Leaving Las Vegas: Sands May Do Just That as Rumors Swirl on Fate of Venetian, Palazzo

Posted on: October 26, 2020, 04:06h.

Last updated on: October 26, 2020, 04:39h.

Shares of Las Vegas Sands (NYSE:LVS) jumped during Monday’s after-hours session following a report that the company is mulling a sale of its Sin City operations in a transaction that could fetch up to $6 billion.

Bloomberg originally reported the chatter earlier Monday afternoon. Casino.org reached out to LVS for comment, but did not hear back prior to publication of this article.

With a market capitalization of $37.52 billion at Monday’s close, LVS is the world’s largest gaming company by that metric. But its footprint in its namesake city is relatively small. While the Venetian and the Palazzo on the Strip are two of the most plush integrated resorts in the US, Sands derives the bulk of its earnings before interest, taxes, depreciation and amortization (EBITDA) and revenue from its Asia-Pacific operations, centered in Macau and Singapore.

When the company delivered third-quarter results last week, it posted a surprise adjusted EBITDA profit of $70 million at Marina Bay Sands (MBS) in Singapore, while the Las Vegas business lost $40 million during the July through September period.

Likely Limited Number of Realistic Suitors

Assuming LVS does move forward with divesting its Nevada operations, the timing is less than optimal because the coronavirus pandemic is depressing gaming real estate prices.

Conversely, it’s rare that Strip assets with the brand recognition and cache of Sands Convention Center, Venetian and Palazzo come up for sale. With gaming companies easily raising cash in capital markets, there are likely to be plenty of interested suitors.

How many can credibly pull off such a deal is another matter. In addition to LVS, just four other traditional domestic gaming companies have market caps in excess of $6 billion. By process of deduction, Caesars Entertainment (NASDAQ:CZR) can be eliminated because it’s still digesting a massive takeover while trying to wrap up a bid for William Hill. Penn National Gaming (NASDAQ:PENN) is likely out because it’s looking to reduce debt and could be more Las Vegas seller than buyer.

That leaves MGM Resorts International (NYSE:MGM) and Wynn Resorts (NASDAQ:WYNN). The former is already the largest Strip presence, while the latter, like LVS, is far more focused on Macau.

Given the rumored $6 billion price tag and the scant number of gaming companies that can realistically afford to come to the table with LVS, the company could look to a private equity firm if it’s intent on selling its Las Vegas business.

Bad Sign for Vegas?

Rumors about the fate of Sands’ Las Vegas assets sparked reaction that exploring such sales is negative commentary on Sin City’s recovery trajectory.

For its part, the company is consistent in its view that Macau and Singapore will bounce back more rapidly than the US gaming mecca, with one LVS executive saying earlier this year Las Vegas is “a tough place to be” because of the coronavirus pandemic.

LVS shares are higher by 3.30 percent in Monday’s after-hours session, but previously traded up by as much as 12 percent.

Related News Articles

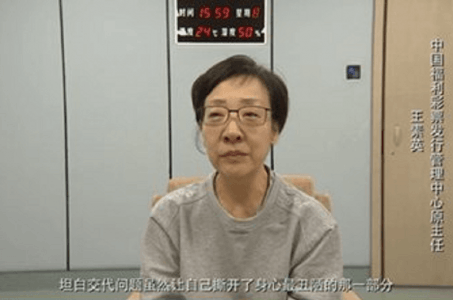

Top Chinese Lottery Officials Paraded After Possible $20 Billion Embezzlement

PointsBet Could Be Ideal Sports Betting Takeover Target

Most Popular

IGT Discloses Cybersecurity Incident, Financial Impact Not Clear

Sphere Threat Prompts Dolan to End Oak View Agreement

This Pizza & Wings Costs $653 at Allegiant VIP Box in Vegas!

MGM Springfield Casino Evacuated Following Weekend Blaze

Most Commented

-

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 4 Comments -

VEGAS MYTHS RE-BUSTED: The Final Resting Place of Whiskey Pete

— October 25, 2024 — 3 Comments -

Chukchansi Gold Casino Hit with Protests Against Disenrollment

— October 21, 2024 — 3 Comments

Last Comments ( 3 )

Boyd would ruin the properties......they can’t/won’t take proper care of the properties it has now.

Boyd gaming

Boyd Gaming? Don’t assume they sell the whole lot to one company.....