Ohio Multimillion-Dollar Gaming Operations Lead Grand Jury to Indict Four, Feds Reveal

Posted on: May 20, 2021, 10:14h.

Last updated on: May 20, 2021, 12:56h.

Four suspects were recently indicted by an Ohio grand jury after jurors were presented with evidence about several alleged illegal gambling sites.

Each of the four defendants was charged on Tuesday. They appeared before federal Magistrate Jonathan Greenberg in Cleveland later in the week.

Two of the illegal businesses operated in Canton, Ohio. The gaming sites called the Skilled Shamrock and Redemption Skill Games 777 (Redemption), are now shuttered.

While open, the two sites and others provided skill games in Stark County, according to The Repository, a Canton newspaper.

Several Federal Charges

The four were charged with operating an illegal gambling business and defrauding the federal government.

The indictment claims that between 2010 and 2018, Jason Kachner, his wife, Rebecca Kachner, and Ronald DiPietro, who is a CPA, conspired to operate Skilled Shamrock.

From 2012 through 2017, players at Skilled Shamrock allegedly wagered more than $34 million, according to a statement from Acting US Attorney Bridget M. Brennan of the Northern District of Ohio. That led to more than $4 million in net income for the operators, the statement adds.

Between 2013 through 2018, both of the Kachners, and a third man, Thomas Helmick, conspired to operate Redemption. They also allegedly conspired to defraud the IRS by filing false tax returns.

The returns allegedly concealed a “substantial portion” of Redemption’s gross receipts, prosecutors said. The returns also hid the names of the gaming operations’ owners, the Feds add.

Faulty Tax Records, Fraud Charges

DiPietro was also charged with assisting in the preparation of false tax returns for the Kachners between 2013 and 2017. The returns allegedly failed to report the Kachners’ true income from the Skilled Shamrock, Feds said.

The Kachners were also charged with allegedly filing false individual tax returns for the five-year period. Helmick was charged with filing his own false individual income tax returns between 2014 and 2016.

The cases stem from 2018 when federal agents raided several Stark County skill game businesses, The Repository said.

All four defendants were targets for conspiracy to defraud the United States and to conduct an illegal gambling business, money laundering, structuring, and tax violations in association with their ownership and operation of (illegal gambling businesses) in Northeast Ohio,” an IRS agent said in a criminal complaint filed last month.

If convicted, Jason and Rebecca Kachner, DiPietro, and Helmick each face a maximum sentence of five years in prison for each conspiracy count and five years in prison for each illegal gambling business count.

The Kachners and Helmick also face three years in prison for each false tax return count. DiPietro faces three years in prison for each count of aiding in the preparation of a false tax return.

One Defendant Maintains Innocence

“Mr. DiPietro denies all the charges and we look forward to our day in court where his name, reputation and the charges against him will be certainly absolved,” Attorney Robert Fedor, who represents DiPietro, told The Repository.

Related News Articles

Nevada Sex Worker Claims Innocence After Arrest for Brothel Shooting

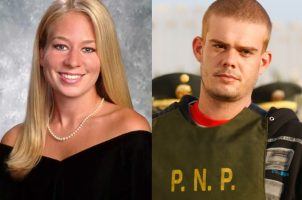

Natalee Holloway Suspect ‘Took Care of Things’ After Disappearance

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet