Las Vegas Sands Bearish Sentiment Overdone, Analyst Says as he Upgrades Stock, Raises Price Forecast

Posted on: September 9, 2019, 02:00h.

Last updated on: September 9, 2019, 03:11h.

Shares of Las Vegas Sands Corp. (NYSE:LVS) soared 3.41 percent Monday, extending a run that has seen the stock jump more than four percent this month, after an analyst boosted his rating and price target on the casino operator.

In a note out Monday, Deutsche Bank analyst Carlo Santarelli raised his rating on the operator of five Macau casinos to “buy” from “hold,” while modestly adjusting his price forecast on the shares to $70 from $69. LVS shares closed at $58.11 today, 16.52 percent below the stock’s 52-week high.

Like other companies with sizable Macau exposure, LVS has seen its stock pinched by softness in the Chinese Special Administrative Region (SAR). Gross gaming revenue (GGR) on the peninsula slumped 8.6 percent last month, the third-worst month of 2019. ut Santarelli sees the region’s fortunes reversing for the better and improving investors sentiment toward Macau.

Bearish Macau sentiment has created an opportunistic entry point for medium to longer-term oriented investors,” said the Deutsche Bank analyst of Sands stock.

While LVS shares have scuffled, some analysts have defended the operator. Last week, Stifel analyst Steven Wieczynski spoke glowingly of the company, saying “We see nothing out there at this point capable of tempering our long-term enthusiasm on the name.”

Temporary Headwinds

As is the case with some other analysts, Santarelli sees the recent pro-democracy protests in Hong Kong as having weighed on Macau’s August revenue. But that scenario is largely viewed as a temporary on Wall Street.

Hong Kong is an important pass through point for Macau, both by air and via a 34-miles-long bridge linking the two regions. Last month, the demonstrators forced a multi-day closure of Hong Kong International Airport, stunting some visits to Macau.

Current valuation on LVS shares is “predicated primarily on choppy top line trends in Macau, which we believe are largely a function of geopolitical headwinds,” said Santarelli.

With Santarelli’s Monday upgrade of LVS shares, there are seven analysts rating the stock “buy,” five with “outperform” marks on the name, and eight that call it a “hold.” The Deutsche Bank analyst’s price forecast of $70 is in line with the Wall Street average.

Macau Buffer

The Marina Bay Sands, one of just two Singapore casinos, is a property that could help Sands weather some of the aforementioned Macau volatility.

That property stands to benefit “from the “stemming of the [Hong Kong] protests and the longer-term benefits from the MBS hotel and amenities expansion,” said Santarelli.

LVS recently procured a $2.71 billion credit facility that is expected to be used for expansion plans at Marina Bay Sands, the world’s most profitable casino. Earlier this year, the company said it’s planning to spend up to $3.3 billion on expansion and enhancements at that venue through 2024.

Related News Articles

David Baazov’s Lawyer Grills AMF, Claims Regulator’s Case Is Full of Holes

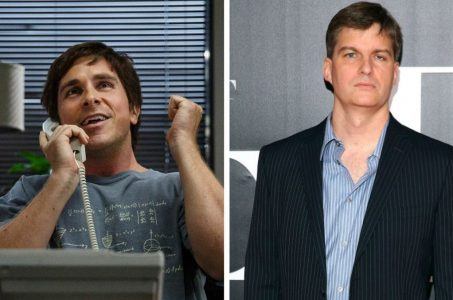

Burry, Inspiration for ‘Big Short’, Adds to Wynn Resorts Investment

Most Popular

This Pizza & Wings Costs $653 at Allegiant VIP Box in Vegas!

Sphere Threat Prompts Dolan to End Oak View Agreement

MGM Springfield Casino Evacuated Following Weekend Blaze

Atlantic City Casinos Experience Haunting October as Gaming Win Falls 8.5%

Most Commented

-

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 4 Comments -

Chukchansi Gold Casino Hit with Protests Against Disenrollment

— October 21, 2024 — 3 Comments

No comments yet