CityCenter Transaction Credit Negative for MGM Due to Lease Obligations, Says Moody’s

Posted on: July 12, 2021, 12:01h.

Last updated on: July 12, 2021, 03:46h.

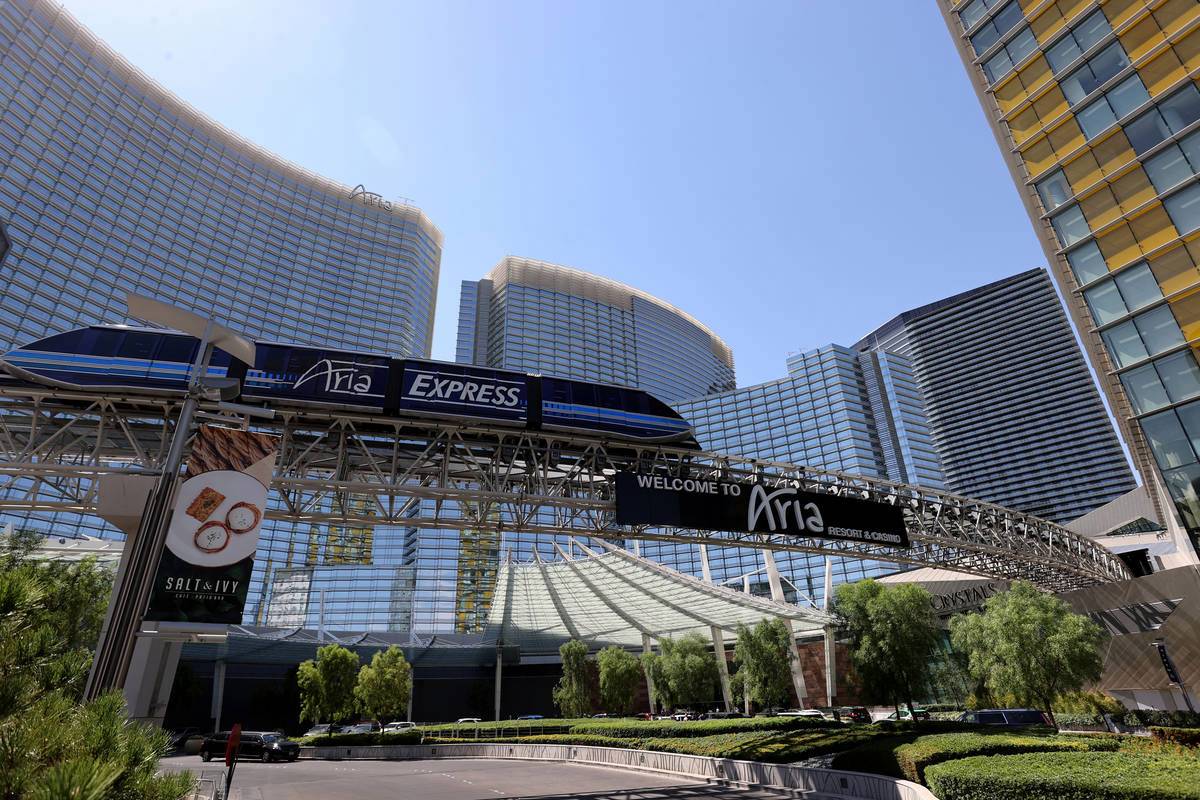

Purchasing the 50 percent of CityCenter it didn’t previously own and selling the real estate of Aria and Vdara casino resorts carries negative credit implications for MGM Resorts International (NYSE:MGM).

That’s the view of Moody’s Investors Service, which says in a recent report the recently announced transaction is credit negative for the gaming company. Earlier this month, MGM said it’s paying $2.12 billion to Infinity World Development for the 50 percent interest in CityCenter. It is also selling the property assets of Aria and Vdara to private equity firm Blackstone (NYSE:BX) for $3.89 billion in cash in a sale-leaseback deal.

The transaction is credit negative, given the expectation for a considerable amount of lease obligations related to the transaction to come on the balance sheet (potentially higher than MGM’s consolidated 2020 rent multiple equivalent of around 11x), increasing leverage and financial risk,” said Moody’s.

The research firm has a “Ba3” rating with a “negative” outlook on the Mirage operator. Bonds with any of the three “Ba” ratings on the Moody’s scale are deemed to have speculative elements and are “subject to substantial credit risk.”

That said, MGM has plenty of cash and access to ample liquidity. At the end of the first quarter, it had $6.2 billion in cash on hand and total liquidity of $9.7 billion, including cash and revolver access, giving it one of the strongest balance sheets in the gaming industry.

For MGM, No Impact on Ratings

Though the Aria/Vdara sales mesh with MGM’s asset-light quest, the combined transaction, including the CityCenter purchase, caught some industry observers by surprise. That’s because those weren’t properties MGM previously indicated it was open to selling.

MGM is leasing back Aria and Vdara from Blackstone at an initial annual rent of $215 million, meaning the sale price of $3.89 billion is a multiple of 18.1x the lease terms. Since late 2019, the gaming company has significantly liquidated its real estate holdings, dramatically increasing cash on hand in the process. However, due to these transactions being structured as sale-leasebacks, whereby the seller maintains day-to-day control of the venue, long-term lease costs are added to MGM’s financial obligations.

“Despite the expectation for significant new lease obligations for MGM associated with the transaction, Moody’s does not expect the transactions to have a meaningful impact on MGM’s consolidated leverage in 2022, where gross debt-to-earnings before interest, taxes, depreciation and amortization (EBITDA) leverage is expected near 7x,” said the ratings agency.

Ways to Boost ‘Negative’ Outlook

Should MGM choose to do so, there are avenues for it to shed the “negative” outlook on its debt rating.

“Resolving the negative outlook will relate primarily to the pace and degree of the earnings recovery and accompanying improvement in leverage,” adds Moody’s.

Additionally, if the casino operator needs more cash, it can access that capital without issuing debt. It can continue paring its stake in MGM Growth Properties (NYSE:MGP) — something it pledged to do — effectively raise cash without growing its debt burden.

Related News Articles

Connecticut Airport Casino Wins Right-To-Know Case Against MGM

888-Rank Ditches Pursuit of William Hill

Most Popular

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

VEGAS MYTHS RE-BUSTED: The Traveling Welcome to Las Vegas Sign

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 33 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet