Tribal Casinos Account For Nearly Half of US Gaming Market, AGA Report Says

Posted on: November 9, 2018, 06:00h.

Last updated on: November 8, 2018, 03:29h.

A new report released by the American Gaming Association (AGA) shows just how significant tribal casinos are to America’s economic landscape. In the 28 states where tribes operate gaming facilities, 676,428 workers were employed and paid total wages that exceeded $36.2 billion in 2016, the year of the most recent available data.

Additionally, the 500 venues in the state paid $15.2 billion in local, state, and federal taxes for 2016, according to the report.

The study on Class II and III gaming was conducted Dr. Alan P. Meister and Meister Economic Consulting. Meister’s website biography states he has “extensive experience analyzing economic issues related to the gaming industry, including Indian gaming.” He conducted a similar study for the AGA last year.

The data shows that tribal casinos continue to keep up with the pace of commercial casinos across the country.

Meister’s report on tribal gaming released two years ago, which was based on 2014 numbers, showed Native American casinos were responsible for 43.5 percent of the US market.

Tribal gaming operators create nearly half of all U.S. gaming revenue,” said AGA Senior Vice President of Public Affairs Sara Slane.

The report shows that the four states that exceeded $5 billion in sales during 2016 were Florida, Oklahoma, California, and Washington, proving that their success spans both coasts and in between.

Advantage California

Native American gaming facilities are most prolific in California, where 74 operated in 2016. Those casinos provided the Golden State with 124,274 jobs worth nearly $9 billion in wages. The $19.9 billion in sales generated $3.4 billion in tax dollars for the state.

With 131, Oklahoma is the state with the most tribal casinos. That number is nearly twice that of California’s and makes the Sooner State the one whose Native American venues created the second-highest economic impact. Those casinos employed 74,723 employees that took home over $4.2 billion in wages and paid the government over $1.6 billion in taxes.

Florida is the state that’s getting the most out of its relatively small number of tribal casinos. With just eight operating across the Sunshine State, Florida’s Native American properties generated the third-highest sales total, with over $6.1 billion in 2016. The 45,962 employees that made over $2.5 billion at those casinos also ranked third for overall wage impact in the country among Indian gaming properties.

Washington was the other state to crack the $5 billion sales threshold, with 31 facilities that employ 35,044 workers.

Arizona, Minnesota, Wisconsin, Michigan, New York, and Connecticut all came in between $2-$5 billion in total sales for tribal gaming. Additionally, Oregon, New Mexico, Louisiana, Alabama, and North Carolina all exceeded $1 billion.

Efforts have been made this year to bring tribal gaming to states where there currently are no facilities. Indian tribes in Maine sought to open casinos without the approval of the state, but lawmakers voted against seeking the opinion of the state’s Supreme Judicial Court on the proposal.

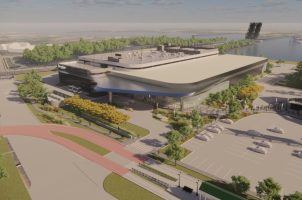

In Virginia, the Pamunkey Indian Tribe bought 600 acres for $3 million to build a $700 million casino, should state lawmakers move to allow casinos.

Casinos Sue Control Board Over Card Rooms

In California, where tribal gaming leads the country, a lawsuit could be brewing between the state’s Bureau of Gambling Control (BGC) and the California Nations Indian Gaming Association (CNIGA).

CNIGA has said that it will sue the BGC over its decision to “defer enforcement” of the removal of certain banked card games from card clubs across the state.

The tribal casinos contest that certain games are in violation of Class III gaming exclusivity rights held by the tribes, and have asked the state to disapprove of them. In September, the BGC said it will “rescind game approvals” but will provide “time to enable cardrooms to prepare for this action.”

That was called a “delaying tactic” by CNIGA Chairman Steve Stallings.

“At this point, we’re suing,” Stallings said.

Related News Articles

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

Last Comment ( 1 )

How many of these faux Indian tribes are still on the federal welfare rolls receiving their share of the $20-billion in taxpayer monies year after year after year given to support some 1.7-million enrolled member for free food, housing, education and health care when non-Indian U.S./State citizen taxpayers see $30-Plus billion in gaming revenue flowing into their coffers!