IRS Cracks Down on $13B in Unreported Gambling Winnings

Posted on: October 7, 2024, 11:15h.

Last updated on: October 7, 2024, 01:47h.

After an audit revealed that Uncle Sam may have let more than $1 billion in income tax on recent casino jackpots go uncollected, the IRS is cracking down on the oversight. And one of Las Vegas’ most recognizable casino gamblers finds himself in the crackdown’s crosshairs.

The news was delivered by this Sept. 30 report from the independent IRS watchdog group Treasury Inspector General for Tax Administration (TIGTA). It found that 148,908 Americans with gambling winnings exceeding $15,000 failed to file tax returns between 2018 and 2020.

Their winnings exceeded $13.2 billion dollars, making the unpaid taxes just north of $1.4 billion.

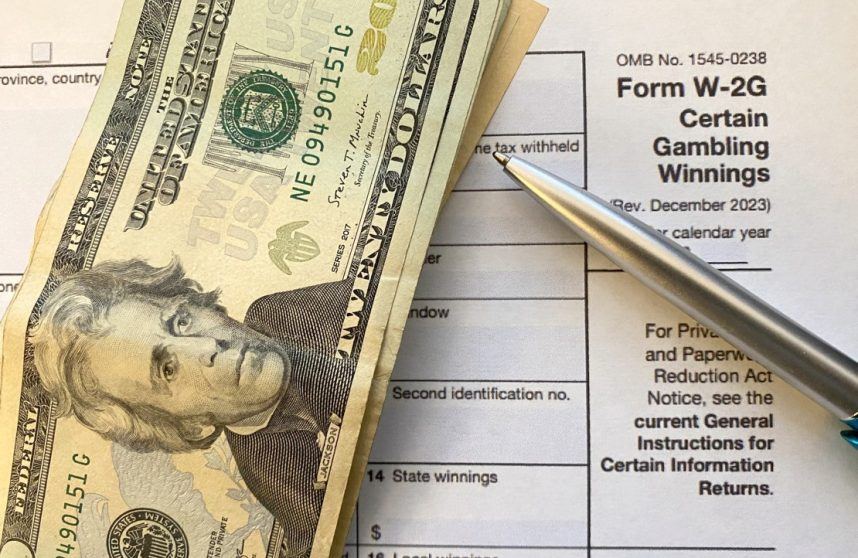

TIGTA analyzed the W-2G forms generated by casinos when gamblers hit slot jackpots of $1,200 or more or Keno wins of $1,500 or more. Its report noted that 103,000 of these delinquent winners were never issued notices or faced with efforts to bring them into compliance.

In a response to the report, the IRS wrote, “We agree with the recommendation,” vowing to begin enforcement actions.

The Internal Revenue Code states that gains from gambling are fully taxable and must be reported as income by individual taxpayers. Gambling losses may be deducted for filers itemizing up to the amount of their winnings.

Other Findings

Among the TIGTA report’s other concerns were hundreds of W-2Gs that were filed by casinos without the required taxpayer identification numbers. This makes it extremely difficult for the IRS to trace the winnings to its recipients.

Also, the watchdog group noted, the IRS has too few processes in place to identify noncompliance with excise taxes by gambling operators, particularly in the rapidly growing online sports-betting market.

The IRS also agreed with the latter recommendation. However, it disputed the significance of the W-2Gs without taxpayer IDs, since the number was small.

“While this population may not be large in absolute terms, we believe that the amount of backup withholding that should have been withheld is significant,” TIGTA responded.

Code Adjustments

Form W-2G’s Summary of Withholding Requirements doesn’t currently single out earnings from sports gambling or iGaming. Sports betting is among the fastest-growing sectors of the U.S. gaming industry, with retail and/or online sportsbooks regulated in 38 states and Washington, D.C.

The IRS has obliged to specifically inform taxpayers of their filing requirements for sports betting and online casino gambling winnings.

“Form W-2G has not evolved with the growth of the gambling industry,” TIGTA’s report read. “For example, the wager codes on Form W-2G include only nine specific types of gambling activities, which do not include a wager code for sports betting. If there was a wager code specifically for sports betting, the IRS could use this information to identify potential non-filers and under-reporters.”

The Treasury estimates that U.S. taxpayers underpaid their federal taxes by $688 billion in 2021, with non-filers responsible for 11% of the unreceived funds. The IRS’ Failure to File penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The maximum penalty is 25% of the unpaid tax.

The IRS typically reserves criminal prosecution for exceptional cases where massive fraud and tax evasion evidence is rampant.

Vital Error

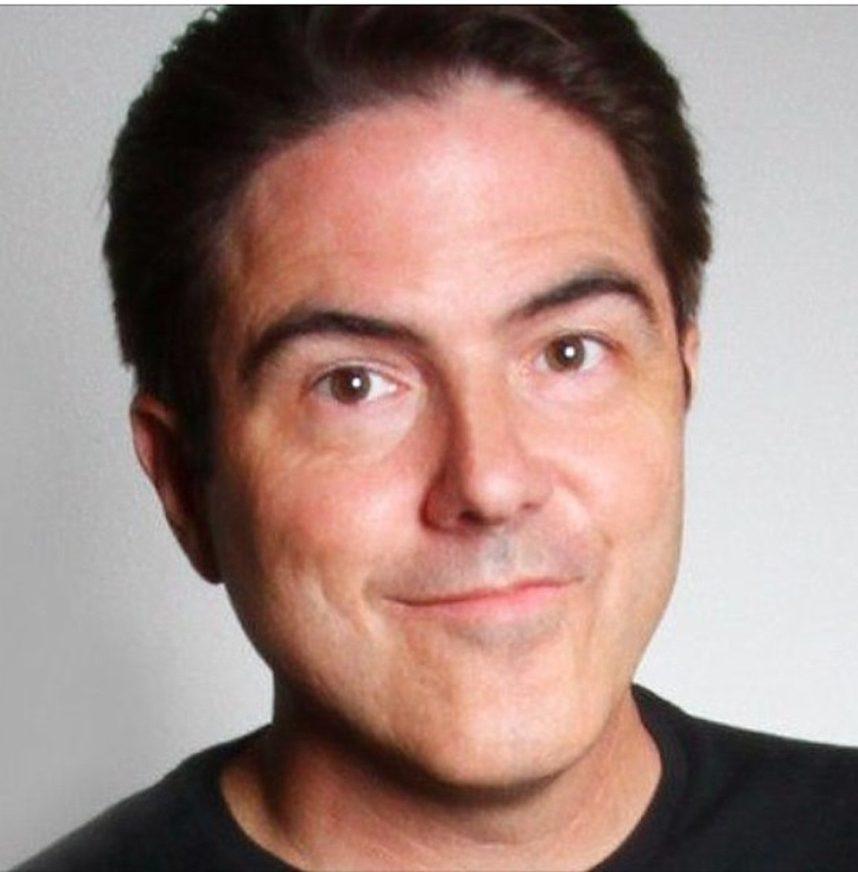

Last month, Scott Roeben, founder of Casino.org’s own Vital Vegas, received an IRS audit letter regarding taxes on $100,000 in unreported W-2G income in 2022.

The letter gave him 30 days to respond with specific four-year-old documentation or “further steps” would ensue.

The only problem, Roeben says, is that he filed his 2022 tax return on time, with all gambling income reported.

“I filed everything properly,” he said. “I just had a large number of jackpots, so that triggered the audit, presumably.”

Roeben called the IRS’s campaign “selective persecution of casino patrons because of the stigma attached to gambling,” adding that it demonstrates “how out of touch the IRS is with the reality of gambling.”

“This is making people jump through hoops, spend money on tax professionals to help with their audits and reconsider a pursuit they enjoy,” he says, adding that, even in the case of tax cheats, “jackpots are far from the entire picture when it comes to gambling.

“It’s like saying passengers of the Titanic had an absolute blast for 2,070 miles.”

Related News Articles

Star Entertainment, Crown Resorts to Pay More in New Gaming Tax

Slot Tax Threshold Increase Supported by IRS Advisory Council

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

Last Comment ( 1 )

Because the "personal exemption" deduction was combined with the standard deduction, gambling losses for recreational gamblers can not be deducted for the 90% who now take the standard deduction of around $15,000. Taxpayers with relatively small amounts of W2-G "income" who have actually lost money gambling are further penalized by paying 10% to 37% on their "win". Every $1000 on a W2-G can cost $100 to $370, even for those who actually lost money.