William Hill Says “Thanks, But No Thanks” to 888-Rank Improved Offer

Posted on: August 15, 2016, 04:00h.

Last updated on: August 15, 2016, 02:56h.

UK bookmaker William Hill has rejected a revised second offer from a consortium composed of 888 Holdings and the Rank Group, which proposes that the three companies combine to create a consolidated gambling powerhouse.

Last week, William Hill rejected a cash and paper offer of £3.16 billion ($4.6 billion) out of hand, on the grounds that it was too low. The wagering outfit also maintained that the proposal was too complex and the deal too debt-laden.

The newer offer, which arrived on Monday morning, would value William Hill at £3.47 billion ($4.76 billion), or 394p a share, compared with the initial offer of 364p. The consortium suggested the new deal was a “compelling value creation opportunity for William Hill.”

But Hill quickly reiterated its stance that the bid was still “substantially” too low, and that it would not consider an offer based on “risk, debt, and hope.”

“The board continues to see no merit in engaging with the consortium,” was the seemingly final response from the bookmaker.

Price War

In fact, the two parties seem so far from being on the same page on this one that they even disagree on the value of the actual bid. The consortium’s valuation, noted above, is disputed by William Hill.

Rank-888 based its offer on the market cap of the three companies on August 5, the day before its first bid. But William Hill has calculated that same value on the company’s market cap on July 22, the day before the announcement that a bid was being prepared. According to the latter evaluation, the offer is worth only £3.1 billion ($3.99 billion).

“As we have said before, this is highly opportunistic and complex and does not enhance the strategic positioning of William Hill,” said Gareth Davis, William Hill’s chairman. “The board continues to believe we have a strong team to deliver superior value to our shareholders and trading at the start of the second half gives us renewed confidence in our stand-alone strategy.”

Conflicting Visions

William Hill is not thrilled with the timing of the offer, either. The company was left in a vulnerable position by the ousting of its CEO James Henderson earlier this month. Word was that the departure was due to his failure to revive the company’s underperforming digital operations, hence the description of the bid by Davis as “opportunistic.”

The consortium, meanwhile, has said its proposal would create a “transformational force” in the global and betting gaming industry. 888-Rank also insists it would make the UK’s largest “multi-channel gambling operator by revenue and profit with a complementary combination of retail and digital brands and proprietary technology, content and products.”

Through synergies between the three companies, says the consortium, it would create $100 million a year in cost savings, with revenues of £2.7 billion ($3.47 billion).

William Hill noted that the cost savings would not be achieved until 2020, and said that in the meantime, such a merger would create one of the most highly leveraged gambling companies in Europe.

Related News Articles

Australian Casinos Blooming, Thanks to Influx of Asian Tourists

New York Governor Andrew Cuomo Rejects Idea of Casino Bailouts

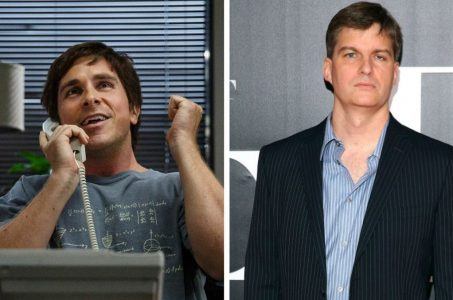

Burry, Inspiration for ‘Big Short’, Adds to Wynn Resorts Investment

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

— December 17, 2024 — 7 Comments

No comments yet