Iowa Gaming Regulators Order Market Study Regarding Cedar Rapids Casino

Posted on: July 9, 2024, 01:50h.

Last updated on: July 9, 2024, 02:20h.

Iowa gaming regulators announced Monday that they want a market study on how a casino resort in Cedar Rapids would impact the state’s commercial gaming industry.

During the Iowa Racing and Gaming Commission’s (IRGC) Monday meeting at the Prairie Meadows Casino and Hotel in Altoona, commissioners passed a motion to conduct a review of allowing a casino in Linn County. The IRGC will soon issue a request for proposals for the market study report.

In the interim, the IRGC will hold a virtual meeting this Friday to unveil a rough timeline for when the gaming regulator might accept applications for a casino in Linn County.

Moratorium Ends, Development Group Ready

In 2022, the Iowa Legislature passed a bill that prohibited the IRGC from issuing new casino licenses for two years. The moratorium came after Iowa’s current 19 state-licensed casinos campaigned for a stoppage on additional competition as new casinos opened in neighboring Nebraska.

House lawmakers earlier this year voted to extend the casino moratorium by five years through June 2029, but the plan didn’t pass in the Senate. That was a major win for the Cedar Rapids Development Group (CRDG), a consortium of mostly local businesspeople who have sought a casino license for Cedar Rapids for more than a decade.

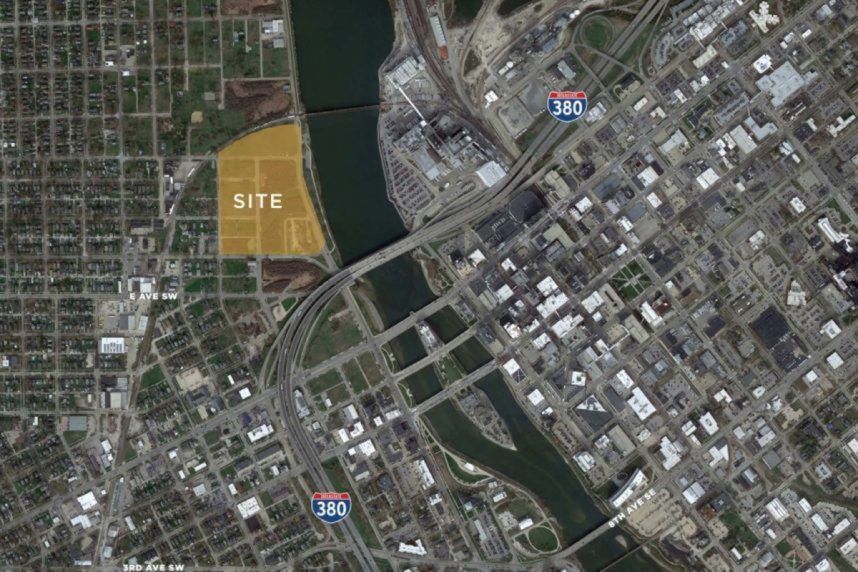

CRDG is partnered with Peninsula Pacific Entertainment (P2E) for a project called Cedar Crossing. The development is targeting 25 acres of land currently owned by the city just north of Interstate 380, west of the Cedar River between F and I avenues and 1st and 5th streets.

CRDG has a right-to-purchase agreement with the city for the land should it gain a casino license from the state. The development group last year paid the city $165K for first dibs on the property. The selling price will be based on an independent assessment.

P2E President Jonathan Swain told state commissioners this week that they’ve paid more than $800K on design plans for Cedar Crossing. A new rendering will be accompanied by the group’s forthcoming casino application.

Referendum First

Iowa’s casinos continue to stress that the state gaming industry has reached market saturation and that another casino will further strain their operations, reduce state tax revenue, and put jobs in jeopardy. CRDG argues a casino in Iowa’s second-most populated city would only grow the state gaming industry and provide Iowans with a true Las Vegas experience closer to home.

With the casino moratorium over, the IRGC can expand the state gaming industry. The agency denied casino applications for a Cedar Rapids casino in 2014 and 2017 on cannibalization worries. However, the five IRGC members who voted against the Cedar Rapids bids in those years are no longer serving on the commission.

Iowa’s casino law requires host counties to hold countywide referendums asking local voters if they support allowing a casino in their hometown.

Linn County held successful casino referendums in 2013 and 2021. Since the county held two casino referendums within eight years with positive support, a subsequent referendum to allow the IRGC to consider casino bids isn’t needed.

Iowa’s gaming law additionally requires casino licenses to be held jointly by nonprofit organizations and their casino operating partners.

The CRDG has formed the Linn County Gaming Association, a nonprofit, that will bid for the Cedar Rapids license in conjunction with P2E. If approved, the development group has pledged to allocate 8% of its annual gross gaming revenue to local and state charities.

Commercial casinos in Iowa must donate a minimum of 3% of their gaming revenue to charity. The state tax on gross gaming revenue varies from 5% to 22%, based on annual win.

Related News Articles

Iowa Casino Moratorium to Lift, Clear Way for Cedar Rapids Resort

Cedar Rapids Casino Developers to Apply for Iowa Gaming License

Most Popular

Sphere Threat Prompts Dolan to End Oak View Agreement

MGM Springfield Casino Evacuated Following Weekend Blaze

This Pizza & Wings Costs $653 at Allegiant VIP Box in Vegas!

Atlantic City Casinos Experience Haunting October as Gaming Win Falls 8.5%

Most Commented

-

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 4 Comments -

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments -

Chukchansi Gold Casino Hit with Protests Against Disenrollment

— October 21, 2024 — 3 Comments

No comments yet