Congressional Gaming Caucus Wants Tax Threshold Raised on Slot Jackpots

Posted on: September 25, 2021, 04:58h.

Last updated on: September 26, 2021, 05:46h.

Members of the Congressional Gaming Caucus want to know when they can expect a report on raising the tax threshold on slot machine winnings. The call comes nine months after Congress passed legislation asking the US Treasury Department to determine whether raising it was feasible.

The tax reporting threshold on slot machines is currently $1,200.

In a letter Friday to Treasury Secretary Janet Yellen, six members of the caucus reminded her about the report. It comes as lawmakers on Capitol Hill are looking to finish spending bills for the 2022 fiscal year, which starts next Friday.

We ask that the department prepare this report as expeditiously as possible and deliver it to Congress to address this long-standing and burdensome issue,” the lawmakers wrote. “We appreciate your attention and look forward to working with you on the matter.”

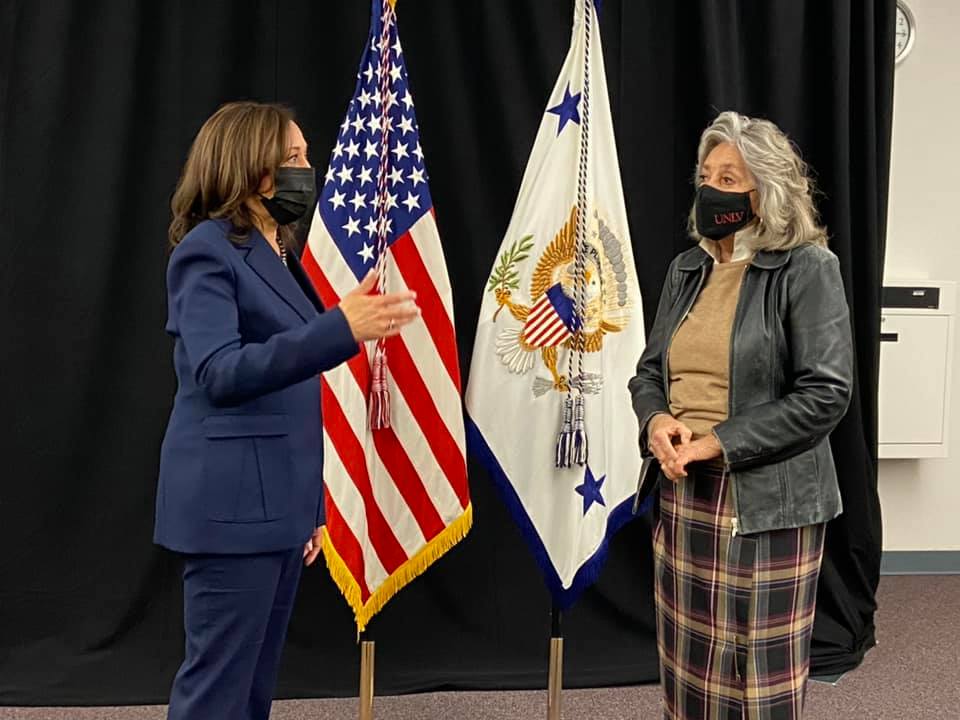

The letter was signed by US Reps. Dina Titus, D-Nev.; Guy Reschenthaler, R-Penn.; Steven Horsford, D-Nev.; Mark Amodei, R-Nev.; Anthony Brown, D-Md.; and Kelly Armstrong, R-ND. Titus and Reschenthaler serve as the cochairs of the caucus.

The study request was part of an omnibus spending bill lawmakers passed in late December. The bill called for the Treasury to report its findings to Congress within 90 days of its enactment.

That deadline passed on March 27.

At the time the bill was signed into law, President Trump was still in office. The Biden Administration would not take over until Jan. 20. Yellen was confirmed by the Senate on Jan. 25.

Current Slot Tax Threshold Set 44 Years Ago

While the caucus asked for a feasibility report, the members already have a firm position on the matter, and they shared that with Yellen as well in the letter.

The federal government set the threshold at $1,200 in 1977. The caucus told Yellen that when a slot player wins a jackpot of that size or larger, it forces the casino to immediately shut down that machine. A casino employee then must go to the winner and hand them a W2-G tax form to report gaming winnings.

“Because the threshold has not kept up with inflation, this outdated policy has produced a dramatic increase in the number of reportable jackpots, which has increased the operational costs and associated burdens for casinos, their patrons, and the Internal Revenue Service,” the letter stated.

This also isn’t the first time the Treasury Department has been called on to raise the threshold. In May 2019, Titus and US Rep. Darin LaHood, R-Ill., wrote to then-Assistant Treasury Secretary David Kautter to raise the threshold to $5,000.

In May 2020, the American Gaming Association brought up the same issue. That’s after Trump signed an executive order calling on federal agencies to consider rescinding policies that would hinder the country’s recovery from the COVID-19 pandemic.

US Rep. Titus to Speak at G2E

Friday’s letter comes as Titus gets ready to meet with key gaming industry leaders in less than two weeks.

At next month’s Global Gaming Expo, Titus and Nevada Gov. Steve Sisolak will deliver a joint keynote on Oct. 5 to discuss Nevada’s recovery and gaming’s role in that.

G2E runs from Oct. 4-7 at the Venetian Expo on the Strip.

Related News Articles

New Online Gambling Ban Bill Introduced to US House

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet