Morgan Stanley Upgrades Macau Projections Despite ATM Clampdown

Posted on: July 9, 2017, 02:00h.

Last updated on: July 9, 2017, 07:59h.

Morgan Stanley has raised its growth projections for resurgent Macau, despite implementations of restrictions on ATM use this week.

On Thursday, the banking group revised its estimates of Macau’s year-on-year gross gaming revenue growth for full-year 2017 from 12 percent to 15 percent.

The note came two days after authorities announced the suspension of cash withdrawals from ATMs that are not yet equipped with the latest KYC (know-your-customer) facial recognition technology.

In May, the Macau government said that users of UnionPay, China’s only domestic bankcard, would be required to insert their mainland ID cards and have identities verified by the new facial recognition technology before making a cash withdrawal. The tech would gradually be integrated into the gambling hub’s 1,300-odd machines.

Two Thirds of ATMs Have Facial Recognition

This was the latest measure to prevent money laundering and capital flight from the mainland. But it came as a short, sharp reminder to investors that Macau’s fortunes remain intrinsically tied to the policy whims of Beijing.

It’s believed that around 30 percent of gambling budgets for Macau’s mass customers come from UnionPay debit cards, and casino stock fell on the announcement.

Early this week, Macau’s monetary authority (AMCM) said that, as of Tuesday, 834 ATMs had been fitted with the new technology, putting an estimated 466 machines, or just over a third, out of bounds for Chinese mainlanders.

“The AMCM has been requesting banks to speed up the implementation [of KYC machines] and is striving, in collaboration with each bank, to cover all ATMs in Macau including those inside casinos and in their surrounding areas by this year-end,” the statement said

Infrastructure Improvements

Morgan Stanley said it was “concerned” about the ATM restrictions, but cited the resurgent VIP segment and continuing mass-market growth as reasons to be cheerful. It said it expects VIP revenue to grow 16 percent this year, and the mass-market segment by 14 percent.

Its analysts cited positive new developments in infrastructure, such as the Taipa Maritime Terminal, which opened to passengers on June 1.

The terminal is expected to alleviate the traffic congestion in Cotai caused by the previous, temporary terminal, as well as creating a “paradigm shift” in tourists to the Cotai Strip arriving by sea.

“Gaming revenue growth has beaten market expectations since July 2016 amid China macro[economic] recovery, resulting in Macau [casino stocks] outperforming the Hang Seng Index by 6 percent in the first half of 2017 and 26 percent in the second half of 2016, and we see positive earnings revisions continuing,” analysts said.

Related News Articles

Gaming Equipment Manufacturers See (Mostly) Rising Stock Prices in December

Wynn Land Deal Shows Deep Connections Between Wynn, Trump, and Ruffin

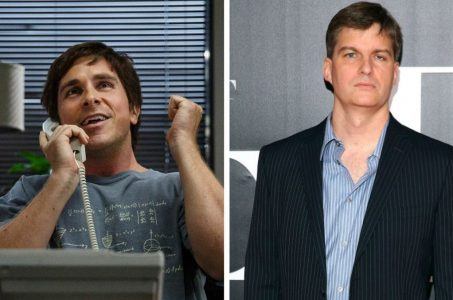

Burry, Inspiration for ‘Big Short’, Adds to Wynn Resorts Investment

Most Popular

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

Vegas Casino Resorts Install Detectors to Smoke Out Vapers — Report

Most Commented

-

Zillow: Town Outside Las Vegas Named the Most Popular Retirement City in 2024

— December 26, 2024 — 33 Comments -

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 33 Comments -

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

— December 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments

No comments yet