Las Vegas Sands Request for Long Island Tax Breaks Draws Ire

Posted on: June 4, 2023, 07:05h.

Last updated on: June 5, 2023, 11:22h.

A Nassau County civic group claims it’s the “height of hypocrisy” for Las Vegas Sands to seek tax relief in its quest to build a $4 billion integrated resort in Uniondale, NY.

The “Say NO to the Casino Civic Association” issued a scathing statement after reports surfaced last week that Sands was seeking tax breaks. Reports said it could approach the Nassau County Industrial Development Association (IDA) with requests for sales tax relief on select items, and a reduction in the mortgage recording tax. Specifically, the gaming operator is said to be aiming for sales tax exemptions on construction equipment, raw materials, and furnishings for the yet-to-be-approved gaming venue.

It is the height of hypocrisy for one of the world’s most profitable casino companies, with a market capitalization of $45 billion (and majority owned by a billionaire worth more than $34 billion) to ask for “tax breaks” from Nassau County residents,” according to a statement issued by the anti-casino group.

The majority ownership being referenced by the civic organization is that of Dr. Miriam Adelson, Sheldon Adelson’s widow, and her family. They are the majority owners of Sands stock, which closed last Friday with a market value of $42.38 billion.

Group Wants Sands to Pay its ‘Fair Share’

The “Say NO to the Casino Civic Association” claimed Las Vegas Sands is looking to skirt tax obligations to the county should it be awarded a gaming license. The group contends that the gaming company should be subject to the same levies as any other local business.

Nassau County has previously granted mortgage relief on Nassau Coliseum, the site where Sands is looking to build the casino hotel. Companies requesting sales tax relief in the early stages of large-scale projects is commonplace across the US.

“Now that Las Vegas Sands has been awarded the land lease, it doesn’t want to pay its fair share of sales tax and real estate taxes. The pervasive negative impacts that a casino will bring to our county will require significant additional government and community resources to address,” added “Say NO to the Casino Civic Association.”

While LVS will reportedly seek tax relief, the company is on the hook for a sizable cash payment to Nassau County. That’s regardless of its success in winning one of three downstate casino licenses.

Civic Organization Doesn’t See Value in Casino

The “Say NO to the Casino Civic Association” takes issue with the potential economic benefits of a Nassau County casino. It claims it will make money off of locals and contribute a meager percentage to the county’s annual budget.

If Las Vegas Sands is, unfortunately, awarded a gaming license, the annual payment Las Vegas Sands’ will make to Nassau County represents a mere 1.4% of the county’s budget, and now, they’re asking for an even better bargain,” noted the group.

Conversely, the venue will create thousands of jobs, resulting in elevated contributions to New York’s income tax collection efforts. Additionally, the casino resort’s convention space, entertainment, eateries, and rooms could be significant sales tax generators for Nassau County over the long haul.

Related News Articles

Las Vegas Sands Seeking Tax Breaks for Long Island Casino

New York Provides Answers to Initial Batch of Downstate Casino Inquiries

Newsday Slams New York Casino Process

Caesars Regional Casinos Could Boost Stock, Says Analyst

Most Popular

IGT Discloses Cybersecurity Incident, Financial Impact Not Clear

What ‘Casino’ Didn’t Tell You About Mob Wife Geri Rosenthal

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

Fairfax County Officials Say No NoVA Casino in Affluent Northern Virginia

Most Commented

-

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 6 Comments -

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 5 Comments -

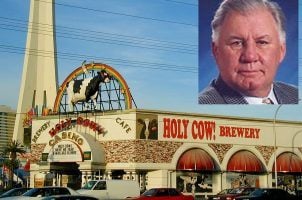

LOST VEGAS: The Historic Holy Cow Casino

— November 29, 2024 — 4 Comments

Last Comments ( 6 )

The Nassau County hub process demonstrates exactly what the NYS gaming commission sought to AVOID in the downstate license process — a community firmly against the casino, but a powerful and organized gaming company railroading the community to impose the casino on our community. In Nassau, the County Executive, Bruce Blakeman, his family has close ties to Sands (his brother ran Adelson’s non-profit). He allowed Sands to orchestrate a process of smoke and mirrors regarding receiving community input. Hofstra University, which is located near the proposed Casino, is suing the county because the county blatantly violated open meetings laws. Meanwhile, the Sands has been sometimes quietly, sometimes not so quietly, offering “community benefits” to anyone willing to support the project - even a local addiction non-profit supports it. How could that be? It’s sad - few want the casino, but our voices are not being heard in Nassau County.

If LVS is asking for tax breaks now, before they have even broken ground on construction, just imagine what they might demand once they have embedded themselves in the community and they can threaten to lay off their employees right before an election!

It is estimated by Sands that “in excess of $2 billion” will be lost (gross gaming revenue to Sands) annually at this proposed casino that would make it the largest grossing casino in the US. Most of the money that will be lost in this massive casino would have been spent by residents locally and subject to sales tax. This loss of sales tax revenue offsets much of the promised tax benefits of the casino. There is no free ride when it comes to casino economics - it just a mindless shuffling of dollars with no products being produced or no worthwhile services being rendered.

Greed on the part of area residents in favor of the casino will come back later as one of their greatest regrets. They refuse to believe that now -- they will definitely believe it when a casino brings the chaos they haven't even thought about yet. Family homes in Nassau County will become broken homes. Is that an acceptable risk?

Sands market capitalization at the close of the markets on Friday was $45.046 billion.

All of the money used to pay the employees of the proposed casino -- along with the much, much greater amounts of money that will enrich the already wealthy casino owners -- will come from gamblers who lose. These gamblers will primarily come from the local community surrounding the casino, and the funds they lose will no longer be available to be spent on goods or services at other area businesses - or on basic necessities for the gamblers' families. How many more jobs will be lost at businesses in the surrounding community than will be created by the casino itself? How much long-term economic growth and technological development will be forgone if the Long Island community focuses its hopes and dreams on gambling instead of economically productive activities? How many more children will go hungry or become homeless because their parents become addicted to gambling?