MGM Resorts Added to S&P 500, Company Should Benefit From Increased Trading

Posted on: July 21, 2017, 05:00h.

Last updated on: July 21, 2017, 04:37h.

MGM Resorts International will become the newest member of the revered S&P 500 prior to the open of trading on Wednesday, July 26.

The stock’s addition to the Standard and Poor’s index will presumably increase trading activity on the Nevada-based casino and hospitality conglomerate.

The S&P 500 is a preferred US index, one that rivals with the Dow Jones Industrial Average. Many investors mimic its activity, and numerous investment management firms offer mutual funds that replicate its holdings.

MGM Resorts joins industry colleague Wynn Resorts, the only other Nevada company on the index. Other gaming-related listed companies include developers Activision Blizzard and Electronic Arts.

Indexes are tools used by investors to evaluate the overall health of the US stock market. Indexes cannot be directly bought into, as they’re computed measurement devices formed by financial research firms.

MGM has been on a spending spree as of late. It recently bought out Boyd Gaming’s stake in the Borgata in Atlantic City, and opened a $1.4 billion resort outside Washington, DC. MGM remains under construction in Springfield, Massachusetts, and on a second property in Macau, a $3.1 billion venture.

MGM stock has soared from just over $25 in March, to more than $34 this week.

S&P’s Importance

MGM’s inclusion to the S&P 500 should give the stock a small bump in valuation next week. That’s because investors who are purchasing shares of mutual funds that mirror the 500 are essentially buying slivers of MGM without perhaps even knowing it.

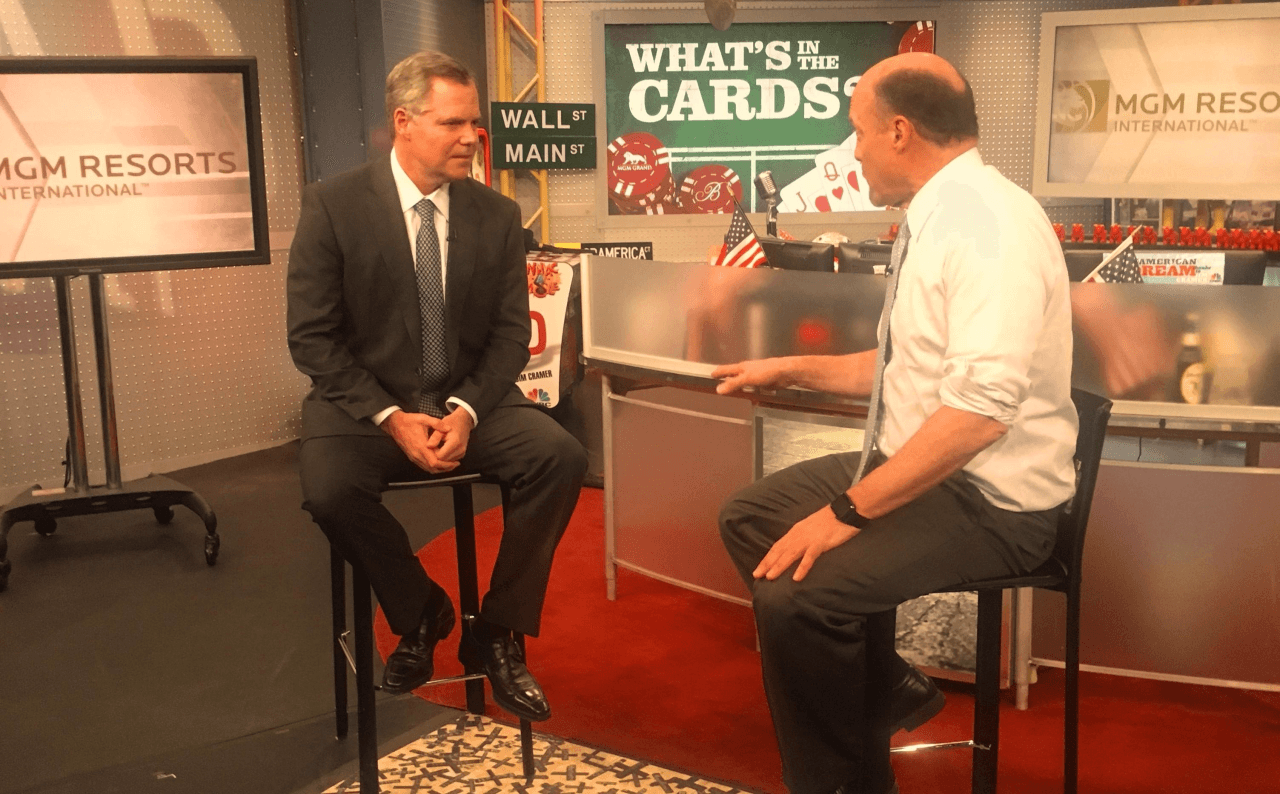

MGM CEO Jim Murren called his company’s addition to the index a “significant milestone,” and that he is “honored to join the esteemed companies that compromise the S&P 500.”

All 500 stocks are large companies that are traded on either the New York Stock Exchange or NASDAQ. A few notables include Berkshire Hathaway, Google (Alphabet), Facebook, and Microsoft.

Since 1970, the S&P 500 has delivered an annual return (including dividends) of over 14 percent. Its best year came in 1995, up almost 38 percent, while its worst came in 2008 when it dropped 37 percent on the heels of the Great Recession.

Buying Power

When stocks are added to the S&P, they average about a three percent gain in their first week of trading. After one month, companies typically see a seven percent increase.

That means MGM should have a much higher valuation come September than it did last week. With Japan soon taking bids on its forthcoming integrated casino resorts, that plays well for Murren.

Two gambling licenses are expected to be up for grabs when Japan’s legislature settles on its gambling regulations. MGM, along with Las Vegas Sands, Wynn Resorts, Hard Rock, Caesars, and multiple other companies, are readying to bid on the properties.

Las Vegas Sands and MGM are the presumptive frontrunners, with the firms hinting that they’re prepared to spend $10 billion each. Both companies have vast experience in Asia gambling markets, owning casinos in Macau, Hainan, and Singapore.

Forecasts on what the liberalized gambling could generate each year upon maturation vary wildly. Analysts have theorized that the casino recipients could combined make anywhere from $5 billion to $25 billion annually.

Related News Articles

Connecticut Airport Casino Wins Right-To-Know Case Against MGM

Wynn Land Deal Shows Deep Connections Between Wynn, Trump, and Ruffin

Most Popular

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

Vegas Casino Resorts Install Detectors to Smoke Out Vapers — Report

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 33 Comments -

Zillow: Town Outside Las Vegas Named the Most Popular Retirement City in 2024

— December 26, 2024 — 32 Comments -

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

— December 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments

No comments yet