New Jersey Sports Betting Handle Could Overtake Nevada Next Year

Posted on: April 25, 2019, 07:39h.

Last updated on: April 25, 2019, 07:39h.

Full-scale sports betting was prohibited everywhere in the US not named Nevada prior to last May’s historic ruling from the Supreme Court that said the longstanding federal ban violated the Constitution.

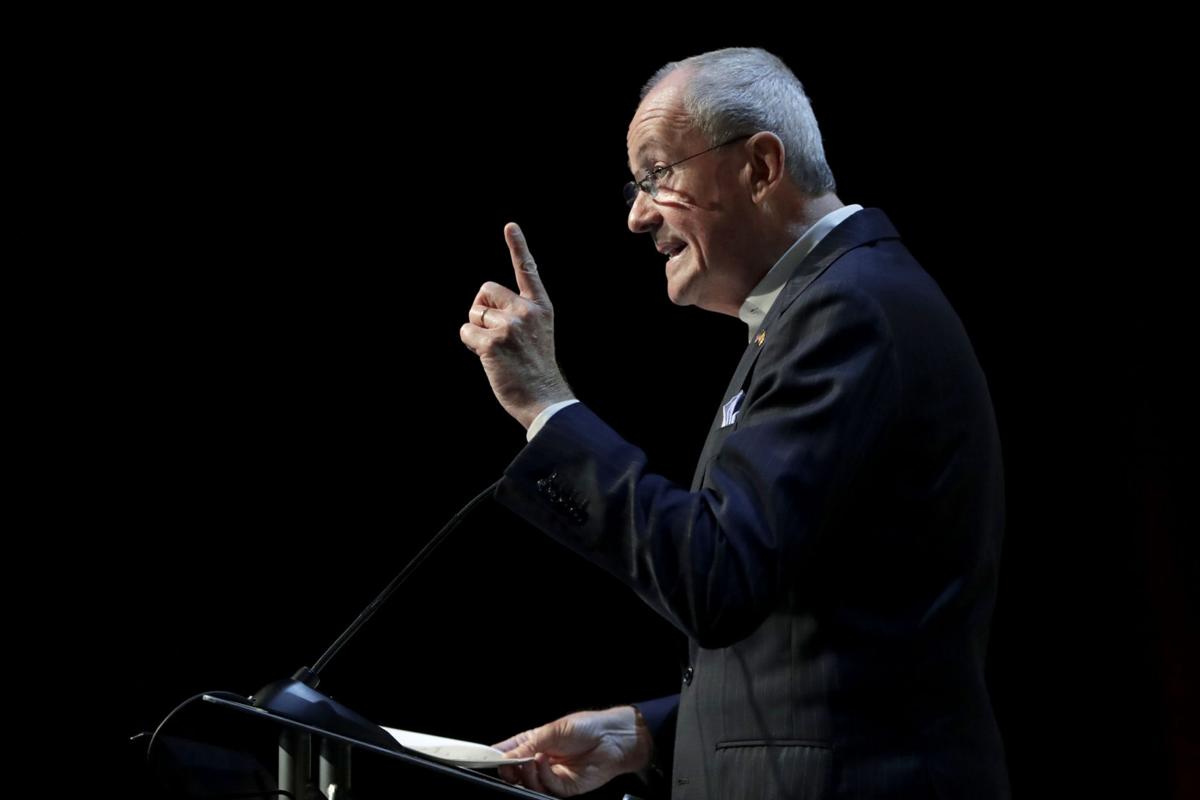

Less than a year later, and New Jersey is poised to potentially overtake Nevada as the richest sports betting state in terms of total bets placed – aka handle. Gov. Phil Murphy (D) believes it could happen as early as next year.

In the 10 months since Murphy placed the first legal sports wager last June, sportsbooks have accepted more than $2.3 billion in wagers. Nevada sportsbooks took over $5 billion in sports bets in 2018. But New Jersey’s sports betting is only now becoming fully operational.

The first sportsbooks opened June 14 at the Borgata in Atlantic City, and Monmouth Park racetrack in Oceanport. Throughout the summer, sportsbooks popped up at Ocean, Bally’s, Harrah’s, Resorts, and Golden Nugget, as well as the Meadowlands horse racetrack in northern New Jersey. Hard Rock opened a small sports betting area in January 2019.

Mobile wagering went live last August – and casinos and racetracks partnered with online sports betting operators to take wagers remotely within the state’s borders.

Governor Optimistic

Murphy addressed the gaming industry this week at the Betting on Sports America conference. The first-term governor spoke at the Meadowlands Expo Center in Secaucus.

Nevada is clearly in our sights,” Murphy declared. “We can overtake it as early as next year.”

There’s a host of reasons why that could occur. New Jersey’s population is nearly three times the size of Nevada’s, and masses of people travel in and out of the state each day. New Jersey’s quick embrace of mobile betting has also paid off.

Along with Nevada and New Jersey, sports betting is operational in Delaware, Rhode Island, Pennsylvania, West Virginia, Mississippi, and New Mexico.

Unlike in several of those states where gross revenue and subsequent tax benefits aren’t being realized due to the reluctancy to allow bets to be placed online, the Garden State is living up to expectations.

The New Jersey Division of Gaming Enforcement reports that 63 percent of bets in 2018 were made online. And through the first quarter of 2019, that’s increased to 80 percent.

Tax Benefits

New Jersey hoping to become the No. 1 sports betting state in America, but not only for bragging rights. With gross gaming revenue (GGR) from sports betting taxed at 8.5 percent for land-based wagers, and 13 percent on mobile, and the Garden State stands to reap new financial rewards in the years ahead.

The shortened 2018 operations put more than $10.4 million into New Jersey government coffers. The added casino win from sports betting – along with online gambling – is playing a critical role in the revitalization and stabilization of Atlantic City.

Land-based GGR win in Atlantic City grew four percent last year, but with internet gaming and sports betting (excluding track revenue), the nine-casino town collectively saw total income jump 7.5 percent – an increase of $200.6 million.

Related News Articles

Maryland Casinos Tell Lawmakers to Back Sports Betting

Outlook Rosy for Sports Betting if Supreme Court Approves Legalization

Derek Stevens Announces Circa Las Vegas Resort and City’s Largest Sportsbook

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet