Mohegan Sun, Foxwoods Report Slot Machine Win of $866M in 2021

Posted on: January 18, 2022, 08:42h.

Last updated on: January 18, 2022, 02:50h.

Mohegan Sun and Foxwoods experienced a much better year in terms of gross gaming revenue (GGR) in 2021 than the two Southeastern Connecticut casinos did in 2020.

GGR from the tribal casinos’ slot machines totaled roughly $866 million last year. That’s a 32 percent year-over-year gain from 2020.

Under their longstanding Class III gaming compacts, the two properties share 25 percent of their slot win with the state. As a result, government coffers collected $216.5 million in 2021 from the tribal slots.

Mohegan Sun accounted for $126.9 million of the tax receipts, and Foxwoods the remaining $89.6 million. The state does not receive any of the tribes’ table game revenue.

Last year was substantially for the tribes. Both Mohegan Sun and Foxwoods stayed open the whole year without any temporary closings, as was the case in 2020 when much remained unknown about the coronavirus.

Though GGR climbed in 2021, casino business remains suppressed from pre-pandemic 2019, when Mohegan Sun and Foxwoods won around $982 million from their slot machines.

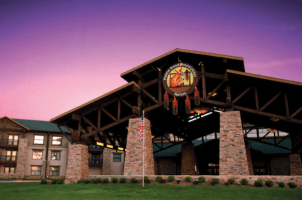

Mohegan Sun is owned and operated by the Mohegan Tribe. Foxwoods is owned and operated by the Mashantucket Tribal Nation.

Tribal Gaming Expansion

The days of Connecticut’s two tribal casinos enjoying a regional monopoly on slot machines and table games in the Northeast have long passed.

With casinos now located in neighboring New York, Rhode Island, and Massachusetts, slot win at the two Connecticut resorts has declined greatly over the past 15 years. GGR from the tribal terminals generated a record $433.6 million in state taxes in 2006, meaning the slots won more than $1.7 billion from gamblers that year.

Mohegan Sun and Foxwoods are beginning to offset some of those losses by way of new gaming privileges. Last year, the tribes and Gov. Ned Lamont (D) agreed to a revenue-sharing pact. That allows Mohegan Sun and Foxwoods to operate in-person and mobile sports betting, plus iGaming with interactive slots and table games.

The tribes share 18 percent of their GGR from iGaming with the state for the first five years. The tax rate increases to 20 percent thereafter. As for sports betting, the tribes are subject to a 13.75 percent tax regardless of whether the income is derived online or in-person.

Sports betting and iGaming operations were only permitted to commence in October. But Mohegan Sun and Foxwoods’ digital gaming units have already paid the state more than $6.6 million in taxes from iGaming, and another $2.8 million from online sports gambling. Tax revenue from retail sportsbooks has not yet been published by the state.

Strong 2021 Finish

Along with sports betting and internet casino gambling, Mohegan Sun and Foxwoods have a reason for optimism as 2022 begins. Last month, the tribal casinos reported strong year-over-year GGR increases on their slot machines. That’s a telling sign that customers are returning to brick-and-mortar properties.

Mohegan Sun slot win jumped 29.5 percent to $41.8 million. Foxwoods terminals made even better gains, its $30.5 million haul representing a 42 percent increase from December 2020.

Mohegan Sun is partnered with FanDuel for its sports betting and online gaming operations, while Foxwoods and DraftKings have teamed up.

Related News Articles

Connecticut Sports Betting, iGaming Regulations Gain Legislative Approval

Genius Sports, Sportradar Seen Benefiting from Florida Sports Betting

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet