Penn National Slides 45 Percent, Three Others Down More Than 40 Percent as Gaming Stock Bloodletting Continues

Posted on: March 16, 2020, 02:58h.

Last updated on: March 16, 2020, 03:38h.

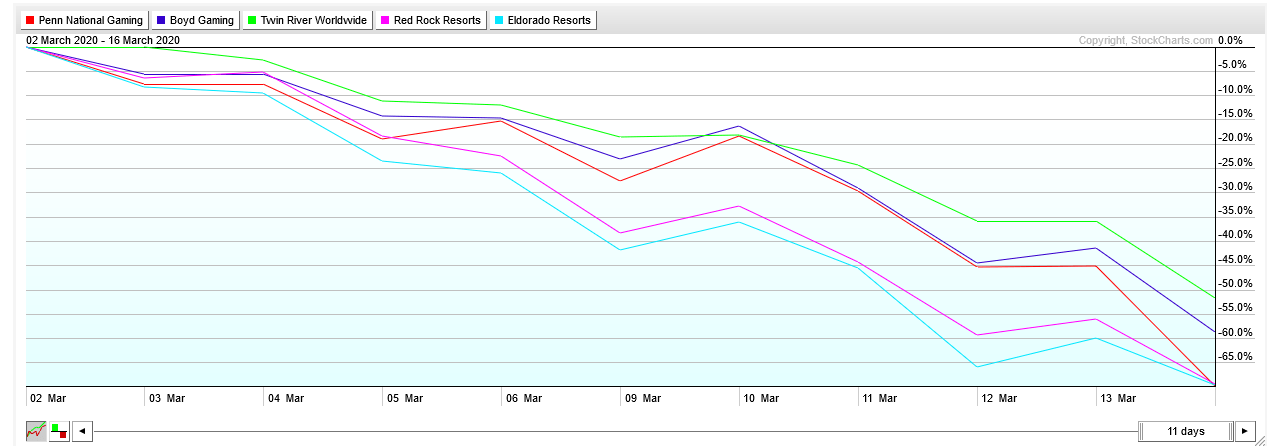

On the worst day for US equities since 1987, gaming stocks weren’t immune from selling pressure. In fact, the group was one of the worst offenders today, with technology provider Everi Holdings Inc. (NYSE:EVRI) plunging more than 60 percent, while casino operator Penn National Gaming (NASDAQ:PENN) shed 44.80 percent.

The gaming industry has rapidly become one of the worst-performing consumer discretionary segments, as the novel coronavirus has taken hold in the US, prompting a spate of casino closures from coast to coast while stoking fears the US economy – the world’s largest – will soon slip into a recession.

Monday’s slide by Penn National means the stock resides 78.20 percent below its 52-week high, and that it would need to more than triple to get back to the levels seen in late January when the operator revealed it was taking a minority stake in Barstool Sports.

Among regional gaming equities, Penn wasn’t the only offender today, nor has it been alone in shedding market value this month. Boyd Gaming (NYSE:BYD) tumbled 29.34 percent, while Eldorado Resorts (NASDAQ:ERI) dipped 24.37 percent on its way to its lowest closing price since late 2016.

Those operators have not made announcements about the near-term status of Nevada casinos. But each has temporarily shuttered gaming properties in other regions, including the Midwest and the South, because of the COVID-19 epidemic.

Big Boys Barely Better

Regional gaming stocks weren’t the only industry offenders Monday. After saying Sunday that it will temporarily close its Las Vegas Strip integrated resorts, among other domestic properties, MGM Resorts International (NYSE:MGM) shed more than a third of its value in a single day on volume that was more than triple the daily average.

Wynn Resorts (NASDAQ:WYNN) said it’s closing its two Sin City properties and Encore Boston Harbor for two weeks, an announcement that sent that stock lower by more than 24 percent.

Interestingly, one of the best-performing gaming equities on Monday – though that’s not saying much – was Las Vegas Sands (NYSE:LVS). The operator of the Palazzo and Venetian said it’s keeping those integrated resorts open and that it’s not planning staff reductions.

Currently, Nevada isn’t forcing casino closures. But the state has outlined a series of new policies and procedures aimed at preventing the spread of COVID-19, many of which pertain to travel and leisure destinations. With Monday’s close at $40.39, LVS stock resides at its lowest levels in roughly four years.

Another Issue

Underscoring the weakness in shares of casino operators today is the following factoid: of Monday’s 80 worst-performing US-listed equities on a percentage, six were gaming stocks.

That doesn’t mean the worst is over for these names. Actually, the opposite could prove to be true due to another potential headwind.

With gaming stocks being bludgeoned this month, the price forecasts on many are as high as 1.5x or double current market prices, meaning sell-side analysts could soon start paring targets to save some face in the wake of a new bear market.

Related News Articles

Corvex Management Pushes Kindred to Consider Sale

Disney CEO Bob Iger Lukewarm on Sports Betting

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet