Kentucky Sports Betting Bill Passes House Committee, But Odds of Legislative Approval Remain Long

Posted on: February 21, 2019, 12:09h.

Last updated on: February 21, 2019, 03:19h.

A Kentucky sports betting bill passed a state House committee this week with unanimous support, but for the legislation to one day become law, the statute will need backing from both sides of the political aisle.

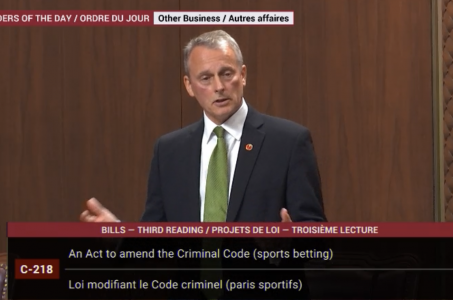

House Bill 175 – introduced by Rep. Adam Koenig (R-Erlanger) – would allow Kentuckians to gamble on sports at the state’s horse racetracks, Kentucky Speedway, and through mobile apps. To bet online, patrons would first need to register in person at one of the approved sportsbooks.

The legislation would bar betting on collegiate events that take place in the Bluegrass State. Some believe that should be changed, but Koenig told Casino.org, “I’d rather keep it the way it is right now. However, nothing is written in stone in legislation.”

Sportsbooks would be taxed at 9.75 percent on land-based revenues, and 14.25 percent on mobile wagers. HB 175 would additionally legalize online poker and daily fantasy sports.

The Kentucky House Committee on Licensing, Occupations, and Administrative Regulations voted 14-0 on Wednesday to pass the legislation. It now moves to the House floor for full consideration.

Sports Betting Bill Odds

Kentucky is one of just 10 states that doesn’t have either commercial or tribal casinos.

The conservative population – which hasn’t voted for a Democrat in a presidential election since 1996 – has traditionally been opposed to gambling. Koenig said he isn’t sure if the votes are there to pass the legislation.

We are talking to people and counting votes as we speak,” Koenig told Casino.org.

For HB 175 to pass and move to the Kentucky Senate, 61 of the House’s 100 members will need to vote in its favor.

Kentucky – like many states across the US – has an escalating public pension crisis. It’s estimated to be more than $39 billion underfunded over the next three decades. Tax revenue from sports betting won’t bridge that colossal gap, but would nonetheless help.

Commonwealth Economics, a research firm based in Lexington, found that if Kentucky legalized sports betting before its neighbors, the state will benefit as much as $48 million annually in tax proceeds. However, if operations expand outside West Virginia where sportsbooks are already up and running to states such as Tennessee, Ohio, Virginia, and Illinois, Kentucky’s tax benefit drops to just $20 million a year.

North Dakota Makes Progress

Legislation in North Dakota to authorize sports gambling at charitable organizations passed the state House this week by a vote of 52-38. Charitable gaming in the state currently includes pull tabs, bingo, and blackjack.

The lower chamber’s vote moves the statute to the Senate for consideration. Taxes on sports betting would fluctuate depending on total revenue.

“I don’t think we’re going to gamble our way to prosperity,” critic Rep. Bernie Satrom (R-Jamestown) told The Forum. Rep. Michael Howe (R-West Fargo) disagrees, saying sports wagering is “already occurring in North Dakota. Let’s keep that money … for charities, addiction services, and tax revenue.”

North Dakota’s Native American casinos would not be permitted to operate sports betting under the legislation.

Related News Articles

Maryland Casinos Tell Lawmakers to Back Sports Betting

Debate on Canadian Sports Betting Bill Likely to Resume Monday

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 31 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet