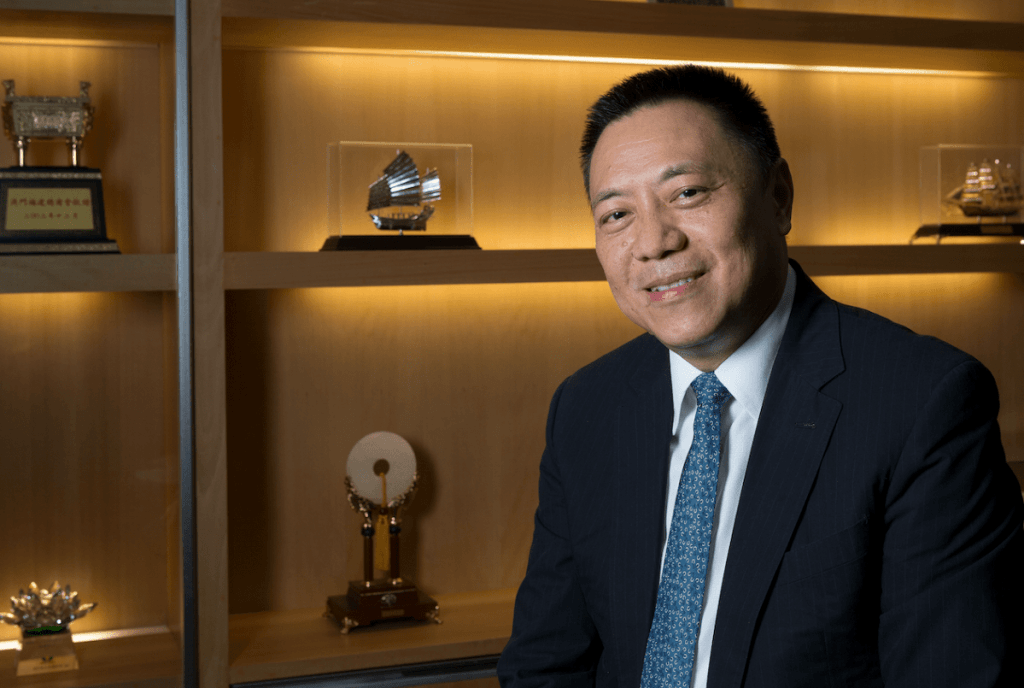

That means that 2017 will be the first year in which Macau’s casinos will enjoy GGR growth since 2013. Earlier this month, Macau Secretary for Economy Lionel Leong projected that 2017 revenues would be better than in 2016, and that double-digit growth would likely continue in the months to come.

Long-Term Growth Visions

Tuesday also saw the release of a note from Fitch Ratings in which the firm said that they are maintaining “a positive long-term outlook” for Macau.

Fitch noted that it saw potential for further growth of the mass-market segment in the Asia-Pacific region, saying that while competition for middle class gamblers was increasing, so was spending among Chinese citizens. The note said that Chinese tourism would be a major driver of gaming revenues throughout Southeast Asia, including in Macau.

Those trends led Fitch to predict that 2018 would be a second consecutive growth year for the territory. According to the company’s analysts, they expect Macau to enjoy “high-single-digit” growth next year, mostly on the back of mass market gamblers.

Fitch did say that the fact that many Macau operators have debt that lasts past their concession periods, all of which end in 2020 or 2022, is a risk. However, with license renewal details set to be released sometime next year, it’s unlikely that this will cause any unexpected issues for debt issuers or the operators themselves.

Related News Articles

Wynn Boston Harbor Paying Top Dollar to Demolish Nearby Homes

Penn National in No Rush to Build Pennsylvania Satellite Casino

Most Popular

Vegas Casino Resorts Install Detectors to Smoke Out Vapers — Report

Las Vegas Installs License Plate-Reading Cameras

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 33 Comments -

Zillow: Town Outside Las Vegas Named the Most Popular Retirement City in 2024

— December 26, 2024 — 33 Comments -

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

— December 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments

No comments yet