AGS/Inspired Deal May Not Happen or Could Reach $13 a Share: Analyst

Posted on: August 16, 2022, 10:35h.

Last updated on: August 17, 2022, 10:46h.

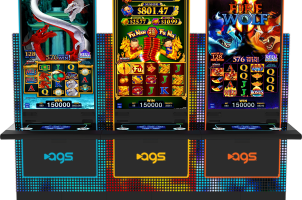

It’s possible that Inspired Entertainment’s (NASDAQ:INSE) pursuit of AGS (NYSE:AGS) doesn’t end in a consummated deal. But it’s also plausible the suitor boosts its offer for the slot machine maker.

That’s the sentiment of Stifel analyst Jeffrey Stantial who, in a note to clients today, explores both scenarios. Though Inspired hasn’t officially confirmed it’s courting AGS, news to that effect broke last week. The target later revealed it received and rejected a $10 a share, all-cash takeover proposal.

Stantial says a variety of factors could make it difficult for Inspired to seal this deal, though AGS confirmed it is holding talks with the prospective buyer.

Overall, we sense investors are skeptical a deal will be reached, given INSE’s debt capacity, financing risks, still forthcoming ROI for AGS’s operational improvements, and a history of trading over $18/share,” wrote the Stifel analyst.

While the point about trading above $18 is relevant, the 52-week high on AGS stock is $10.45, and it hasn’t closed above that in three years.

Apollo Considerations, Offer Could Be Boosted

As Stantial points out, much of the success of Inspired’s overture for AGS could boil down to what price Apollo Global Management (NYSE:APO) is willing to accept.

As of the end of the second quarter, the private equity giant owned 8.2 million shares of the gaming equipment maker, or 22.08% of its shares outstanding. That’s more than double the amount controlled by the second-largest institutional investor. It indicates Apollo could have considerable sway when it comes to AGS being acquired or remaining independent. The private equity company also controls two AGS board seats.

“While we agree the odds appear to be stacked against a potential deal, ultimately we come back to Apollo’s likely influence in the decision highlighting the relative maturity (~9 years) of the investment,” adds Stantial. “Assuming INSE/AGS come to an agreement, we could see the final purchase price drift closer to ~$13/share given still manageable PF leverage, and return thresholds for key AGS shareholders.”

An offer of $13 a share hasn’t been publicly revealed, and it would be nearly double AGS’s closing price on Aug. 11 — the day prior to the acquisition news initially being reported.

Assessing Inspired’s Motivations

Inspired’s attraction to AGS is understandable. The suitor doesn’t have much top line exposure to the US, and the slot upgrade cycle could be lengthy, potentially providing support for the AGS thesis. Additionally, many AGS customers are regional and tribal casinos with loyal customer bases that may be unfazed by a recession.

Additionally, analysts note the marriage would be accretive to Inspired’s earnings per share, and would boost its free cash flow. Still, there are moving parts regarding bringing an AGS/Inspired marriage to the altar.

“Coupled with a shareholder base that likewise believes in the long-term story and valuation dislocation, and we expect management’s preference is to see the ongoing turn-around efforts out to fruition,” concludes Stantial. “However, we do note the INSE CEO position remains unfilled following the founder’s departure in 2018, with responsibilities split among the Chairman, COO, CFO, and CSO. This could suggest optionality around AGS management joining the pro-forma company.”

Related News Articles

AGS Confirms Receipt of Takeover Offer, Ongoing Talks

PlayAGS Plunges After Ending Merger Talks with Inspired Entertainment

Aristocrat Leisure Could Pursue Prudent Acquisition Strategy

IGT Asset Sales Could Draw Interest from European Suitors

Most Popular

The Casino Scandal in New Las Vegas Mayor’s Closet

LOST VEGAS: Wynn’s $28 Million Popeye

MGM Springfield Casino Evacuated Following Weekend Blaze

Sphere Threat Prompts Dolan to End Oak View Agreement

Mark Wahlberg’s Latest Acting Role: Las Vegas Gym Operator

Most Commented

-

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments -

DraftKings Upgrades Loyalty Plan, Unveils New Elite Program

— October 22, 2024 — 2 Comments -

VEGAS MYTHS RE-BUSTED: Tiger Attack Wasn’t Siegfried & Roy’s Fault

— November 8, 2024 — 2 Comments -

Massachusetts Sheriff Drove Cop Car to MGM Springfield Drunk, Missing Tire

— October 7, 2024 — 2 Comments

No comments yet