MGM Investor Barry Diller Criticizes WaPo Over Endorsement Flap

Posted on: November 5, 2024, 02:13h.

Last updated on: November 5, 2024, 03:12h.

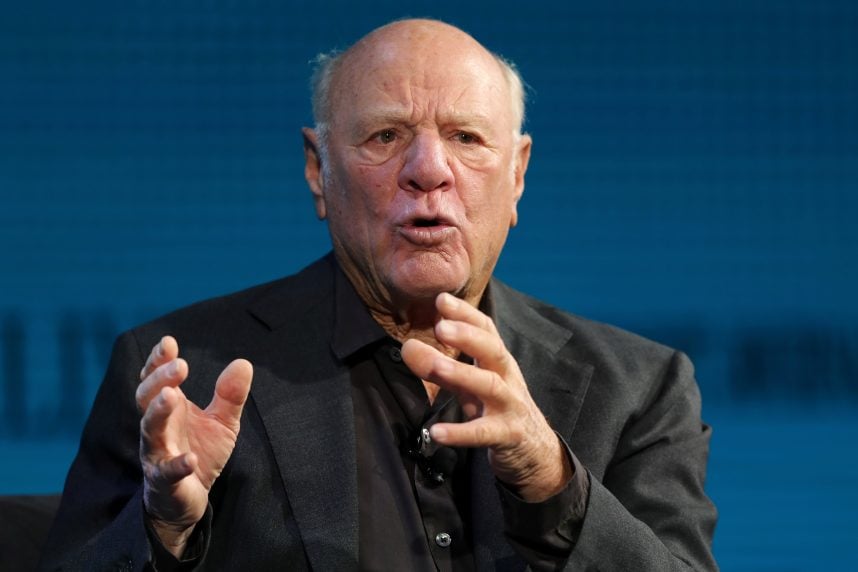

The chairman of IAC/InterActiveCorp (NASDAQ: IAC), the company that’s the largest shareholder of MGM Resorts International (NYSE: MGM), wasn’t pleased with The Washington Post’s decision to not endorse a presidential candidate this year.

IAC Chairman Barry Diller, a major donor to the Democrat party and its candidates, admits to being irked by the paper’s decision to snap its 36-year run of endorsing presidential candidates. He said if that was the road the media entity was going to travel, it should have done so months prior, not close to Election Day.

They made a blunder — it should’ve happened months before, and it didn’t, and that’s the issue with it,” Diller said in a Monday CNBC interview.

The newspaper’s decision to not endorse a presidential candidate was announced on October 25, less than two weeks before Election Day. Diller, who is friends with Post owner Jeff Bezos, said it was a “principled” call to scrap presidential endorsements.

WaPo Subscribers Flee After Endorsement Controversy

The Post, which has been accused of being too left-leaning, was prepared to endorse Vice President Kamala Harris (D) until Amazon founder Bezos put the kibosh on that effort.

“Presidential endorsements do nothing to tip the scales of an election,” Bezos opined. “No undecided voters in Pennsylvania are going to say, ‘I’m going with Newspaper A’s endorsement.’ None. What presidential endorsements actually do is create a perception of bias.”

In the wake of that decision, reporters at the publication publicly expressed indignation, and an estimated 250K customers canceled subscriptions. While the decision to not endorse Harris may have been a catalyst to drive some subscribers out the door, The Post has been grappling with attrition on that front for some time.

In December 2022, The Wall Street Journal reported that The Post bled 500K subscribers during President Biden’s first two years in office. During that period, The Post lost money and was among several media outlets – most of which have overtly left-leaning political biases – that laid off staffers.

Inside the IAC/MGM Relationship

Diller’s IAC initiated its investment in MGM in August 2020, buying $1 billion worth of the casino giant’s shares at that time. His conglomerate, which has its own media interests, added another $1 billion over the coming months.

In February 2022, Diller’s company partnered with MGM to buy $405 million worth of the casino operator’s shares sold by Keith Meister’s Corvex Management. Since building its stake in MGM in 2020, IAC hasn’t pared it.

Due to IAC not trimming its MGM position and the gaming company’s penchant for reducing its shares outstanding count via buybacks, IAC owned just over 20% of the Aria operator as of May. That cements IAC’s status as MGM’s biggest investor. To date, Diller’s firm has been a passive investor in the gaming operator and hasn’t publicly pushed for asset sales or leadership changes.

Related News Articles

Wynn CEO Craig Billings Signs Four-Year Extension

MGM Stock Chart Signals Possible Near-Term Upside

Caesars Price Target Lowered on Limited F1 Impact

Red Rock Resorts Draws Wall Street Cheer

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 32 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet