Robinhood CEO Says Broker is Examining Sports Betting

Posted on: December 4, 2024, 02:50h.

Last updated on: December 4, 2024, 03:01h.

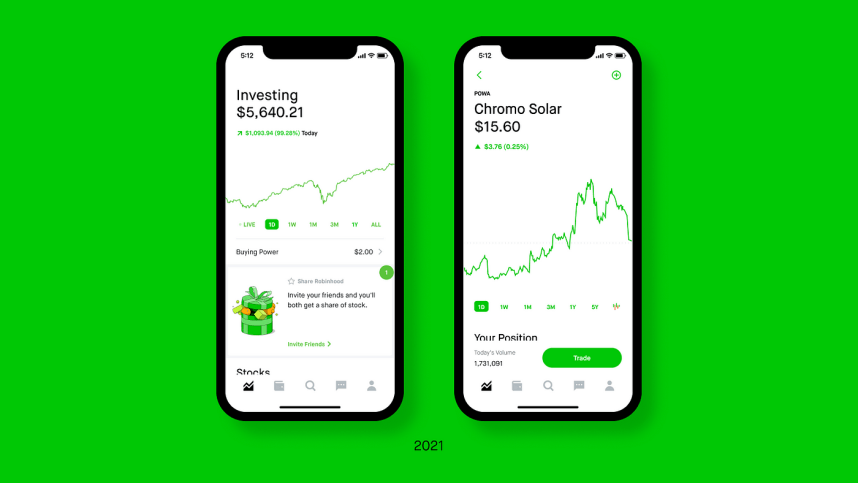

At the company’s investor day on Wednesday, Robinhood (NASDAQ: HOOD) CEO Vlad Tenev said the firm is evaluating avenues to get into sports betting.

Tenev told shareholders that the purveyor of the popular investing mobile application is “keenly looking” for ways to enter the sports betting arena, and that customers are interested in wagers that would be the equivalent of futures contracts on sporting events. That implies the brokerage firm’s foray into sports wagering, assuming it materializes, would offer something different than traditional sides and totals bets.

Robinhood entered the events contracts space in late October, announcing an election betting offering that was available only to US customers who had been approved for margin investing and Level 2 or 3 options trading. In its investor presentation, the financial services firm said its events contracts offering resulted in more than 500K funded futures accounts and more than 500 million contracts traded in just a week.

In its investor deck, Robinhood listed event contracts under the “white space” category — areas in which the company currently doesn’t have significant penetration, but ones in which it expects to fill those voids in the coming years.

Robinhood Has Ideal Sports Betting Demographics

Robinhood and sports betting could be an ideal match for multiple reasons, including the fact that the bulk of transactions on the trading platform take place via smartphones. The same is true of regulated sports wagering in the US.

Additionally, customer demographics align favorably with the sports betting space. Eighty percent of Robinhood customers make either $50K to $100K, or $100K or more annually, and 75% are millennials or members of Gen Z. Sixty percent are men. Those age and income ranges are highly coveted by sportsbook operators.

Robinhood has also proven proficient in another area that’s relevant in sports wagering: customer retention. That’s likely the byproduct of switching costs and tax issues associated with moving brokerage accounts, but Robinhood’s customer retention rate as of October was approximately 95%, up from 80% two years prior.

The average customer holds about $6,500 in assets at Robinhood, a figure that doubled over the past two years, according to the investor presentation.

Robinhood Clients Primed for Sports Betting

Two other asset classes — cryptocurrency and options — confirm Robinhood and sports event contracts could be an ideal pairing. Options trading on the platform is surging and last month, the company rolled out equity index options.

As for cryptocurrency, which is beloved by younger investors and many sports bettors, Robinhood has approximately 12 million funded crypto accounts with $21 billion in combined assets under custody.

Robinhood is already among the largest platforms in terms of notional crypto volume among retail traders, reaching $85 billion in the third quarter despite offering just 20 digital assets. By comparison, Coinbase’s notional retail volume was less than double Robinhood’s with 13x as many tokens.

Related News Articles

Fanatics Sells Candy Digital Stake Amid ‘Imploding’ NFT Market

DraftKings Reignmakers Seen Boosting Profits, Revenue

Most Popular

Jackpot News Roundup: Two Major Holiday Wins at California’s Sky River Casino

PUCK, NO! Health Dept. Closes Las Vegas Wolfgang Puck Restaurant

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

MGM Osaka to Begin Construction on Main Resort Structure in April 2025

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 33 Comments -

Zillow: Town Outside Las Vegas Named the Most Popular Retirement City in 2024

— December 26, 2024 — 31 Comments -

Oakland A’s Prez Resigns, Raising Questions About Las Vegas Move

— December 27, 2024 — 9 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments

No comments yet