Tennessee Considers Handle Tax as Sportsbook Revenues Peak – Analysis

Posted on: March 22, 2023, 06:00h.

Last updated on: March 22, 2023, 11:44h.

Tennessee first stood out among the states legalizing sports betting by allowing only online wagering. Now, the Volunteer State is considering bucking conventional wisdom again.

Bills have been filed in both chambers of the Tennessee General Assembly that would eliminate the state’s 20% tax on revenue and replace it with a handle tax. That means the state would get a cut of each bet placed, regardless of whether the operator or the bettor wins.

Senate Bill 475, sponsored by state Sen. John Stevens (R-Huntingdon), would set the tax at 2%, while the House bill proposed a 1.85% tax. Both versions would also allow operators to deduct the .25% federal excise tax they pay on their handles but not any promotional credits.

If lawmakers approve either, Tennessee would become the first state to levy a sports betting tax by handle.

House Bill 1362, sponsored by state Rep. Andrew Farmer (R-Sevierville), also amends the annual license renewal fee structure. Rather than all operators paying $750K a year to take bets in Tennessee, only those sportsbooks that report a handle of $500 million or more in a calendar year would pay that rate.

Those accepting more than $100 million in wagers but less than $500 million would pay $500K, and operators who post handles of less than $100 million would pay $250K.

Any new licensee will still have to pay the $750K fee the first time when the state approves their application.

Both bills also eliminate the 10% mandatory hold the state enacted when creating its sports betting regulations nearly three years ago.

‘Business Friendly’ Key in Tennessee

Farmer reassured colleagues in a House committee meeting earlier this month that the proposed changes won’t be too severe. At the same time, he said the state’s not trying to “poach” the sportsbooks.

It’s going to make plenty of money,” he said. “We just want to try to be as business friendly as possible because the more money these folks make, the more tax revenues are going to be there.”

Both bills continue to work their way through their respective chambers. Farmer’s bill gets a hearing Wednesday in the House Finance, Ways, and Means Subcommittee. Stevens’ legislation goes before the Senate Finance, Ways, and Means Committee next Wednesday.

Revenues Reaching Record Highs

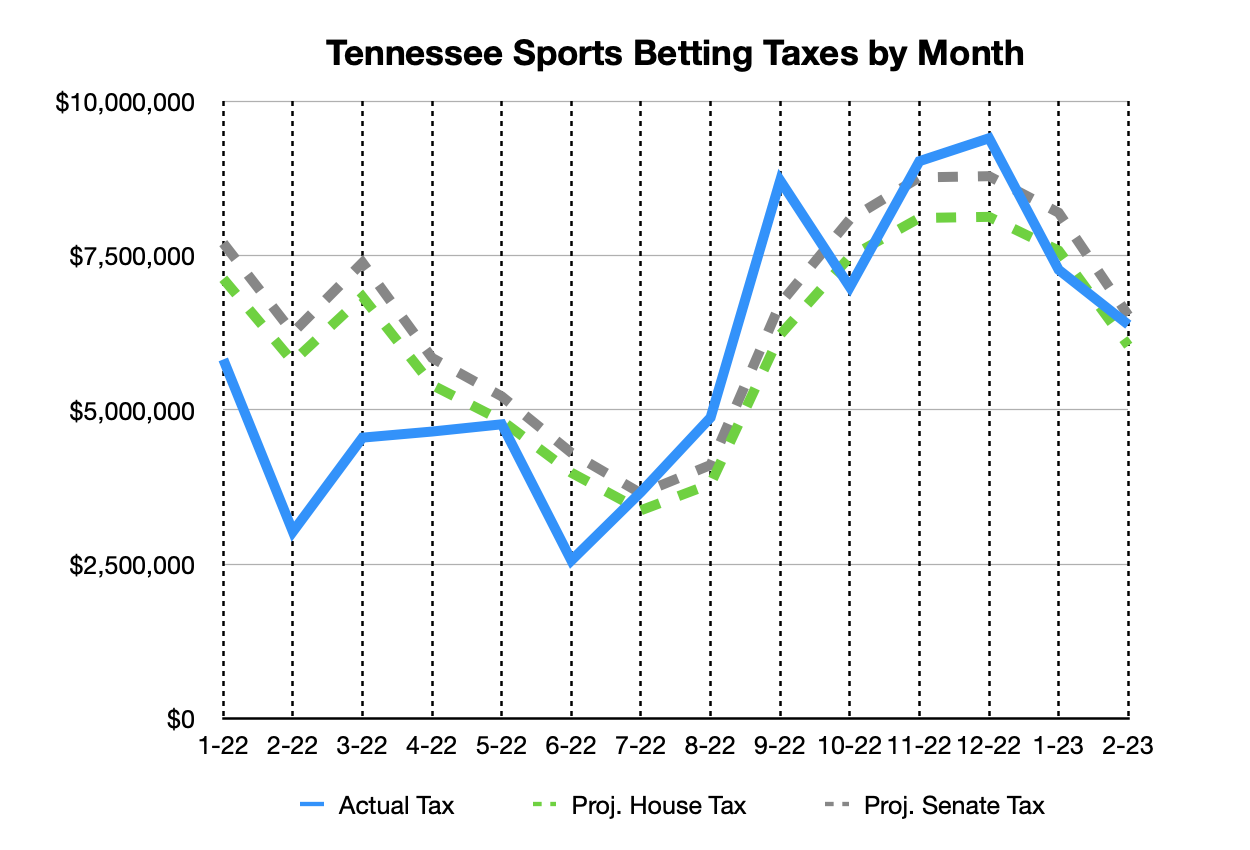

A review of reports published by the Tennessee Sports Wagering Advisory Committee (SWAC) shows that if either chamber’s handle tax was in place for 2022, the state would have made a little more money for the year. That’s also based on how Stevens described how the tax would work, with sportsbooks taking the .25% excise tax off the total handle and then taxing the remainder at 2%.

Tennessee sports bettors wagered $3.85 billion last year, and sportsbooks paid $9.6 million to the federal government.

For the calendar year, SWAC reported Tennessee received almost $68.1 million in tax revenue. The Senate’s tax plan would have generated about $76.8 million, an increase of about $8.8 million. The House’s lower tax would also have resulted in a modest gain, as the state would have received $71.1 million.

The House bill also reduces the state’s revenue from license fees since few of the 13 licensed operators would have had handles exceeding $500 million last year. Unlike several states, SWAC doesn’t break down handle and revenue by operator. Still, it’s a safe bet to assume FanDuel and DraftKings command the highest market shares – just as they do in nearly every other state – and several of the remaining licensees would likely pay one of the lesser two amounts.

One important thing to note is that the tax change comes as sportsbooks post their highest revenue totals ever in the state. The six highest revenue totals have come in the last six months, with the record being $47 million in December.

Based on Casino.org’s calculations, when the state posted a record handle of $440.4 million in December, either chamber’s handle tax would have generated less revenue for the state. Based on the last six months of reports – from September 2022 to February – the House’s handle tax would have produced less revenue in four of the six months, and the Senate’s plan would have in three.

A Handle on Tennessee’s Future

While sportsbooks and state leaders hope they can continue increasing interest and driving up the monthly handle totals, those figures could take a hit in the not-so-distant future.

Only two of Tennessee’s neighbors, Arkansas and Virginia, currently offer mobile sports betting. Two others, Mississippi and North Carolina, allow it at brick-and-mortar casinos. Mississippi, North Carolina, Georgia, Kentucky, and Missouri have discussed legalizing online wagering in their states. Some of those states still have a chance to pass bills this year.

As each neighboring state opens its doors to mobile wagering, it stands to reason it will impact traffic in Tennessee. At a Kentucky Senate Licensing and Occupations Committee hearing last week, lawmakers from Southern Kentucky noted they have friends from their districts that drive across the state line every weekend to place bets.

The discussion of a handle tax comes at a curious time, especially since revenues are peaking and handles are uncertain.

For now, though, it’s a bet Tennessee lawmakers appear willing to make.

Related News Articles

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 32 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet