MGM Recovery Going to Take Time, ‘Cleaner’ Gaming Ideas Available, Says Analyst

Posted on: July 31, 2020, 09:49h.

Last updated on: July 31, 2020, 01:41h.

MGM Resorts International (NYSE:MGM) is faltering Friday, trading lower by nearly five percent a day after the company reported a second-quarter operating loss of $1 billion. The loss highlights Wall Street’s concerns regarding the recovery trajectory for Las Vegas.

On a Thursday conference call with analysts and investors, MGM executives discussed strength in regional markets. But the reality is the company is the largest operator on the Strip — the gaming center analysts are most concerned with, as the coronavirus pandemic remains a headwind for the travel and leisure industry.

In a note to clients today, Stifel analyst Steven Wieczynsk said that “the company’s fortunes are directly tied to demand trends and sentiment along the Las Vegas Strip.”

Since early June, the bulk of MGM’s Strip properties came back online, with the Mirage and Park MGM being the exceptions. On the conference call, CEO Bill Hornbuckle said those venues are taking reservations for Aug. 27, while refuting speculation the Mirage is for sale.

Wieczynski has a “hold” rating on the stock, and he pared his price target on the name to $18 from $20.

Stripped Down

Las Vegas is contending with at least two issues that make its road to recovery longer than, say, Macau or domestic regional gaming markets.

First, business travel, which is vital for propping up weekday occupancy rates on the Strip, has ground to a halt because of the coronavirus pandemic. Second, data confirms many leisure travelers are reluctant to return to Sin City until a COVID-19 vaccine is available. Analysts say July air travel bookings and hotel occupancy rates across the US are stagnating amid a second wave of coronavirus cases.

Although Las Vegas is challenged, MGM said all of its properties that are back online are cash flow positive since the reopening, with Mandalay Bay being the exception. With the operating environment far from normal, MGM is finding ways to lower costs.

“Additionally, as with most of its domestic gaming peers, MGM continues to identify ways to remove costs from the business to enhance margins, even as the top-line remains impaired. MGM highlighted $450 million in annualized cost savings, the majority of which it expects to prove permanent as the business gradually comes back online,” said Wieczynski.

Positive Catalysts

MGM is not a lost cause, however, notes the Stifel analyst. He points to several factors in the company’s favor, including strength in the regional portfolio, $8.1 billion in liquidity, and Hornbuckle, who Wieczynski believes will be well-received by the investment community relative to his predecessor, Jim Murren.

However, catalysts such as margin enhancement, iGaming and sports betting, and Japan are longer ranging in nature, which could keep investors on the sidelines until Las Vegas shows credible signs of recovery.

“We believe there are cleaner ways to invest in themes across the broader gaming realm that do not require an investor to absorb the same level of risk related to the Strip’s recovery trajectory,” said Wieczynski.

Related News Articles

Hard Rock International Wins Right to Build Ottawa Casino

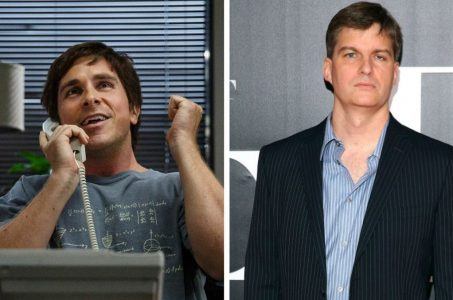

Burry, Inspiration for ‘Big Short’, Adds to Wynn Resorts Investment

Most Popular

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

VEGAS MYTHS RE-BUSTED: The Traveling Welcome to Las Vegas Sign

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 32 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

— December 13, 2024 — 7 Comments

No comments yet