NSW Suitability Probe of Crown Resorts Resuming, Melco Resorts Disposal in Focus

Posted on: June 24, 2020, 09:14h.

Last updated on: June 24, 2020, 02:00h.

The suitability probe of Crown Resorts to hold a casino license in New South Wales (NSW) will soon resume following a nearly three-month suspension because of the COVID-19 pandemic.

The NSW Independent Liquor and Gaming Authority announced this week that it is now safe and practicable to resume the inquiry. However, state officials say the focus of the investigation is slightly changing.

Crown Resorts is nearing completion of its $1.5 billion casino resort in the Sydney inner-city waterfront district of Barangaroo. The resort will feature a 75-floor tower, which will be the capital city’s tallest, with hotel rooms and private residences that start at $5.5 million. The casino will predominantly be for high rollers.

The inquiry is to determine whether the Australian casino giant is a suitable entity defined under state law to conduct business in NSW.

The NSW government has expressed concerns over Crown’s alleged links to organized crime, as well as the company’s suspected shortcomings in combating money laundering at its other gaming properties in Australia.

Melco Issue

Under the Casino Control Act of 1992, the NSW Authority is tasked with ensuring that licensed casino companies are free of criminal influence and exploitation, conduct honest gaming operations, and have appropriate safeguards in place to prevent harm to the public.

In late May of 2019, Melco Resorts entered into an agreement to purchase a 19.99 percent stake in Crown Resorts. Crown billionaire founder and owner James Packer was the seller in the deal that was valued at $1.22 billion at the time.

After Melco acquired the first half of the transaction, the Hong Kong-based casino operator announced it was opting to fold on the second 9.99 percent. In April, Melco said it was selling its first 9.99 percent position to private equity firm Blackstone Group at a deep discount. While Melco paid $8.42 for each of the 67.67 million shares, Blackstone paid $5.31.

Melco credited the pandemic for its reason to fully exit Crown, but the decision also reduces concerns for NSW regulators. Melco is founded and controlled by billionaire Lawrence Ho, one of the sons of Stanley Ho, dubbed the “King of Gambling” and Macau’s founding father.

The elder Ho, who passed away last month at the age of 98, has long been linked to triad groups in China and elsewhere in Asia.

Inquiry Focus

The NSW Independent Liquor and Gaming Authority says it will review if Melco’s disposal of its Crown position “constituted a breach of the Barangaroo restricted gaming license or any other regulatory agreement.” But the agency says with Melco removed, its emphasis is on Crown.

Authority officials say in the inquiry’s updated terms of reference that allegations have been made that Crown Resorts, and/or its agents, affiliates, or subsidiaries, have “engaged in money laundering, breached gambling laws, and partnered with junket operators with links to drug traffickers, money launders, human traffickers, and organized crime groups.”

The Gaming Authority says an announcement will be made soon as to when the casino inquiry will hold its next public meeting.

Related News Articles

Landing International Chairman Suspended Amid Securities Regulator Probe

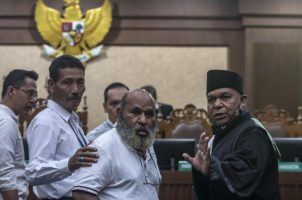

Former Indonesian Governor With Gambling Habit Goes to Prison

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet