Massachusetts Lottery Frequent-Winner Family Accused of $21M Fraud

Posted on: August 24, 2021, 09:15h.

Last updated on: August 24, 2021, 03:07h.

Three Massachusetts residents have been charged with numerous counts of fraud, money laundering, and tax evasion for their roles in what prosecutors allege was a ticket-cashing scheme on a grand scale.

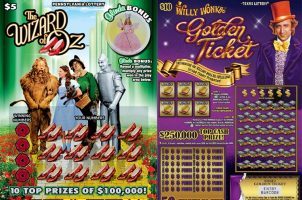

Over eight years, Ali Jaafar and his sons, Mohamed and Yousef, all of Waterford, cashed in 13,000 winning Massachusetts Lottery tickets, mostly scratch-offs, for almost $21 million.

While a statistician might be able to provide an estimate of the astronomical odds of this occurring legally, Michael R. Sweeney, the executive director of the Massachusetts State Lottery, put it bluntly when he told The New York Times Tuesday that “the reality is, it’s zero.”

Nevertheless, the trio has pleaded not guilty to all charges. They also denied accusations that they operated a so-called “discounting scheme,” which involves claiming the prizes on behalf of the real winners who owe money to the state.

The Ten-Percenters

In Massachusetts and other states, money can be deducted from lottery windfalls over a certain threshold if the ticket holder is found to owe unpaid state or federal taxes or child support. In Massachusetts, the threshold is $600.

Lottery winners who find themselves in this predicament sometimes sell their tickets at a discount to an underground ticket-cashing business. The casher usually takes ten percent, hence the terms “discounting” or “ten-percenting.”

Massachusetts Lottery Commission officials temporarily banned the Jaafars from cashing out in 2019 when they realized father Ali was the “top individual lottery ticket casher” that year, and his two sons were third and fourth, respectively.

The Jaafars responded to their ban in 2019 by suing the Lottery, requesting an injunction that would let them continue cashing out their apparently endless stream of winnings. They did not succeed.

Under Massachusetts Lottery regulations, claimants of more than 20 prizes of at least $1,000 in a single year are subject to a review by the director of the lottery, which can result in temporary bans.

Bogus Gambling Losses

The family is also accused of filing false tax returns. Prosecutors claim Ali Jaafar paid less than $24,500 in federal taxes on $15 million in lottery winnings. He also received $886,261 in tax refunds for fake gambling losses from 2011 to 2019.

Meanwhile, Mohamed Jaafar paid less than $21,700 on $3.3 million in winnings. He also received $106,032 in tax refunds for bogus gambling losses over the same period, according to the indictment.

In 2019, Clarance Jones, an 81-year-old man from Lynn, Mass., was sentenced to two months in prison for fraud. That’s after he cashed thousands of tickets worth more than $10 million, profits he squandered at casinos and racetracks, according to his lawyer.

Related News Articles

Lottery Industry Stakes Claim to US Sports Betting Market

Powerball Continues to Dodge Players, Jackpot Grows to $900M

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

Last Comment ( 1 )

What a bunch of bums! Very happy they got caught!