Single Powerball Ticket Wins $754.6M Jackpot, Ninth-Largest Lottery Prize in US

Posted on: February 7, 2023, 08:51h.

Last updated on: February 7, 2023, 11:46h.

A lucky Powerball player in Washington state won a life-changing fortune on Monday night — a $754.6 million pre-tax jackpot.

Powerball’s winning numbers for its February 6 drawing were 5, 11, 22, 23, 69, and the red Powerball 7. The Power Play multiplier was 2x.

Powerball officials reported after the drawing that one ticket matched the six winning numbers. The ticket was purchased in Washington. But the lottery didn’t immediately detail where the lucky numbers were purchased.

Monday night’s win wraps up a streak of 33 consecutive drawings without a jackpot winner. The lucky winner will have to choose between taking the full value of the jackpot paid out over a 30-year annuity, or opting for a one-time lump cash sum of $407.2 million.

After federal taxes, the total values of the disbursement options would be about $476.5 million and $256.5 million.

The jackpot cracked the country’s top 10 largest lottery list, and the top five among Powerball’s richest prizes. Along with the jackpot, five tickets matched all five white balls, but not the red Powerball for the game’s second-best prize of $1 million. One of those tickets purchased the $1 optional Megaplier to double their win to $2 million.

Jackpot Breakdown

If the Washington player decides to take the full value of the jackpot over 30 years, the US government will take about $9.2 million from the annual disbursement through the feds’ effective 37% income tax on the nation’s highest earners.

The 30 payments would come to roughly $15.8 million. If the player chooses the cash option, the feds will take their 37% to reduce the prize by approximately $150.6 million.

Higher interest rates have allowed lottery officials to advertise more robust jackpots than they otherwise would be able to market. Powerball and Mega Millions base their advertised jackpots on the 30-year annuity payout.

With those annuities invested in bonds backed by the US Treasury and those savings vehicles dependent on the Federal Reserve interest benchmark, the full 30-year values have soared since the feds increased rates from nearly zero to almost 5% over the past 12 months.

Washington Provides Savings

Monday night’s jackpot winner didn’t only overcome the seemingly unimaginable odds of one in 292.5 million — their good fortune also extended to where they purchased the ticket. Washington is one of only nine states that doesn’t consider lottery winnings as taxable income.

Most states do, and the average state income tax for 2023 is about 5% in taxing states. If Powerball’s newest jackpot winner picks the cash option, Washington’s tax-free lottery law will save the winner about $20 million.

Choosing the payout option is becoming more difficult, with interest rates continuing to rise. Historically, most Powerball and Mega Millions jackpot winners have opted for the cash option, as investing such riches in the stock market and retirement accounts have outpaced the federal interest rate. But with the federal benchmark at its highest level since September 2007, the annuity is becoming more attractive.

Whoever the winner is, Washington does require that lottery winners allow their identities to be made public.

Related News Articles

Powerball Climbs to Third-Largest Jackpot in Game History

Powerball Dodges Players Again, Jackpot Swells to $835M

Most Popular

IGT Discloses Cybersecurity Incident, Financial Impact Not Clear

What ‘Casino’ Didn’t Tell You About Mob Wife Geri Rosenthal

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

Fairfax County Officials Say No NoVA Casino in Affluent Northern Virginia

Most Commented

-

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 6 Comments -

VEGAS MYTHS RE-BUSTED: Casinos Pump in Extra Oxygen

— November 15, 2024 — 5 Comments -

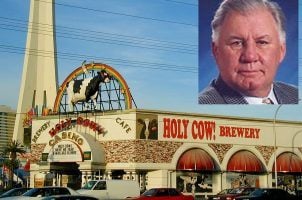

LOST VEGAS: The Historic Holy Cow Casino

— November 29, 2024 — 4 Comments

No comments yet