New Jersey Considering Removing iGaming from Atlantic City Casino Property Tax

Posted on: May 11, 2021, 08:48h.

Last updated on: August 2, 2021, 01:02h.

New legislation in New Jersey seeks to remove gross gaming revenue (GGR) derived online from Atlantic City casinos’ annual property tax liability.

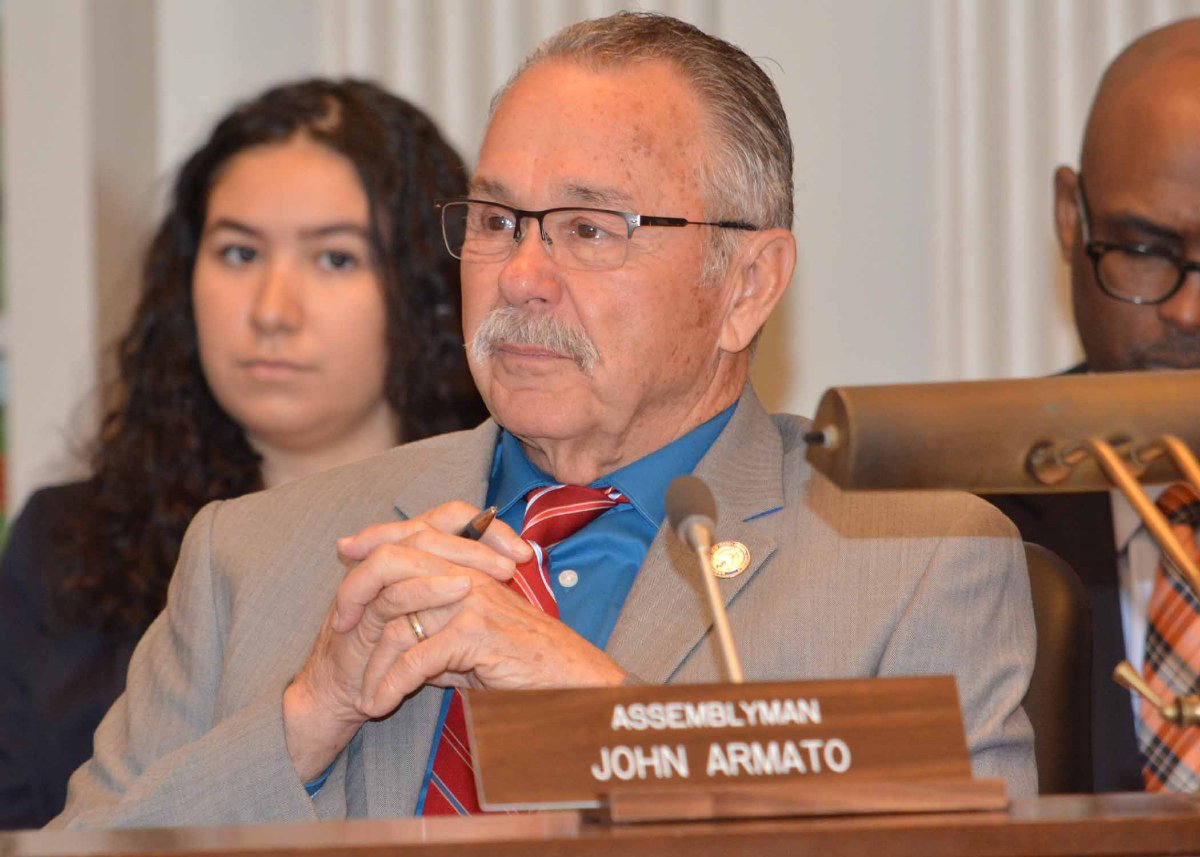

Assembly Bill 5587, introduced last week by Assemblyman John Armato (D-Atlantic), would amend the state’s tax structure on Atlantic City casino gambling. Currently, casino GGR from land-based and internet operations are grouped together as it relates to the Casino Property Tax Stabilization Act.

Passed in 2014, the law guarantees the state at least $120 million annually from Atlantic City casinos. The Tax Stabilization Act came in response to the casino resorts petitioning to have their property tax liabilities reduced in the wake of the economic recession and their casino revenues tumbling.

The 2014 statute increases the casinos’ property tax bill as their GGR increases. For GGR of $2.6 billion or less, the casinos pay $120 million. That increases to as high as $165 million if the annual GGR exceeds $3.4 billion.

Pandemic Powered iGaming

Armato believes GGR generated online should not be included in the brick-and-mortar tax obligation.

The nine land-based casinos have each partnered with interactive gaming suppliers for their internet and mobile applications. They share revenues with such third-party companies, though do not typically disclose their business arrangements.

“Gross gaming revenue means the total amount of revenue raised through casino gaming, including revenue from sports pool operations, from all the casino gaming properties located in Atlantic City as determined by the division for calendar years 2014 through 2020,” Armato’s bill reads. “Gross gaming revenue shall not include revenue derived from internet casino gaming and internet sports wagering during calendar years 2021 through 2025.”

The division refers to the New Jersey Division of Gaming Enforcement (DGE), the state’s gaming regulator.

The tax change proposal has no impact on sports betting at the Meadowlands, Monmouth Park, and Freehold Raceway, as those venues were not part of the 2014 Atlantic City property tax scheme.

False Advertising

New Jersey’s gaming industry was greatly damaged by the COVID-19 pandemic. Full-year GGR declined by 16.9 percent. The DGE numbers show that the nine casinos and two sports betting racetracks won more than $2.88 billion.

However, brick-and-mortar gambling inside Atlantic City casinos was actually down almost 44 percent. Slot machines won $833.7 million fewer dollars last year, and revenue from table games slid $340.3 million.

There is so much help that we really need with these properties,” Hard Rock Atlantic City President Joe Lupo told WOND 1400 AM in January.

“We need to see the city revitalized, and it’s not going to happen when the media is reporting increases when they add in online revenue that is going to third-party companies that don’t have any stake in the [Atlantic City] game.”

While land-based gaming was down 43.7 percent in 2020, iGaming GGR more than doubled. Online casinos won $970.3 million from gamblers, a $482.7 million surge on 2019.

Related News Articles

David Baazov’s Lawyer Grills AMF, Claims Regulator’s Case Is Full of Holes

Genting Group Focused on Japan, Predicts ‘Fierce’ Bidding War

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 31 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet