Paddy Power Betfair Fined £2.2 Million for Failing to Detect Criminal Gambling Sprees

Posted on: October 16, 2018, 05:00h.

Last updated on: October 16, 2018, 03:26h.

UK regulators have fined Paddy Power Betfair (PPB) £2.2 million ($2.9 million), after the operator failed to stop two customers from gambling “significant sums” of stolen money on the Betfair betting exchange.

According to The Guardian, one of these customers was Simon Price, the former chief executive of Birmingham Dogs Home, in the UK’s Midlands region. He was sentenced to five years imprisonment in December for embezzling £900,000 ($1.2 million) in legacy payments to the charity over a four-year period, $650,000 ($857,000) of which he blew on Betfair.

The sentencing judge told Price that his actions had “weakened public confidence” in the work of the dogs’ home and impaired its ability to raise the £1.85 million ($2.44 million) per year needed to stay open. Media reports at the time noted that none of the stolen money had been repaid and reported it was likely to ever be recovered.

But the UK Gambling Commission (UKGC) confirmed Tuesday that the charity’s funds will be reimbursed from the PPB fine. The rest will be directed to problem gambling charity Gamble Aware.

Red Flags Unheeded

The UKGC said PPB failed to intervene when customer behavior should have raised clear red flags. It also said the operator had failed to carry out adequate anti-money laundering checks. In handing out the fine, it cited five specific cases where PPB had failed in its duties of compliance.

“As a result of Paddy Power Betfair’s failings, significant amounts of stolen money flowed through their exchange and this is simply not acceptable. Operators have a duty to all of their customers to seek to prevent the proceeds of crime from being used in gambling,” said the UKGC.

“These failings all stem from one simple principle: operators must know their customer. If they know their customer and ask the right questions, then they place themselves in a strong position to meet their anti-money-laundering and social responsibility obligations,” it added.

Escalating Fines

The regulator has cracked down on compliance failings over the last year, a sign that the political mood has turned against the country’s liberal gambling industry. Fines against UK gambling companies rose more than tenfold in 2017, from £1.6 million ($2.1 million) in the previous year to £18 million ($24 million).

These included a record £7.8 million ($10 million) fine doled out to 888 Holdings for allowing 7,000 people who had voluntarily banned themselves to access their accounts.

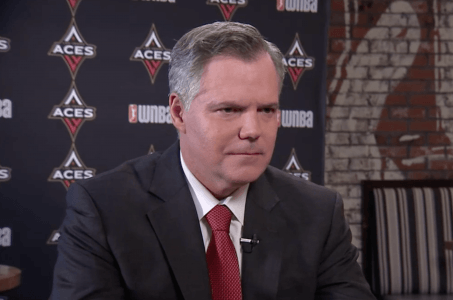

“We have a responsibility to intervene when our customers show signs of problem gambling,” said PPB CEO Peter Jackson. “In these five cases our interventions were not effective and we are very sorry that this occurred.

“In recent years, we have invested in an extensive program of work to strengthen our resources and systems in responsible gambling and customer protection,” he added.

Related News Articles

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 31 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet